$AVE

SMART,

EARN

MORE

THE NEW RULES FOR

RETIREMENT IN VESTING

DENNIS BLITZ

Copyright 2008 by Dennis Blitz

All rights reserved.

This book, or parts thereof, may not be reproduced in any form without permission from the publisher; exceptions are made for brief excerpts used in published reviews.

Published by Adams Business, an Imprint of

Adams Media, an F+W Publications Company

57 Littlefield Street, Avon, MA 02322. U.S.A.

www.adamsmedia.com

ISBN-10: 1-59869-645-9

ISBN-13: 978-1-59869-645-5

eISBN: 978-1-44051-538-5

Printed in Canada.

J I H G F E D C B A

Library of Congress Cataloging-in-Publication Data

is available from the publisher.

This publication is designed to provide accurate and authoritative information with regard to the subject matter covered. It is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional advice. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations

Many of the designations used by manufacturers and sellers to distinguish their product are claimed as trademarks. Where those designations appear in this book and Adams Media was aware of a trademark claim, the designations have been printed with initial capital letters.

This book is available at quantity discounts for bulk purchases.

For information, please call 1-800-289-0963.

DEDICATION

Maybe the reason we write books is so we can dedicate the effort to the people who mean the most to us. As an author, you start to think about the dedication very early in the process; you want it to be right and to express your appreciation. Then the publisher calls and says its due now. I know that this dedication will leave unmentioned many very important people, and to them I apologize.

To my parents, Mary and Lou Blitz. No matter how long we go to school, we learn all our important lessons at home.

To my four wonderful children, Marla, Lauren, Jason, Brian, plus the two more who joined our family and made it even better, Stacy and Andrew. To four fantastic and brilliant grandchildren, Carter, Sammy, Lily, and Gabe. My children and grandchildren have brought me more happiness than I could have wished for.

And, most importantly, to my best friend, helpful critic, and intellectual guide, the Redhead from Southfield, my wife Gayle.

Dennis

CONTENTS

INTRODUCTION

This Message Could Mean an Extra Million Dollars for You and Your Family

Each year, millions of intelligent and prudent people set aside money for their future. For many, saving money is a struggle. Yet even in the face of higher costs of living and unexpected emergencies, they continue. Sadly, too often their efforts are rewarded with dreadfully poor returns.

Newspaper headlines, television talk shows, and investment company sales literature continue to proclaim that Americans need to save more. For many, that advice is sheer nonsense. Millions of Americans are already saving and investing billions of dollars each year. The following figures represent net investment inflow for 2006.

| Investment Type | Investment Amount |

| U.S. mutual funds | $17 trillion |

| Exchange-traded funds (ETFs) | $1.2 trillion |

| Unit investment trusts (Source: Investment Company Institute) | $29 billion |

| Annuity purchases (Source: LIMRA International) | $240 billion |

In addition, people are investing in real estate, new businesses, and a host of other opportunities.

So, why do we keep reading that Americans are saving less than ever before? As the old saying goes, Figures dont lie, but liars figure. Many of the figures we read in the headlines are derived by using an outdated measuring tool, the net inflow into bank savings accounts. However, for many of us bank savings accounts are no longer the preferred method of saving, so this indicator keeps shrinking. This obsolete indicator is frequently cited by the investment industry to make its self-serving point.

The real reason for the disappointing balances in our savings andinvestment accounts is that those accounts are earning abysmal returns.

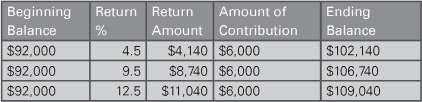

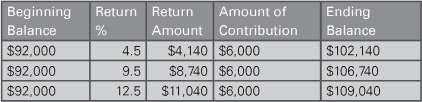

The impact of even a slight improvement in our annual return will have a dramatic effect on our financial future. Lets look at an example. Joe has worked at the same company for fifteen years. The company is good to Joe and provides him with a 401(k) plan. Joe contributes to the 401(k) plan religiously (smart move, Joe). This year he will contribute $4,000, and his employer will match 50 percent ($2,000) for a total contribution of $6,000. At the beginning of the year, Joes 401(k) account has a balance of $92,000.

Assuming that Joe invests the $6,000 on the last day of the year, take a look at how dramatically various returns impact his account balance.

As you can see, the return on Joes investments has a greater impact on the growth of his account than the amount of his annual contribution. Over Joes career, the impact of performance will add or subtract hundreds of thousands of dollars from his account. For those who earn or save more than Joe, the impact could be as high as $1 million over a lifetime.

Yet, rather than being advised to monitor the returns on our investments, why are we instead told that we must save more?

You need only look to the source of the save more mantra. For the most part, this advice comes from studies that are commissioned and distributed by the investment industry. We should view these studies with the same suspicion we reserve for studies done by drug companiesyou know, the ones that always find that we should take more drugs. The investment industry benefits each time we invest more of our money. In 2006 the mutual fund industry alone collected commissions and annual investment fees of $200 billion.

The Rich Do Get Richer... Because They Know How to Invest

Of course, we cannot simply blame the investment industry for our poor investment returns. The fundamental barrier on our road to investment success is: most Americans have never been taught how to invest. Unfortunately, we cant look to the investment industry to teach us how to invest. Just as casinos earn the bulk of their money from inexperienced gamblers, the investment industry thrives on passive, unskilled investors. Such investors:

Are less likely to question fees and charges.

Are less likely to demand premium results when paying a premium fee.

Are less skeptical of inflated sales claims.

In spite of the industrys claims that we must save more, the real path to successful investment results is to improve our annual returns.

Now, here is the good news: Achieving higher annual investment returns is not an insurmountable task. We all can earn better returns if we are willing to become a little more knowledgeable about investing.

Anyone can learn how to earn more from their investments. I know, because I have taught investment techniques to thousands of people over the years.

Why I Wrote This Book

In 1969, I graduated from college with every intention of becoming a certified public accountant. However, as I walked out the doors of the university, I decided that I wanted to first spend a little time following my passion.

Next page