Contents

Guide

My first REIT investment was way back in 2002 when I bought Ascendas REIT. How I wish this book had been available at that time. I would have made fewer mistakes and more profits!

MOHAMED SALLEH MARICAN

Founder and CEO, Second Chance Properties Ltd

Building Wealth Through REITs is a great contribution to the nascent REIT market in Asia. We believe REITs are a perfect investment vehicle for Asian investors, yet to date the popularity and investor enthusiasm in Asia for REITs is still lacking. This comes down to various misperceptions that Bobby sets out to debunk with this ground-breaking book.

RAYMOND WONG

Executive Director, Saizen REIT

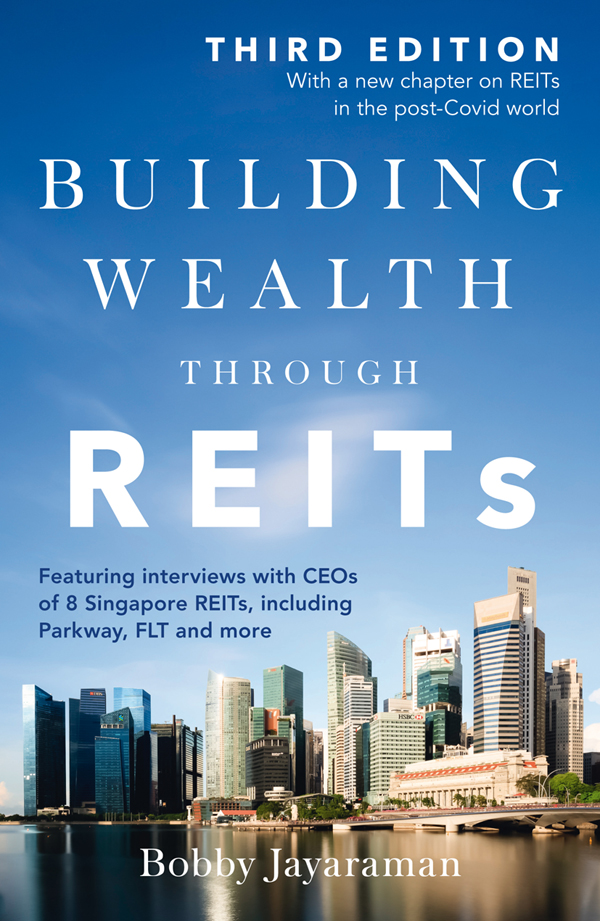

2021 Marshall Cavendish International (Asia) Private Limited

First published in 2012

This third edition published in 2021 by Marshall Cavendish Business An imprint of Marshall Cavendish International

All rights reserved

No part of this publication may be reproduced, stored in a retrieval system or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, without the prior permission of the copyright owner. Requests for permission should be addressed to the Publisher, Marshall Cavendish International (Asia) Private Limited, 1 New Industrial Road, Singapore 536196.

Tel: (65) 6213 9300 E-mail:

Website: www.marshallcavendish.com/genref

The publisher makes no representation or warranties with respect to the contents of this book, and specifically disclaims any implied warranties or merchantability or fitness for any particular purpose, and shall in no event be liable for any loss of profit or any other commercial damage, including but not limited to special, incidental, consequential, or other damages.

Other Marshall Cavendish Offices:

Marshall Cavendish Corporation, 800 Westchester Ave, Suite N-641, Rye Brook, NY 10573, USA Marshall Cavendish International (Thailand) Co Ltd, 253 Asoke, 16th Floor, Sukhumvit 21 Road, Klongtoey Nua, Wattana, Bangkok 10110, Thailand Marshall Cavendish (Malaysia) Sdn Bhd, Times Subang, Lot 46, Subang Hi-Tech Industrial Park, Batu Tiga, 40000 Shah Alam, Selangor Darul Ehsan, Malaysia

Marshall Cavendish is a registered trademark of Times Publishing Limited

National Library Board, Singapore Cataloguing-in-Publication Data

Names: Jayaraman, Bobby.

Title: Building wealth through REITS / Bobby Jayaraman.

Description: Third edition. | Singapore : Marshall Cavendish Business, [2021] |

First published: 2012.

