Contents

This guidebook to The 9 Steps to Financial Freedom offers a systematic approach that is divided into three sections. It is imperative that you do all the steps and do them in order.

The first section takes us back to our most significant formative experiences with money. We revisit these experiences in order to understand why we do not always do what we know we should do when it comes to our money. Once we have achieved this understanding, then we are able to change not only our attitudes but our actions and start to create a life that is financially free.

The next section contains the Must-Dos to obtain Financial Freedom, as well as the Laws of Money. Here we will learn financial actions that we must take today to protect our tomorrows. We will learn about trusts and wills, credit card debt, saving for retirement, and the insurance we should and should not have. Most important, we will learn why it is so critical to trust ourselves more than we trust others, even the professionals to whom we are so accustomed to listening.

The last section takes us beyond money into an area of life that all the money in the world just cant buy. It is here that we learn the secrets of the money cycle and solve the mystery of money. With this last section we have entered the realm of Financial Freedom.

How to Use Your Guidebook

With the aid of this guidebook, you will complete several interactive exercises to help you get in touch with and overcome your fears about money, as well as educate yourself about essential actions you need to take. The guidebook is what I consider a crash course in The 9 Steps to Financial Freedom. It highlights the most important concepts in that book. Please use it as a quick reference resource, a place to keep notes and record your thoughts, and a means to stay in touch with your financial habits and create an action plan.

The most critical steps on the path to Financial Freedom are the first two steps in the guidebook. Over the past few years, I have found that these two steps are the ones that most of you have difficulty with. To help make this journey easier, go to my Web site, www.suzeorman.com, where you will be able to access, free of charge, the audio program Facing Your Fears & Creating New Truths, and hear these first two steps come alive. You will listen as approximately thirty people just like you go through these steps. Along with these people, you will laugh, cry, and make the connection from your past to your present, as well as break the chains of bondage that have kept you from having more and being more.

To access the audio program Facing Your Fears & Creating New Truths, visit my Web site, www.suzeorman.com. Click on the Product/Book Log-In link at the top of the homepage. Enter the username: ask suze and the password: freedom. Then download the audio program and listen away. Throughout Steps 1 and 2 you will see the following symbol  . When you see this symbol, please know that it is a reminder that there is an audio program available to offer further assistance in completing the exercise you are being asked to perform.

. When you see this symbol, please know that it is a reminder that there is an audio program available to offer further assistance in completing the exercise you are being asked to perform.

Financial Freedom:

The Power Is Within You

WHAT DO YOU WANT FROM YOUR MONEY?

Financial Freedom is the pathway to inner and outer happiness, and the power to discover that pathway is within you. But first you have to know where you want that path to take you. You have to know what your goals are and in what direction you want to go. Not identifying your goals is like visiting a foreign city without a map, and without knowing what treasures are contained in that city. If you did this you would probably wander around the city aimlessly, maybe coming across the treasures, maybe not. Without financial goals and a road map to get you to them, it is highly probable that you will miss out on treasures that lie within your own financial city.

You purchased this guidebook for a reason, didnt you? Why? How did you think it was going to help you? In what way did you think it was going to guide you on your path to Financial Freedom? I want you to give some thought to your intention in buying this guidebook. To help yourself see your intentions clearly, ask yourself the following questions:

What do I want my ultimate financial destiny to be?

What do I want from my money today, as well as years from now?

What do I need to do to make my life worthwhile?

Please note that your intention should be long-range, what you want to see happen to you over the course of your lifenot just today but for the next thirty or forty years. It is this intention that will help carry you through your entire financial life.

After you have given this some thought, please write your intention in the space provided below.

My intention in buying this guidebook:

COMPLETION COMMITMENT

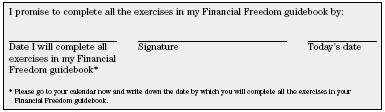

At important junctures throughout this guidebook, I will be asking you to make a written commitment to yourself to complete certain actions by a particular date or for a specific period of time. The 9 Steps to Financial Freedom can become a reality to you only if you complete the commitments I am asking of you. The first commitment starts right now, so please sign the commitment promise below, not going out further than six months from today before you commit yourself to completing all the exercises in this guidebook.

All we really have in life to give to ourselves and to one another is our word. When we give it, we must never break it, for then we truly have nothing. Do not let the date you have just committed to arrive without having completed your commitment.

As you go through the guidebook, please use the checklist on the next page to mark off the actions you have completed. As you check off each action, you will start to feel a sense of accomplishment and power over your money. One of the goals of this guidebook is for you to have power over your moneyrather than for your money to have power over you. At this point, you should have completed these actions: (1) intention in buying guidebook and (2) completion commitment, so please check off these two actions below. Throughout the guidebook you will see the checklist symbol  as a reminder to come back to this list and check off the specific action you have completed.

as a reminder to come back to this list and check off the specific action you have completed.

THE 9 STEPS TO FINANCIAL FREEDOM CHECKLIST

______ Intention in buying guidebook

______ Completion commitment

______ Goal-setting exercise

STEP 1

______ Money messages exercise

______ Think about your past

______ Money memories exercise

STEP 2

______ Embrace your fears

______ Fear exercise

______ One greatest fear

______ Connect money memory and greatest fear exercise

______ Creating a new truth exercise

______ Reinforce your new truth

______ New truth commitment

STEP 3

______ Estimated average monthly costs

______ How much is going out? exercise

______ How much is going out? commitment

. When you see this symbol, please know that it is a reminder that there is an audio program available to offer further assistance in completing the exercise you are being asked to perform.

. When you see this symbol, please know that it is a reminder that there is an audio program available to offer further assistance in completing the exercise you are being asked to perform.

as a reminder to come back to this list and check off the specific action you have completed.

as a reminder to come back to this list and check off the specific action you have completed.