How to Bitcoin

Kristian Kho, Khor Win Win, Crystaline Loo, Lee Shu Wei, Shaun Paul Lee, Teh Sze Jin, Bobby Ong

Copyright 2021 CoinGecko

st edition, February 2021

Layout: Anna Tan

teaspoonpublishing.com.my

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except brief extracts for the purpose of review, without the prior permission in writing of the publisher and copyright owners. It is also advisable to consult the publisher if in any doubt as to the legality of any copying which is to be undertaken.

Bitcoin might seem very complicated to the uninitiated and it is, but this book really simplifies it.

Mati Greenspan, Founder & CEO of Quantum Economics

Its not too late to be early to bitcoin. How to Bitcoin is a great introduction that anyone can learn from whether youre a beginner or financial professional. Find out why crypto is the fastest growing asset class in the world.

Nicolas Cary, Co-Founder of Blockchain.com and Co-Founder & Chairman of SkysTheLimit.org

Education ensures that everyone can benefit from the Bitcoin revolution.

Dan Held, Business Development Manager of Kraken

CONTENTS

2 9

Introduction

Welcome to CoinGeckos second book, How to Bitcoin ! We received so much positive feedback on our first book, How to DeFi , that we decided to write this one!

Bitcoin was the first cryptocurrency that got us started on our journey. Our understanding of Bitcoin has opened up many opportunities for us, and in these pages, we hope to share our collective knowledge with you. In How to Bitcoin, you will learn of Bitcoins transformative aspects and how it can open new opportunities for you too.

Bitcoin is not new. As we write this, it is 12 years old. That being said, it is still early and not too late to learn about Bitcoin and its implications for the future. Perhaps you would have heard of Bitcoin as this magic Internet money with revolutionary potential. We hope to debunk that and put together what makes Bitcoin revolutionary other than just magic.

How to Bitcoin is written for beginners with simple analogies to help you understand how it works. There are step-by-step guides to show you how to buy and secure your first bitcoin. It will be a relatively light read if you already have a deep understanding of Bitcoin. If so, we would be honored to receive your suggestions on improving this book.

Lastly, we see a future where owning a bitcoin is a matter of choice and foresight rather than ignorance. We hope this book can contribute to making that a reality.

CoinGecko Research Team

Kristian Kho, Khor Win Win, Crystaline Loo, Lee Shu Wei, Shaun Paul Lee, Teh Sze Jin, Bobby Ong

1 January 2021

Part 1: What is Bitcoin?

Chapter 1: Bitcoin and Money

Bitcoin is a peer-to-peer electronic payment system that allows parties to transact with each other without the need to use any trusted third-party intermediaries. It is an alternative to our traditional financial system, where payments need to be routed through financial institutions.

When you use Bitcoin, you do not need to trust a centralised entity such as a government, a bank, or a financial institution. For example, in the traditional financial system, using PayPal requires that you trust PayPals ability to make transactions. Paying with your Mastercard requires that you trust Mastercard, your bank, your merchant's bank, and other payment processors to clear your transaction.

Even using cash requires you and your counterparty to trust your government officials. As recently as 2016 the Prime Minister of India demonetized the 500 and 1,000 rupee notes causing significant immediate volatility.

Bitcoin is a payment protocol and a cryptocurrency itself. This protocol is a payment network that allows for transactions to be routed without relying on any third parties. It is powered by a new technology known as the blockchain. Bitcoin is also known as a cryptocurrency, a type of virtual currency, because transactions are secured using cryptography.

For the purposes of this book, we will be representing Bitcoin with a capitalized B whenever we refer to the Bitcoin protocol and bitcoin with a lowercase b when we refer to the bitcoin cryptocurrency.

Bitcoin distinguishes itself from traditional fiat currencies as it is not backed by any government, central bank, or centralized authority. Instead, it is created, stored, and distributed digitally on a public, decentralized ledger that follows a strict set of simple rules.

This is the philosophy that created Bitcointhe ability to operate a financial system in a decentralized manner without the need to trust any centralized intermediary.

Government Money

Before we continue with bitcoin itself, it may be worth revisiting the money that we use on a day-to-day basis.

For something that almost everyone on Earth labors for and cherishes after, few understand how money functions and even less comprehend the intricacies of the fiat monetary system.

It is well enough that people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning. Quote attributed to Henry Ford |

Government Money is what is known as fiat currency , or in simple English, Money by Decree.

Fiat is derived from the Latin word fiat, which essentially means let it be done. Fiat has been deemed as money because it is mandated by governments as being legal tender by law and thus must be accepted as a valid form of payment under the scrutiny of our legal jurisdiction.

