worried about saving, investing or retirement.

feel free to make notes in the margins.

Introduction

Five years ago I started an asset management business and called it Cartesian Capital, after the French philosopher and mathematician Ren Descartes. He is best known for the saying, I think therefore I am, and his mathematical legacy includes the x-axis and y-axis plane. The string of numbers your GPS uses are called Cartesian coordinates, after Descartes.

Before that, I earned my stripes on trading floors and investment teams for large international banks, where I traded and invested such large sums of money that it often felt a bit surreal. But Ive learned that every investment decision I take is important to the ordinary investor you.

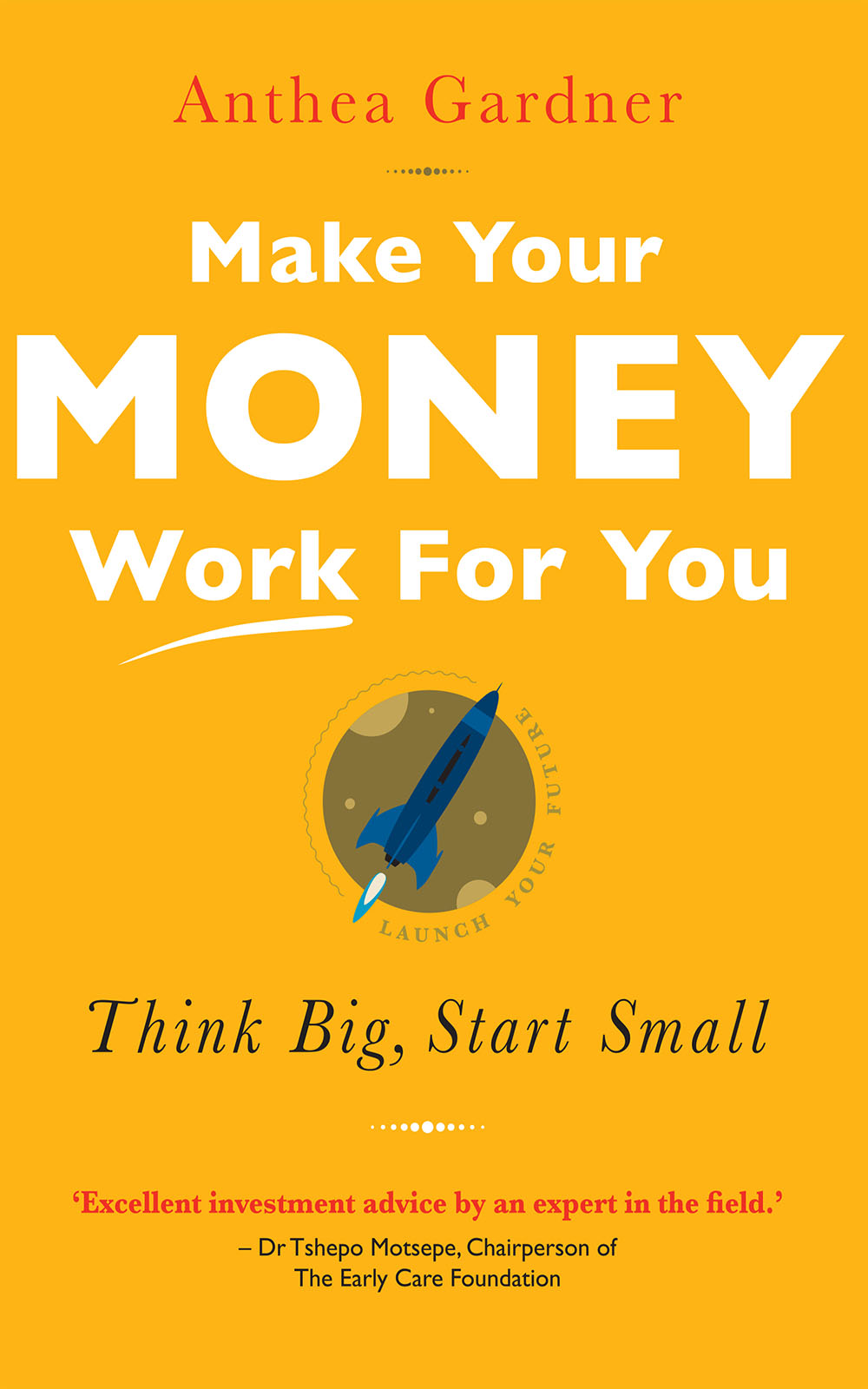

This book will show you how to take control of your financial future and how to make your hard-earned cash work harder for you what we sometimes refer to as sweating your assets. For the record, your assets include your house, investments and cash.

Whether youre a salaried employee with a company pension fund, a brave entrepreneur with overheads to meet every month or a future entrepreneur, this book will introduce you to the exciting world of investing and give you the knowledge you need to create wealth with your salary or savings. The goal is to retire comfortably, gain financial independence, create your personal discretionary spending fund, or all of the above.

