Praise for

Buffett

In this engaging biography, Roger Lowenstein tells not only how Mr. Buffett made it but how he has managed to avoid spending itthe most fascinating part of the story a delightful portrait of a homespun capitalist.

The New York Times

Lively, smoothly written, and elaborately researched the best book by far on this legendary character.

Business Week (Top 10 Business Books of 1995)

A delightful portrait.

The New York Times Book Review

A significant contribution to the craft of biography as well as an illuminating and comforting story for investors everywhere.

Chicago Tribune

Thoroughly researched and perceptive a highly readable account.

Financial Times

Lowenstein has accomplished something remarkable.

Los Angeles Times

Buffett throws a lot of light on the character of a man who is now almost as famous for his homespun aphorisms as he is for the prowess which has made him the second wealthiest individual in the United States.

The Independent (London)

Lowensteins excellent biography burnishes the Buffett myth while deconstructing it with heavy doses of reality.

Barrons

Many people know of Warren Buffetts riches and investment savvy. But here youll get to know the boy who searched the local golf course for used but marketable golf balls and started a lemonade stand on a heavily trafficked street in front of a friends house instead of his own quieter street. And you can explore the psyche of a father of three who, while married to one woman, lived with another, among other personal details about the man behind the investments.

U.S. News & World Report

Buffett is a landmark portrait of a uniquely American lifea portrait that offers an enthralling, precisely documented, full-fleshed characterization of an American icon. It is a work that should be required reading in every business curriculum, for it relates directly to the current and future interests of individual and corporate investors throughout America.

Business Book Review

Anyone who reads this will walk away from the experience with a much richer sense of who Warren Buffett is and what makes him a great investor, perhaps enhancing their own investment returns as well one heck of a good book.

The Motley Fool

As much a history of investing in the latter half of the 20th century as it is a penetrating look at Buffett splendid.

Salon.com

[An] excellent biography [that provides] personal glimpses of a very private man.

Publishers Weekly

Lowenstein does a remarkable job of telling the financial story of Buffetts rise to securities fame [in this] highly interesting, fascinating near hagiographic biography.

Library Journal

The first definitive, inside account of the life and career of this American original.

Ingram

The prose [Roger Lowenstein] displays here is an admirable mixture of the clear-eyed and the poetic. The book is both empathetic and intelligent, without ever slopping over into fawning.

The Washington Monthly

This work of art from Roger Lowenstein chronicles the intimately private as well as the investing life of one of the greatest investors ever.

MarketThoughts.com

2008 Random House Trade Paperback Edition

Copyright 1995, 2008 by Roger Lowenstein

All rights reserved.

Published in the United States by Random House Trade Paperbacks, an imprint of The Random House Publishing Group, a division of Random House, Inc., New York.

R ANDOM H OUSE T RADE P APERBACKS and colophon are trademarks of Random House, Inc.

Originally published in hardcover and in slightly different form in the United States by Random House, an imprint of The Random House Publishing Group, a division of Random House, Inc., in 1995.

Grateful acknowledgment is made to the following for permission to print both previously published and unpublished material:

WARREN E. BUFFETT : Excerpts from letters, reports to the Buffett Partnership and Berkshire Hathaway, and annual reports. Reprinted by permission of Warren E. Buffett.

FORBES : Excerpt from Look at All Those Beautiful, Scantily Clad Girls Out There (November 1, 1974). Copyright 1974 by Forbes Inc. Reprinted by permission of Forbes magazine.

OMAHA WORLD-HERALD : Excerpts from Susie Sings for More Than Her Supper by Al Pagel (April 17, 1977) and Klewitt Legacy as Unusual as His Life by Warren Buffett (January 20, 1980). Reprinted by permission of the Omaha World-Herald. THE WALL STREET TRANSCRIPT: Excerpt from Pension Fund and Money Managers (December 23, 1974), excerpt from editors interview tih Eric T. Miller (April 23, 1973), and excerpt from Some Thoughts for Financial Analysis (June 17, 1974).

Copyright 1973, 1974 by The Wall Street Transcript Corporation. Reprinted by permission of The Wall Street Transcript.

eISBN: 978-0-8041-5060-6

www.atrandom.com

v3.1_r3

Contents

INTRODUCTION

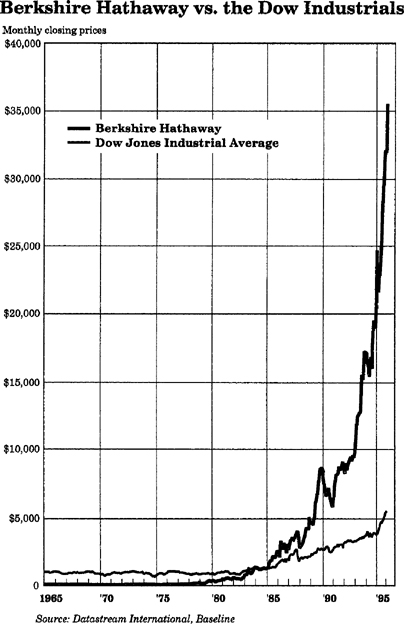

In the annals of investing, Warren Buffett stands alone. Starting from scratch, simply by picking stocks and companies for investment, Buffett amassed one of the epochal fortunes of the twentieth century. Over a period of four decadesmore than enough to iron out the effects of fortuitous rolls of the diceBuffett outperformed the stock market, by a stunning margin and without taking undue risks or suffering a single losing year. This is a feat that market savants, Main Street brokers, and academic scholars had long proclaimed to be impossible. By virtue of this steady, superior compounding, Buffett acquired a magical-seeming net worth of $15 billion, and counting.

Buffett did this in markets bullish and bearish and through economies fat and lean, from the Eisenhower years to Bill Clinton, from the 1950s to the 1990s, from saddle shoes and Vietnam to junk bonds and the information age. Over the broad sweep of postwar America, as the major stock averages advanced by 11 percent or so a year, Buffett racked up a compounded annual gain of 29.2 percent.

The uniqueness of this achievement is more significant in that it was the fruit of old-fashioned, long-term investing. Wall Streets modern financiers got rich by exploiting their control of the publics money: their essential trick was to take inand sell outthe public at opportune moments. Buffett shunned this game, as well as the more venal excesses for which Wall Street is deservedly famous. In effect, he rediscovered the art of pure capitalisma cold-blooded sport, but a fair one.

The public shareholders who invested with Buffett also got rich, and in exactly the same proportion to their capital that Buffett did. The numbers themselves are almost inconceivable. If one had invested $10,000 when Buffett began his career, working out of his study in Omaha in 1956, and had stuck with him throughout, one would have had an investment at the end of 1995 worth $125 million.