With most things in government, money is handled with a top-down approach. National leaders decide every facet of the monetary system and regular folks follow the rules that have been set.

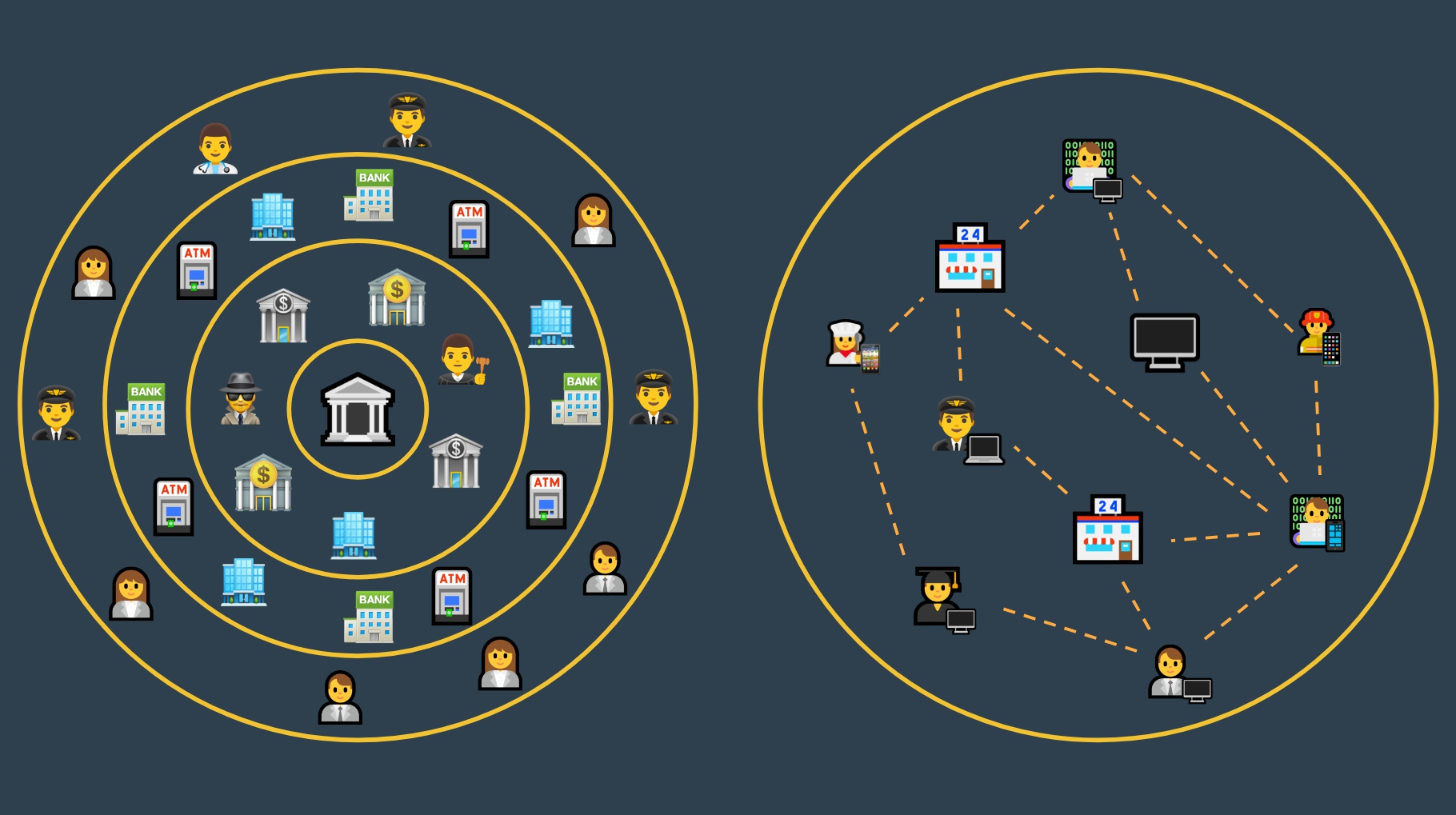

Fiats layered bureaucratic system vs. Bitcoins peer-to-peer system.

In an ideal world, a top-down fiat monetary system isnt all that bad. After all, not everyone is an expert in economics and finance; it is perfectly acceptable to just use a robust value-transfer system without needing to worry about anything as one goes on with their daily lives.

However, for the past century or so, this has not been the case.

