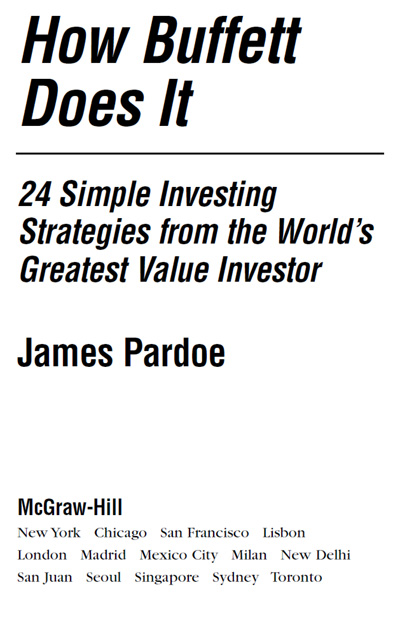

Copyright 2005 by McGraw-Hill Education. All rights reserved. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of the publisher.

ISBN: 978-0-07-162257-8

MHID: 0-07-162257-8

The material in this eBook also appears in the print version of this title: ISBN: 978-0-07-144912-0, MHID: 0-07-144912-4.

E-book conversion by Codemantra

Version 1.0

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill Education books are available at special quantity discounts to use as premiums and sales promotions or for use in corporate training programs. To contact a representative, please visit the Contact Us page at www.mhprofessional.com.

TERMS OF USE

This is a copyrighted work and McGraw-Hill Education and its licensors reserve all rights in and to the work. Use of this work is subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hill Educations prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED AS IS. McGRAW-HILL EDUCATION AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. McGraw-Hill Education and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill Education nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. McGraw-Hill Education has no responsibility for the content of any information accessed through the work. Under no circumstances shall McGraw-Hill Education and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

Contents

The Warren Buffett Way

For most of us, the stock market is a mystery. Given the abundance of choicesome 7,000+ stocks in the United States alonehow in the world do you make money investing in the stock market? Which stocks should you buy? Who should you listen to? What strategy should you follow?

Many of us are still recovering from the Internet stock crash and are still wary of putting our hard-earned money in the market. Many of us have learned the hard way. It might have been because of a friends cant-miss stock tip, a stockbrokers recommendations, or a technology stock gone bust. One lesson learned by many is that get-rich-quick schemes all too often are get-poor-quick schemes.

If you are an investor who has been burnedwhether by brokers, the Nasdaq crash, mutual funds, day trading, timing-the-market systems, penny stocks, options, or high-tech, high-growth companiesyou really should study Warren Buffetts investment philosophy and approach.

A study of Warren Buffett reveals a proven get-rich-slow method for investing in the stock market. Buffett has turned acorns into oak trees through sound investment practices. You, too, can become a sound investor and make money in the stock market over the long termbut only if you follow his fundamental concepts and adopt his discipline, patience, and temperament.

Warren Buffett did not inherit one cent from his parents. Today, solely through his own investments, he is personally worth more than $40 billion. But from Harvard in the East to Stanford in the West, Buffett is rarely a topic of discussion in the classrooms of the top business schools. In other words, the greatest investor of all time is mostly ignored by academia.

I hope that you wont ignore Buffetts example. I hope that you will consider emulating his investment practices, especially if your previous investment experiences have been unpleasant.

In basketball, a mastery of the fundamentals is crucial to being a good player. A mastery of Buffetts investing fundamentals is crucial to being a sound value investor. These fundamentals include

1. A preference for simplicity over complexity

2. Patience

3. Proper temperament

4. Independent thinking

5. Ignoring distracting macro events

6. The counterintuitive strategy of nondiversification

7. Inactivity, not hyperactivity

8. Buying shares and then holding on to them for dear life

9. A focus on business results and value, not on the share price

10. Aggressive opportunism, seizing an opportunity when it is presented by stock market folly

These fundamentals, as well as others, will make you a better investor. Sound investment principles produce sound results.

Find a great business with great management, says Buffett, and buy shares at a sensible priceand then hold on to them for dear life.

CHAPTER 1

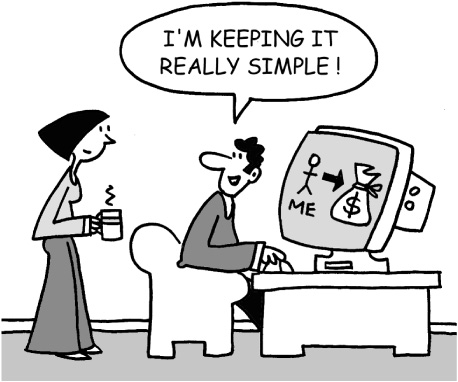

Choose Simplicity over Complexity

When investing, keep it simple. Do whats easy and obvious, advises Buffett; dont try to develop complicated answers to complicated questions.

Many people believe that investing in the stock market is complex, mysterious, and risky and therefore is best left to the professional. This common mind-set holds that the average person cant be a successful investor because success in the stock market requires an advanced business degree, a mastery of complicated mathematical formulas, access to sophisticated market-timing computer programs, and a great deal of time to constantly monitor the market, charts, volume, economic trends, and so on.

Warren Buffett has shown this to be a myth.

Buffett has figured out a successful way to invest in the stock market that is not complex. Anyone with average intelligence is more than capable of being a successful value investor, without the assistance of a professional, because the fundamentals of sound investing are easy to understand.

Buffett will only invest in easy-to-understand, solid, enduring businesses that have a simple explanation for their success, and he never invests in anything complicated that he does not understand.

Remember that degree of difficulty does not count in investing. Look for long-lasting companies with predictable business models.

Next page