Identifiers: OCN 1245252264 | e-ISBN: 978 981 4974 35 6

Subjects: LCSH: Real estate investment trusts.

Classification: DDC 332.63247--dc23

Printed in Singapore

To my son Mark

Hope this sparks your interest in investing

CONTENTS

ACKNOWLEDGEMENTS

I have always been interested in investing and sharing my thoughts about investments from the perspective of a practising investor. My first articles on REITs were published in Pulses, a finance magazine (now defunct), and Singapores The Business Times newspaper in 2010. I wish to thank Ms Teh Hooi Ling for giving me that opportunity. It was the positive feedback from many investors on the articles that inspired me to write this book.

I wish to express my appreciation to the management of several REITs who not only took time from their busy schedules to have in-depth discussions with me on REITs for this book but who have always been very co-operative in openly discussing the many aspects of REITs whenever I had questions. They have been instrumental to me in deepening my understanding of how REITs really work.

Special thanks to Simon Ho and Jeanette Pang from Capita-Mall Trust; Dr Ronnie Tan, Victor Tan, Jacky Chan and Hao Wee Lee from First REIT; Ho Siang Twang and Vincent Yeo from CDL Hospitality Trusts; Lynette Leong and Ho Mei Peng from CapitaCommercial Trust; Dr Chew Tuan Chiong and Chen Fung Leng from Frasers Centrepoint Trust; Raymond Wong, Arnold Ip, Chang Sean Pey and Joey Goh from Saizen REIT; and Viven Sitiabudi and Alvin Cheng from LMIR Trust.

I am grateful to Mr Mohammed Salleh, founder and CEO of Second Chance Properties, for his feedback on the book and for sharing with me his philosophy and insights into property investing and business in general. I have learned to appreciate the many details of running a retail business and the impact on retail REITs through these conversations.

Many thanks to my fellow investment enthusiasts too numerous to mention, regrettably with whom I have frequently exchanged ideas and who have encouraged me to write this book and provided valuable feedback.

Thanks to Lee Mei Lin from Marshall Cavendish, the publishers of this book, and Violet Phoon for her patience in editing it.

Finally, allow me to express my gratitude to my wife Elena and son Mark who put up with regular late nights as I tackled the volatile markets and wrote the book.

PREFACE

TO THE THIRD EDITION

A lot has changed since the first edition of this book was published in 2012. REITs are now immensely popular with all types of investors. The sector has seen a constant flow of IPOs over the past few years; a few REITs have merged while some are pale shadows of themselves.

Retail investors have become much more knowledgeable about REITs and activist investors are starting to make their presence felt in the Singapore REIT world for the first time ever a merger between two REITs (Sabana REIT and ESR REIT) was blocked by an activist fund.

While REITs have their up and down cycles, interest rates fluctuate and REIT sectors go in and out of fashion, the fundamentals of evaluating REITs remain intact. Thus, it is no surprise that this book has undergone several reprints and continues to remain popular.

This edition includes two new interviews with the management of Parkway REIT and Frasers Logistics & Commercial Trust. A chapter on the impact of the Covid-19 pandemic on REITs has been added, and outdated material has been revised and updated with new data.

Most of the material from the first edition, however, continues to remain relevant. Examples that use data from earlier years to illustrate a particular aspect of a REIT (e.g., understanding financial statements or how REITs behave in volatile interest rate environment) have been left unchanged.

As with the first edition, the intention is to make REITs accessible to all.

Happy reading!

BOBBY JAYARAMAN

May 2021

INTRODUCTION

The fact that other people agree or disagree with you makes you neither right nor wrong. You will be right if your facts and reasoning are correct.

BENJAMIN GRAHAM

Real estate investment trusts (REITs) allow you to become part owner of some of the best commercial properties in Singapore and other countries, and earn a regular income stream. The first Singapore REIT (S-REIT) was launched by CapitaMall Trust in July 2002. As of February 2021, there are 42 REITs and property trusts listed on the Singapore Exchange (SGX), with a market capitalisation of close to S$100 billion, making Singapore the largest REIT market in Asia excluding Japan. They cover malls, offices, hotels, industrial assets and residential homes.