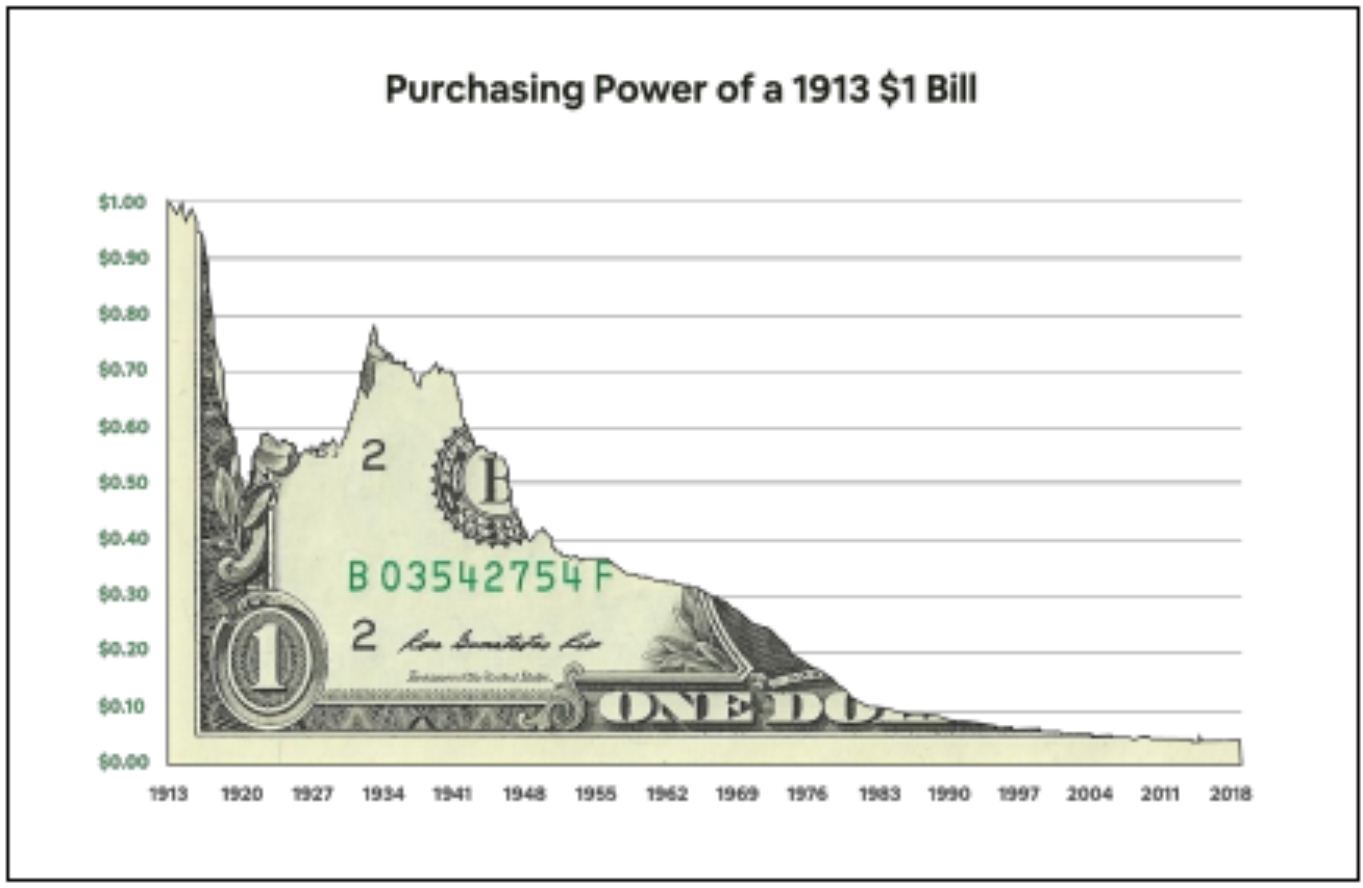

Without going into too much detail, the rules governing paper money, more specifically the US Dollar, changed in 1913.

Data from St. Louis Federal Reserve

2008 Financial Crisis

The above sets the scene for what was about to happen when the whole world economy crashed down during the 2008 Financial Crisis.

The 2008 Financial Crisis in the United States was one of the worst economic disasters in history, crumbling the worlds financial and banking system. Many large financial institutions and banks tragically fell apart. Amongst the fallen were Lehman Brothers and Bear Stearns.

This crisis stemmed from subprime mortgage loans, which in simple terms were loans issued to high-risk borrowers who do not qualify for conventional loans. These loans were then repackaged multiple times into complex derivatives. Bad loans combined with widespread fraudulent practices across various financial institutions exacerbated the housing bubble. It created a ticking time bomb that ultimately blew up into the 2008 Financial Crisis.