Ideally, it is best to start investing as soon as you start earning a salary, but I understand that not everyone was given that advice or shown how to do it when they started working. I advocate starting as soon as possible to take advantage of a system that is set up to help you grow the money you earn. Even if youre in your fifties start now.

Whether youve got R500 000, R50 000, R5 000 or R500 there is no excuse not to start investing as soon as possible. No matter how small or large the amount, with a 12% per annum return you will double your money every six years. Look out for the Rule of 72 in Chapter 8; you wont believe how easy it is to do the calculation and impress your friends.

This book will also introduce you to the concept of risk-taking and how to apply it to your personal circumstances. Ill teach you the difference between an exchange-traded fund (ETF), a managed fund and a unit trust; why you need a retirement annuity (RA) as well as a pension fund; and how to be tax-efficient with your investments.

If one day you decide, like Jeff Bezos, that you want to give up the regularity of a monthly salary and those eye-watering bonuses, commissions or thirteenth cheques to start your own business from your garage, this book will help you create a safety net, put food on the table, and pay the mortgage while you establish your brand and build a financially successful business.

Of course, not everyone dreams of starting the next Amazon, and you might be content that your corporate job affords you a monthly income, sometimes accompanied by a subsidised pension fund and medical aid. However, maybe your son will turn out to be a tennis prodigy who needs to travel to Los Angeles, where all the top tennis coaches are based, or maybe your daughter will be the one who needs you to help cover her rent while she creates the next Facebook from her room in university residence.

So why not create the financial stability that will allow you to give them that helping hand? And if it turns out that they dont need it, well, theres nothing wrong with having money to travel the world in your retirement, paying for life-saving surgery, or not having to worry about whether you will have enough money to live to 100.

I want to demystify investments and the stock market and show you how to invest wisely. While I will do my best to avoid all the technical concepts and jargon, a few basics must be covered. Its important to know the difference between saving and investing, what your personal risk profile looks like, and how to invest to achieve your personal financial goals (were not so worried about anyone else right now, but if you are, then pass this book on to them when youre done).

When a financial advisor is told not to use jargon, or when their client tells them they know nothing about investments, the advisors immediate reaction is to dumb it down and talk down to the person in front of them. This book does not do that. Im going to assume that you are smart and thoughtful enough to understand your personal financial situation (because thats what this is all about), and Im going to assume you want to take the time to think about the concepts and ideas I present in the chapters that follow.

Im sure you know how to use Google to find more information. If you still have questions, email me at invest@cartesian.co.za or visit www.thinkbigstartsmall.co.za.

Notes

This quotation is attributed to Jerry Rice, who is considered to be one of the best wide receivers the US National Football League (NFL) has seen.

A sprint-distance triathlon is a 750-m swim followed by a 20-km cycle and a 5-km run. An Olympic distance is twice the sprint distance: 1,5-km swim, 40-km cycle and 10-km run. A half Ironman is a 1,9-km swim, 90-km cycle and 21,1-km swim. The full Ironman is a 3,8-km swim, 180-km cycle and 42,2-km run.

A Mani, S Mullainathan, E Shafir and J Zhao, Poverty impedes cognitive function, Science 341(6419) (2013), pp 976980.

Larry Bell, Benjamin Franklin Investor, The Franklin Society, 2019. Available at thefranklinsociety.com/benjamin-franklin-investor/, accessed on 10 April 2019.

Mercer Australia, Mercer Melbourne Global Pension Index, 22 October 2018. Available at www.mercer.com.au/our-thinking/mmgpi.html, accessed on 10 April 2019.

From To a Mouse (1786).

James Chen. Pork bellies, Investopedia, 23 January 2018. Available at www.investopedia.com/terms/p/porkbellies.asp, accessed on 10 April 2019.

Lawrence Lewitinn, How Buffett used financial weapons of mass destruction to make billions of dollars, Yahoo Finance, 26 April 2016. Available at finance.yahoo.com/news/how-buffett-used--financial-weapons-of-mass-destruction--to-make-billions-of-dollars-175922498.html, accessed on 10 April 2019.

Palak Shah, NSE leads the charge on tech highway, Business Standard , 25 January 2013. Available at www.business-standard.com/article/markets/nse-leads-the-charge-on-tech-highway-112082100031_1.html, accessed on 10 April 2019.

This quotation is widely attributed to Keynes.

H1 2018 Global art market report, Artprice, 2018. Available at www.artprice.com/artprice-reports/global-art-market-in-h1-2018-by-artprice-com/h1-2018-global-art-market-report-by-artprice-com?from=search, accessed on 10 April 2019.

TCEHY is the US-listed share of Tencent, which has its primary listing in Hong Kong, and where the share code is 700.HK

Caveat lector : these are my own generalisations from years of observation and Im happy to take full responsibility should anyone feel complimented or offended.

BSD refers to the alpha male hotshot in an industry that is still predominantly male.

SENS is operated by the JSE to provide company news and other information with a direct impact on the market.

Technical analysis is the process of analysing shares based on the share price movements, trends, statistical indicators such as standard deviations and moving averages, and patterns such as pennant flags.