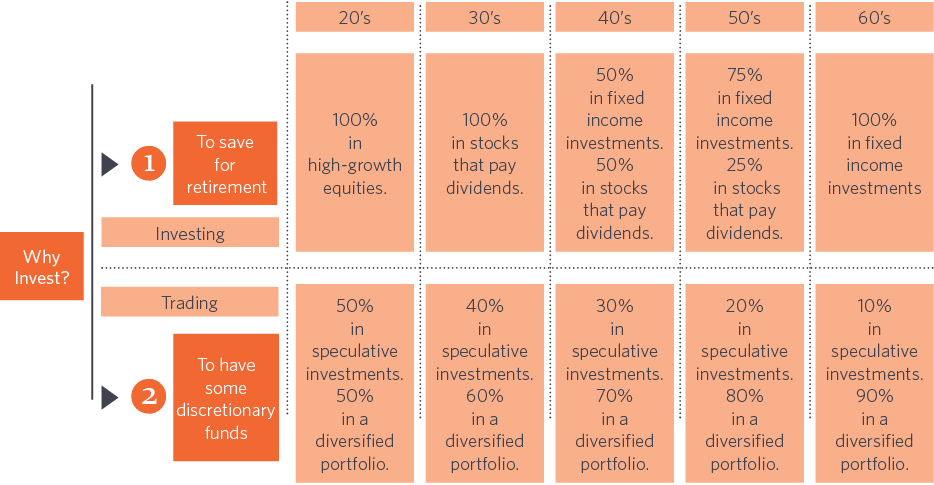

A personal investment blueprint

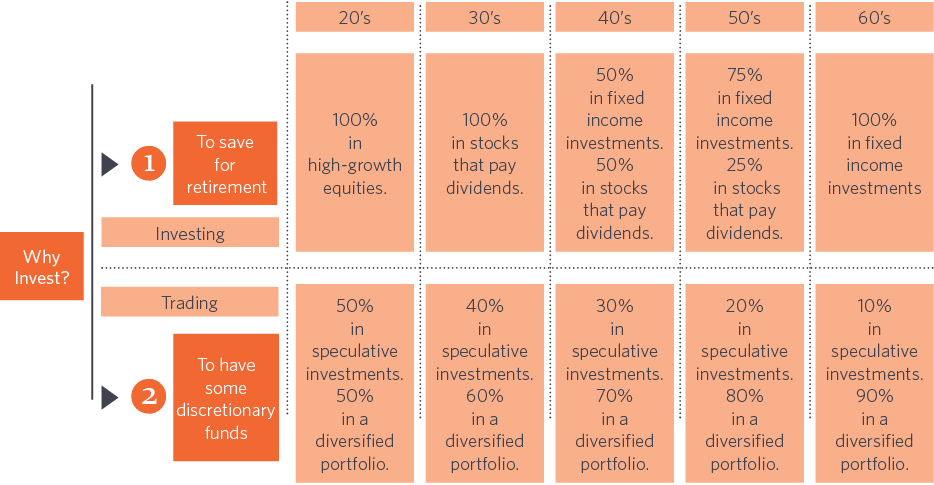

A lifetime investment strategy will never be one-size-fits-all. Instead, your investment choices and decisions should accurately reflect where you are in your working career lifespan. Before you make any investment decisions, take the time to get the right perspective in place first.

Your goal as an investor is really to create two different and distinct revenue streams:

- A retirement revenue stream the steady amount of money coming in each month which will be used to maintain your desired lifestyle throughout your retirement years.

- A discretionary revenue stream extra money which can be used at any time to buy luxuries and other non-essentials which make life fun.

Its vital that you understand and accept that you need to think and act differently about these two revenue streams. For example, you dont want to speculate with your retirement revenue stream this has to be available irrespective of the ups and downs of the economy or the stock market. Equally, if you fail to speculate with your discretionary pool of capital, you can miss out on the impressive gains which can literally supercharge your returns.

Managing both pools of capital differently requires that you have the time and inclination to do so. For example, to create a diversified portfolio for your discretionary revenue stream, youll need a minimum of five stocks in different sectors of the economy. Youll need at least one hour per week to study everything youll need to maintain each shareholding and to stay current with whats happening with each company. If you cannot realistically commit to doing the background work required, youre far better off investing your discretionary funds in a mutual fund rather than trying to make investment decisions for yourself.

Note also the increasing dominance of fixed-income investments in your retirement investments. This may seem counterintuitive when every other market commentator states stocks are the best long-term investment there is available. The point, however, is bonds and other fixed income investments preserve capital. Their value doesnt get affected by the health of the economy as a whole or by the swift downturns which have always characterized the stock market. As you get closer to the stage where your retirement income stream will become vital, caution should dominate your planning.

