Lawrence A. Cunningham

Copyright 2016 Lawrence A. Cunningham

The Buffett Essays Symposium / Lawrence Cunningham.

Includes transcription of live dialogue and annotation.

1. Berkshire Hathaway Inc. 2. Buffett, Warren. 3. Munger, Charlie. 4. Investments. 5. Management

No one has a monopoly on truth or wisdom.

We make progress by listening to each other.

A conversation is a dialogue, not a monologue.

Tell me and I forget. Teach me and I remember.

Involve me and I learn.

Prologue

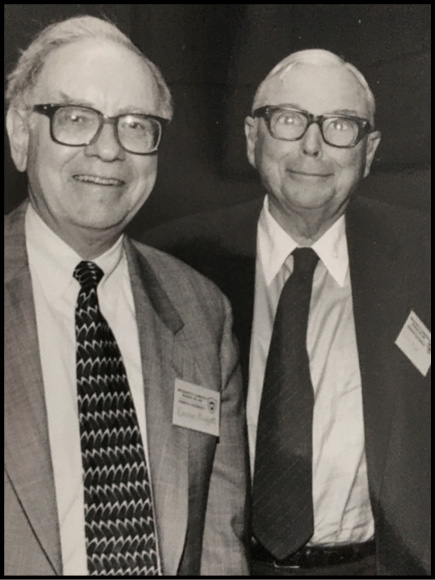

I ntellectual sparks flew among Warren Buffett, Charlie Munger, and other guests at the 1996 symposium to launch The Essays of Warren Buffett: Lessons for Corporate America then a manuscript few guessed would become an international bestseller. After governance expert Ira Millstein declared that boards must develop strategic plans for acquisitions, Buffett countered that more dumb acquisitions are done in the name of strategic plans than any other. When I and a colleague acknowledged including modern finance theory in our teaching, Munger chastised us for peddling twaddle and gibberishquickly adding, I like both these guys.

The two-day conference in New York City began on a Sunday in October, the day after the New York Yankees won the World Series. We probed profound issues of corporate life, topics still being argued about today by shareholders, directors, executives, judges, and scholars. I recently came upon the original tapes of the conference after an old friend, Peter Bevelin, asked me about the event. I had not examined this material in two decades but, when I did, I was struck by how many of the questions we discussed remain vital today. Plus a change, plus cest la mme chose .

For Buffett, change and continuity have been dominant themes since 1956. Back then, the 26-year-old prodigy formed a partnership to acquire small businesses and equity stakes in larger companies. In 1965, the partnership took control of Berkshire Hathaway Inc., a publicly-held and struggling textile manufacturer. The Buffett Partnership soon dissolved, with Berkshire shares distributed to the partners, Munger chief among them. Berkshire proceeded to acquire interests in diverse businesses, including insurance, manufacturing, and retailing.

Under Buffett and Munger, Berkshire has gone through two massive transformations. In the first, the company went from a failed textile manufacturer into a prosperous investment vehicle by 1996. At that time, assets were comprised of 80% marketable securities and 20% in operating companies. In the second, since 1996, Berkshire morphed into a massive conglomerate. Today its assets are comprised 80% of operating companies and 20% marketable securities, though the latters market value exceeds $100 billion.

Performance has been stellar: through 2015, results vastly exceeded benchmarks such as the Dow Jones Industrial Average or Standard & Poors 500. From 1965 to 2015, the Dow increased 18-fold while Berkshire increased 12,000 times, a compound annual rate of 21%, double the S&P.

Despite changing from the partnership to the corporate form, Buffett preserved Berkshires sense of partnership. The legacy is reflected in the first of 15 principles stated for decades in Berkshires owners manual: While our form is corporate, our attitude is partnership. The Berkshire system, as Munger dubbed it in 2015, differs significantly from prevailing practices at other large American corporations.

Buffett provides unconventional takes on numerous topics of corporate life, which is why his company and writings have been so fascinating to study all these years. In governance, the Berkshire emphasis is on trust not control; on mergers, Buffett favors letting shareholders rather than boards make final decisions; in corporate finance, he shuns debt and attracted legions of followers to the field of value investing; and on accounting and taxation, he shaped debates from stock options to merger accounting and raised public attention to inequality in his famous declaration that his secretarys tax rate exceeds his own.

Buffetts writings are primarily contained in his letters to Berkshire shareholders, the centerpiece of the symposium. After carefully reviewing all those letters, I rearranged and collated them by topic into a 150-page booklet for the symposium: governance, investing, acquisitions, accounting, and taxation. At the symposium, a series of panels examined each, spanning more than twelve hours.

Soon after, I prepared an edited version of the formal remarks and supervised the publication of a resulting academic volume of 800 pages, consisting of 18 articles and a transcript of 100 pages. In the two decades since, several of the articles have become classics in their fields and I have regularly released updated editions of The Essays of Warren Buffett: Lessons for Corporate America , which has been translated into a dozen languages.

I invited Warren to participate in the symposium and volunteered to rearrange and republish his letters because my research indicated that they were valuable but underappreciated. I was honored that he accepted. He spent two days with a great crowd, which included many of my students, along with a dozen business law professors whom I enlisted to speak on the panels. Among these was my own teacher, Elliott Weiss, who first introduced me to Buffetts writings and worked closely with Warren a decade earlier on a national project to improve disclosure in corporate America.

The symposium also brought together many distinguished people from Berkshires orbit, including Warrens wife Susan and son Howard; their friend and editor of Warrens annual letters, Carol Loomis; their friend and later Berkshire director Sandy Gottesman and his wife Ruth, a professor at Albert Einstein College of Medicine; Warrens personal attorney George Gillespie and Berkshire attorney Bob Denham; Berkshire executives Ajit Jain and Lou Simpson; and long-time Berkshire shareholder and devotee, Chris Stavrou. Two panels were led by other notable figures: long-time Berkshire shareholder Louis Lowenstein, former president of Supermarkets General Corporation and professor at Columbia University (also the father of Buffett biographer, Roger Lowenstein), and Ira Millstein, a distinguished attorney and leader of the National Association of Corporate Directors.

Among many other notables in the audience of 150 were Bill Ackman, Bruce Berkowitz, and Paul Hilal, all to become prominent investors; Otis Bilodeau, then a student of mine at George Washington University and today the global executive editor of Bloomberg Television; The Honorable Jack Jacobs, then of the Delaware Chancery Court and later a Justice on the Delaware Supreme Court; Marjorie Knowles, an official at TIAA-CREF; and Bob Mundheim, among those who Buffett hand-selected to manage Salomon Brothers after he became its reluctant interim chairman in 1991 following a bond trading scandal at the Wall Street investment bank.