Table of Contents

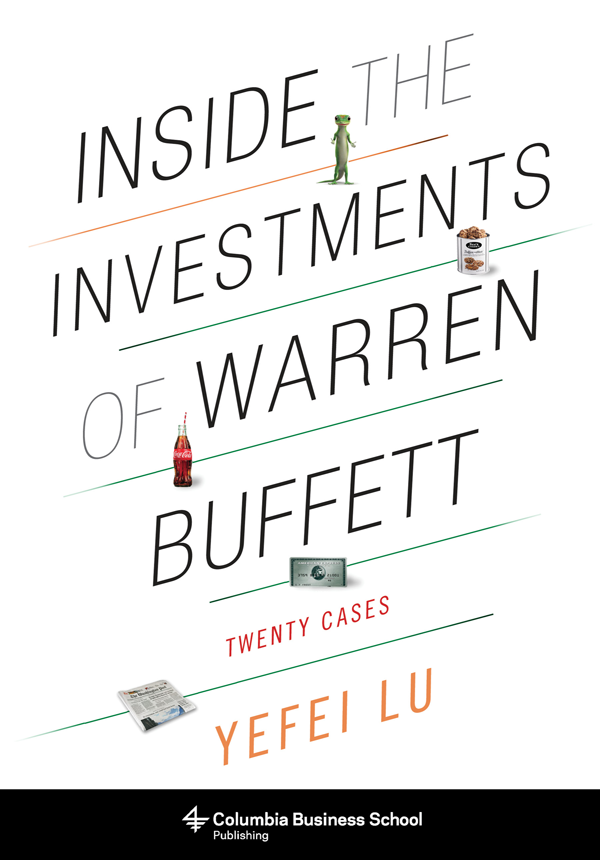

INSIDE THE INVESTMENTS OF WARREN BUFFETT

Columbia University Press

Publishers Since 1893

New York Chichester, West Sussex

cup.columbia.edu

Copyright 2016 Yefei Lu

All rights reserved

E-ISBN 978-0-231-54168-8

Library of Congress Cataloging-in-Publication Data

Names: Lu, Yefei, author.

Title: Inside the investments of Warren Buffett : twenty cases / Yefei Lu.

Description: New York : Columbia University Press, 2016. | Includes bibliographical references and index.

Identifiers: LCCN 2015048094 | ISBN 9780231164627 (cloth : alk. paper)

Subjects: LCSH: Buffett, Warren. | Capitalists and financiersUnited States.

| Investments. | Portfolio management.

Classification: LCC HG172.B84 L8 2016 | DDC 332.6dc23

LC record available at http://lccn.loc.gov/2015048094

A Columbia University Press E-book.

CUP would be pleased to hear about your reading experience with this e-book at .

COVER DESIGN: Noah Arlow

To my love, Nora, and our beautiful daughter, Lily

CONTENTS

This book would not have been possible without the support and contributions of numerous individuals, all of whom I would like to thank sincerely for their help.

First, I would like to thank Eddie Ramsden at the London Business School, who encouraged me to turn what was originally a personal research project into a full-fledged book. Without his vision on what was still missing, I would have concluded that there were already too many books written about Warren Buffett and would never have ventured to write about this topic in this form.

I want to thank Bridget Flannery-McCoy and Stephen Wesley at Columbia University Press, who directly worked with me and together spent countless hours giving me feedback and editing my writing. Thank you so much for your dedication to this project and for sharing your talent. Without you and the help of the entire Columbia University Press organization, this book, as it is written, would not have been possible.

Very important, I would like to acknowledge my current colleagues at Shareholder Value Management AG in Frankfurt, Germany for the critical role that they have individually played. Thank you, Frank Fischer and Reiner Sachs, for creating an organization that has provided me with both an amazing environment and the freedom to continually improve my understanding of value investing, without which I could not have written this book. You are, honestly, each in your own way, two of the most incredible and positive individuals I have ever had the opportunity to work with. I am especially thankful for the very significant time that you, Frank, have spent sharing with me your lessons learned in investing and many other things in life. Thank you also to my colleagues Suad Cehajic, Gianluca Ferrari, Ronny Ruchay, Simon Hruby, and Cedric Schwalm for our frequent discussions on this topic and for taking time out of your busy schedules to read my manuscript drafts and give me detailed feedback. Together, this organization and its individuals have added very significantly to what I know about value investing and about life.

