Suborna Barua - Principles of Green Banking

Here you can read online Suborna Barua - Principles of Green Banking full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2020, publisher: De Gruyter, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Principles of Green Banking

- Author:

- Publisher:De Gruyter

- Genre:

- Year:2020

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Principles of Green Banking: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Principles of Green Banking" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Principles of Green Banking — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Principles of Green Banking" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

The world today is faced with severe environmental complications such as pollution, climate change, and the depletion of resources. The most unfortunate aspect is that much of these environmental stresses are primarily contributed to and driven by human activities. With the aim of faster economic growth and greater economic well-being, over the last centuries, human activities have substantially sacrificed environmental quality and resources, most of which is irrecoverable. This means, most of the environmental damage that human civilization has done to fulfill the objectives of economic prosperity cannot be restored into the original condition and many of the environmental resources consumed can never be renewed. Following the natural living cycle governing our ecosystem, the long-run outcomes of this damage have now begun to worsen the quality of our lives. We are now faced with an increasing level of different environmental threats, for example, climate change and global warming, natural disasters, lack of natural resources like gas to feed industrialization, and scarcity of resources like drinking water that are necessary for living, etc. Unfortunately, the environmental damage and depletion of resources today have reached a stage that might eventually threaten the existence of future generations. How do we respond to this catastrophe? Perhaps, the best way is for everyone to play their part not only to protect the environment but also enrich its quality.

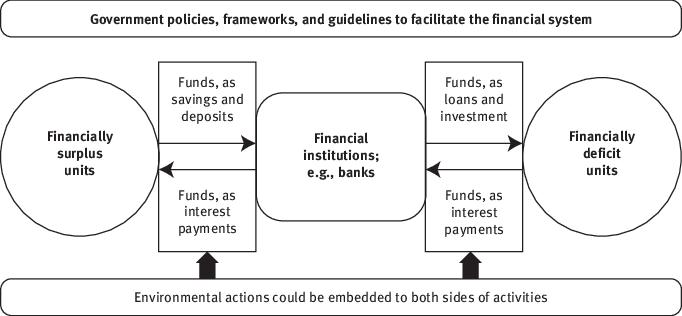

An economic system in a society is comprised of three main economic agents individuals, firms, and the government. Whether an economic system embraces environmental actions into its functionalities or it prioritizes maximization of economic benefits and wealth over the environmental protection largely depends on how the system is designed and how the agents behave. Generally, the governments policies and regulations govern the economic systems functioning; in other words, individuals and firms behave as they are allowed or induced to do under a certain policy and regulatory environment created by the government. However, sometimes the economic agents can also act themselves out of voluntary efforts to aid the economic system in achieving social goals and objectives such as environmental protection. Of course, the impacts that an economic agent can make by its actions would greatly depend on how large it is and how much impactful power it holds in relation to the society and economy. In the contemporary social and economic system, the biggest power perhaps originates from the power of finance. Because, in a market-based economic system, money can be used to exchange almost everything, firms and individuals that have greater financial wealth can hold larger power to influence the market, the economy, and the society as a whole. In this context, financial institutions, being the storehouse and mobilizer of funds throughout the society and economic system, perhaps are the most influential of all economic agents.

The fundamental role of a financial institution is to provide a bridge between the financially surplus and deficit economic units or agents and mobilize funds from the former to the latter. the society and economy utilize resources for economic growth and prosperity. As such, financial institutions can play a central role in achieving social goals or objectives such as environmental protection, alongside driving economic development. With respect to environmental protection particularly, financial institutions are yet to play their desired role, as much of the efforts made are found to be on the part of governments and international donor agencies. Recent discussions in the global community on the role of financial institutions particularly point to banks, as they can undertake actions more powerful than many others to minimize environmental impacts of economic activities and protect the environment for the future.

Source: Author

Figure 1.1: The role of financial institutions in an economy and their environmental actions.

Since the banking sector is crucial for the economic growth of a country, it can be more effective than others in mitigating environmental degradations. Such banking actions prioritizing environmental goals alongside financial objectives can be broadly termed as green banking. Although the term green can broadly refer to a wide range of social, ethical, and environmental dimensions, green banking primarily refers to banks activities and their impacts in relation to environment. Green banking in fact can be the fundamental method through which banks can substantially contribute to save the environment. As banks are a major source of finance to firms and individuals and have an outreach at all levels of society, they can exercise immense power in controlling environmental damage. Generally, being a financial institution, banks are viewed as firms not having a significant environmental impact. However, a deeper understanding of banks activities would necessarily suggest that their environmental impacts through internal (e.g., in-house operations and administrations) and external activities (e.g., lending, investments) are huge, albeit difficult to estimate. Green banking involves pursuing financial and business policies internally and externally that are not hazardous to the environment, and instead help to protect it. Considering the significant level of power banks hold, it is imperative to induce or force them to play a proactive role to save the environment from further damage and degradation and protect it for future generations. To do this, they need to replace their traditional business models with an environment-augmented business model where ecological aspects are integrated, for example, including environmental assessments in lending processes, preferring financing and investment in environment-friendly projects, including energy efficiency requirements in lending contracts, and reducing in-house energy consumption, etc. However, the greening efforts are not something that can be done on an ad-hoc basis; rather they should be evaluated, formalized, and implemented in a systematic manner with a long-term focus to reap the desired benefits in the quickest possible time. It should be noted that, while undertaking greening efforts, banks must conduct cost-benefit analyses of every effort they undertake to have a clear picture about the likely cost to be borne and benefits to be received in the future.

This book is aimed at providing a groundwork for understanding the operational concepts of green banking. Although there has been a lot of discussion regarding green banking recently around the world, there is a lack of useful resources that provide a concrete operational understanding of green banking. As such, this book can be used for understanding the concepts from theoretical and practical aspects. Furthermore, the discussions in each chapter are presented in plain language so that readers across the board can easily grasp the contents. For many of the discussions, application-oriented cases and examples have been included to give readers directions on practically applying different aspects of green banking in real-life banking operations.

The book is organized into ten chapters, in a sequence that would help readers gather a comprehensive understanding. Following this introductory chapter, Chapter 2 focuses on the links and interactions between environmental risks, sustainability, and banking; Chapter 3 presents the global trends and patterns on environment-friendly banking practices at the country and cross-country levels; Chapter 4 provides a brief conceptualization of the definition and meaning of green banking from theoretical and operational perspectives; Chapter 5 highlights the needs and impacts of green banking practices in the current state of the world; Chapter 6 discusses in detail the ten principles of green banking and offers suggestions on how to integrate them in a bank; Chapter 7 elaborates on the operational process of green banking adoption at the bank level and across departments within a bank; Chapter 8 focuses on how green banking can interact with banks traditional risks and regular risk management practices; Chapter 9 outlines how regulatory and policy frameworks on green banking can be designed and developed; and finally, Chapter 10 discusses the potential challenges in the green banking adoption process and presents some measures to mitigate them. Each chapter of this book, except Chapter 1, provides thought-provoking discussion questions for readers at the end of the chapter, alongside examples and cases on the application of green banking.

Font size:

Interval:

Bookmark:

Similar books «Principles of Green Banking»

Look at similar books to Principles of Green Banking. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Principles of Green Banking and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.