Healthy finances

Sort out your money with help from classic financial thinkers

Infinite Ideas

Introduction

Have you ever noticed how some of the richest people out there are surprisingly sensible with their money? Maybe youve even remarked how strange it seemed and wondered why they werent splashing the cash around on a luxury extra home on every continent, flashy sports cars and tiaras for all their pets.

Well, many wealthy people have become wealthy through wise management of their finances of course they treat themselves sometimes but on the whole theyve had to think carefully about their money in order to build and preserve their wealth. The flip side of this is the person who has never learned how to manage money and then suddenly finds themselves in possession of untold wealth due to a big lottery win. Its astonishing how many of these folks are, within a few years, back to worrying about their precarious finances like the rest of us.

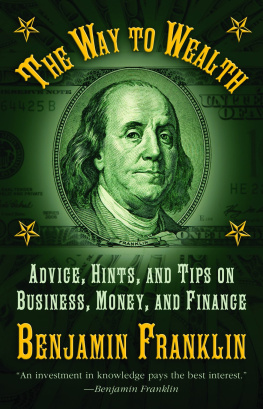

So wed all like to have to worry less about our finances and hopefully have a little spare cash to spend on a few nice things we dont really need, but what can a bunch of writers from yesteryear tell us about looking after our wealth right now? Well a surprising amount of their advice is still relevant. Financial institutions, the opportunities for trade and the way we store money and pass it around may well have altered greatly since writers such as Benjamin Franklin were writing but human nature and our attitudes to wealth have not. Heres a little about the books weve consulted to create the advice in this book.

In 1926 George S. Clason issued the first in a famous series of pamphlets on thrift and financial success, using parables set in ancient Babylon to make his point. These were distributed to millions and were eventually published together as The Richest Man in Babylon. Since then millions of copies have been sold and the book has become a modern inspirational classic. By all accounts, The Richest Man in Babylon is the antithesis of modern society. If quick-fix, magic-bullet philosophies are more your style (even though you know in your heart they dont work) then youll probably be disappointed. If work is a four-letter word and you think delayed gratification is a sexual dysfunction then it might not float your boat. The Richest Man in Babylon doesnt offer overnight solutions but the methods put forward for paying off debt, generating income and building wealth are as valid and applicable today as they were over 8000 years ago in Babylon. And these guys knew a thing or two about money.

In 1940 Fred Schwed, a stock broker whose father had lost everything as a short seller on Wall Street during the Roaring Twenties, published Where are the Customers Yachts?, a timeless classic on how the stock market really works. Schwed had seen the ups of the 1920s boom and the downs of the 1930s Depression, and his insight into the psychology of investment professionals and their customers is as relevant today, in the current financial crisis, as it was in 1940.

The title of the book refers to an old joke: a tourist is being shown all the fancy boats in the harbour, and is told, These are the bankers yachts, and these are the stockbrokers yachts. When he asks, innocently, Where are the customers yachts? he is told that there arent any (in other words, the customers have not got rich from the stock market). In recent decades great strides have been made in the theoretical understanding of financial markets, but Schweds wisdom, developed long before the days of hedge funds and exotic derivatives, still holds true. His central point is that markets are unpredictable. That doesnt matter if youre investing for the long haul, because all the major stock markets perform well in the long term its trying to do better than average, says Schwed, that causes all the trouble. Reading Schweds book is like meeting a friend, and its a great feeling to realise that not everyone in the markets, then or now, is a money-obsessed barbarian.

Weve also included ideas from Samuel Smiles 1859 self improvement classic Self-help, The Wealth of Nations, Adam Smiths landmark examination of political economy from 1776, Benjamin Franklins aphorism-rich pamphlet of 1758, The Way to Wealth and Ralph Waldo Emersons 1841 transcendentalist essay Self-reliance.

We hope that the advice in here will help you improve your financial situation, whether youre hoping to dig yourself out of debt, want to be able to work out the best way of investing your savings or simply want to find away to make the most of your earnings. And if you do find that this book enables you to buy all those unnecessary luxury homes and pet adornments we hope youll also find an appropriate way to thank us.

Life plan

I have actually been fiddling around with common stocks for most of my life.

So says Fred Schwed in Where are the customers yachts? When you go to a financial adviser these days, the first thing she has to do is to conduct a fact find; this is required by the regulators. Its a good rule, because you have to look at your life in the round your income, your prospects, your liabilities, your dependents to make a sensible plan.

One approach to this is to think about your life as a series of stages, with different needs and opportunities occurring at different times. Although the retail end of the financial services industry makes this into a rather irritating, paternalistic we know better than you do ploy, the basic idea is sound you just have to tailor it to suit who you are, not who the bank thinks you ought to be.

Most people dont plan enough for the medium to long term, as many studies have established. A very effective technique for ensuring that you are in control of your finances is to set aside money for specific purposes. Suppose you know that within five years you will need to renovate your kitchen. By regularly paying money into a separate account, you can ensure that you will have the cash when the time comes.

Using this technique, you can then think about your stages of life more clearly. Lets divide them into four: young adulthood, building a family, middle age and retirement.

Young adulthood: people in their twenties naturally have a big appetite for life but usually are earning less than they will later on. Many people at this stage tend to spend too easily. There is a danger of getting into debt. On the other hand, any sound long term investment is likely to grow substantially. Try contributing a small sum each month to an index fund.

Building a family: if you are starting a family, your expenditure is likely to have increased dramatically. Purchasing a home is an important form of long term saving. You also need to start planning for retirement.

Middle age: by this time many people have got some equity in their homes and are at the top of their career and earning power. Now is the time to put as much money as possible into your investments and pension scheme, if you have one.

Retirement: if you dont have to retire, then dont! But if you do, this is when you may have to live off your investments. Protecting your capital becomes very important, so many people start to weight their portfolios heavily towards bonds, which have a predictable return if held to maturity.

Defining idea

Always be a first-rate version of yourself, instead of a second-rate version of somebody else.

Next page