I also would like to thank my previous colleagues at Forum Family Office in Munich. All the individuals in that organization, led by Dr. Burkhard Wittek, have taught me much of the remainder of what I know about value investing. Special thanks goes to Frank Weippert, Till Campe, Jeremie Couix, and Sasha Seiler, who even today are wonderful sparring partners for investment ideas and my valued peers in the German value investing community that I am glad to be a part of.

From this network, I also want to thank Norman Rentrop and Jens Grosse-Allermann, who host the yearly German investor get-together at the Berkshire Hathaway annual meeting. I have had the pleasure of attending on several occasions and have found this a great resource and service especially for the German value investor community.

I owe a significant debt to several other individuals: Rob Vinall of RV Capital, who helped review several chapters of this book and who over the years has taught me about many aspects of value investing for which I am grateful; Frederik Meinertsen of SEB, who took an interest in my rather academic work and gave valuable feedback on several parts of this book; Chris Genovese of Sanborn Maps, who was responsible for historical archiving of the company as of 2013, and who helped me significantly in my research for original materials for that company; Professor T. Lindsay Baker at Tarleton State University, who helped me greatly with the case study of Dempster Mill Manufacturing; and all the individuals, including Ralph Bull and Daniel Teston, who allowed me to use their artwork and photography in my book.

Finally, I want to thank my loving family, Nora, Lily, my parents Xuanyong and Lizhu, and my brother Felix, who have all supported me in this long endeavor, putting up with my countless hours typing away on my computer at home, at the beach, and everywhere in between. Thank you so much for your understanding, your patience, and your love.

Over the last thirty years, Warren Buffett and his investment vehicle Berkshire Hathaway have become household names. Likewise, Omaha, Nebraska is no longer an unknown midwestern town for anyone in the investment community. Buffetts legendary investing performance has prompted small investors to want to invest just like him and many investment professionals seek to emulate his strategies. But what are Buffetts greatest investments and in which context did he make them? Moreover, what can we learn from his experience?

The focus of this book is to uncover answers to these questions by journeying through Buffetts investing career. Specifically, I look at the twenty investments Buffett made that I feel had the largest material impact on his trajectory. I selected a cross-section of different types of investments and investments I found especially informative. I also considered the relative size of each investment at the time it was made.

My approach in analyzing these key investments was to look at the detailed actions Buffett took when he made his investment decisions and try to understand from a third-party perspective what rationales he or any investor was likely to have seen in each situation. Where appropriate, I tried to take the perspective of an investment analyst studying the businesses at the same time in which Buffett did in order to highlight Buffetts unique standpoint. In this way, unlike the many biographical books written about Buffett, this book focuses on telling the story of Buffett only as it relates to his key investments. This book aims to extend beyond the various publications that contain significant information about Buffetts investments (including Buffetts own annual letters) by leveraging original source documents and other historical information where possible. My overall aim is to give readers a realistic analysis of the key investments that Buffett made and then have them draw their own insights and conclusions.

The book consists of three sections, ordered chronologically. The first section details five key investments that Buffett made between 1957 and 1968 when he ran Buffett Partnership Limited, the private investment partnership he managed before taking over Berkshire Hathaway. The second section details nine investments Buffett made between 1968 and 1990, the first two decades when Berkshire Hathaway served as his investment vehicle. The third and final section focuses on the period at Berkshire since 1990. A brief introduction to each section provides a picture of how each investment fits within Buffetts career as well as setting the broader investment context during that time period of the U.S. stock market, the primary market in which Buffett invested. Individual chapters in each section focus on the specific investments, treating each as a case study. The final section of the book reflects upon the broader evolution of Buffett as an investor. It also summarizes my overall learning from Buffetts investment philosophy and strategy based on my analysis of his twenty key investments.