Most people only have three rules when it comes to their personal investment strategy:

- You make the most by buying and holding stocks.

- Trading stocks is alwayswrong,owningstocks is alwaysright.

- Speculation is the height of evil and very risky.

To address these common myths:

- Buy-and-hold does work well if youve picked a company thats moving forward, but it is absolutely ridiculous to do so while you watch a good company go bad. Buy-and-hold assumes a level of ease and perfection which does not exist in the real world.

- Trading short-term buying and selling of stocks far from being an evil is actually the only way you can lock in your gains. The emergence of discount brokers who will execute trades for a few dollars rather than hundreds of dollars has significantly changed the dynamics of share trading, and made it a vital part of intelligent investing.

- If you dont take advantage of a little speculating at some stage, you run the risk of missing out on an opportunity to turn a limited amount of capital into a monster home run. Pure and simple speculation helps you get ahead in a way no other investment strategy can. Equally, it holds the potential to wipe you out financially if overused or applied within an inappropriate context. The key is not to avoid speculation entirely, but to bet on emerging situations you have total conviction about and with an appropriate amount of money.

The basic tools youll need

Before you can start investing or trading successfully, you need these basic tools:

- The ability to compare one stock with another.

- An understanding of the cycles that drive stocks.

- Knowledge of the best places to look for big gains.

Tool # 1 - Comparing stock prices

The only wayyou can compare the stock price of one company to another is by looking at the earnings per share. Once you know that, you then use the equation:

- P=M x E

Price per share = Multiple x Earnings per share

The major determinant of the future price of any share is its anticipated future earnings. If something happens to grow those projected revenues a management change, the release of a new product, changes in the general macroeconomic climate then you would predict the price to change correspondingly.

All of the sophisticated analysis that Wall Street engages is effectively a refinement of this basic P = M x E equation. Wall Street analysts compare the anticipated growth rates of different stocks using various techniques and then decide whether a stock is under-or over-valued. They then make buy and sell recommendations on that basis.

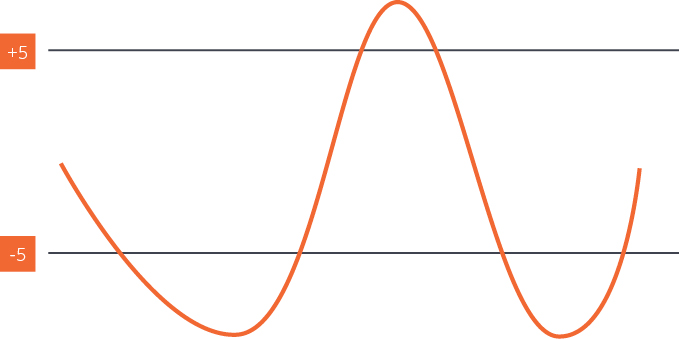

Tool #2 The cycle of stock prices

Sometimes it may appear as if the stock market moves without any discernable pattern, but this conclusion is incorrect. In practice, the stock market ebbs and flows in sync with the cyclical movement of the broader economy. When you keep in mind whats happening in the economy as a whole, you can correctly anticipate the rise and fall of the stocks of various industries.

In simplified terms, the overall GDP cycle looks like this:

When the economy heats up (GDP rises), all financial stocks real estate investment trusts, savings and loans, banks, insurers, brokers, mortgage companies and house builders tend to get their share prices marked down. This is exaggerated by the mutual funds who will get out of these stocks before their earnings are affected. Technology stocks and other cyclicals like consumer product companies will do well at this stage of the cycle.

Conversely, when the economy slows down (GDP falls), its then time to reverse direction and buy financial stocks while selling your technology stocks and cyclicals.

This cycle has been played out endlessly for many years now and will continue to do so for the foreseeable future. Its possible to significantly sharpen your strategy and develop various kinds of sophisticated buy and sell signals, but the key principle is the big mutual fund managers will be buying or selling according to this established pattern. Your challenge is to anticipate their moves beforehand and be in a position to benefit from that knowledge.

Tool #3 - Knowledge of the best places to look

A good place to look for stocks that will generate substantial gains is to identify small capitalization stocks that are just about to begin their journey to mid-or large-capitalization. These wont be well-known companies and will for the largest part be unknown to the financial press.

The key to success here is the herd mentality of Wall Street investors. From time to time, a theme that needs money to grow becomes fashionable. This theme can vary from nanotechnology to low-carb food or right through to alternative energy ideas. If you can take note of the theme that is gaining popularity and get in and out before the markets really understand how to value these stocks rationally, some very impressive gains can be made. The trick is not to overstay your welcome and to actually get out with a profit rather than staying invested long-term and seeing how things actually pan out.

A personal investment blueprint

A personal investment blueprint

The basic tools youll need

The basic tools youll need