Digital Rights Disclaimer

All rights reserved. No portion of this book may be reproduced, distributed, stored in a retrieval system, or transmitted in any form or by any means, (including, without limitation, by electronic, mechanical, photocopy, recording, scanning, or other electronic of mechanical methods) except for brief quotations in critical reviews or articles, without the prior written permission of the publisher. This ebook is licensed and not sold. If you are reading this and did not purchase on .

This publication is protected under the U.S. Copyright Act of 1976 and all other applicable international, federal, state, and local laws, and all rights are reserved, including resale rights: You are not allowed to reproduce, transmit, or sell this book in part or in full without the written permission of the publisher.

Limit of Liability: Please note that much of this publication is based on personal experience and anecdotal evidence. Although the author and publisher have made every reasonable attempt to achieve complete accuracy of the content in this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. Your particular circumstances may not be suited to the examples illustrated in this book; in fact, they likely will not be. You should use the information in this book at your own risk. Nothing in this book is intended to replace common sense or legal, accounting, or professional advice, and it is meant only to inform.

Any trademarks, service marks, product names, and named features are assumed to be the property of their respective owners and are used only for reference. No endorsement is implied when we use one of these terms.

Retire Early with Real Estate

Chad Carson

Published by BiggerPockets Publishing LLC, Denver, CO

Copyright 2018 by Chad Carson.

All Rights Reserved.

Publishers Cataloging-in-Publication data

Names: Carson, Chad, author.

Title: Retire early with real estate : how smart investing can help you escape the 9-to-5 grind and do more of what matters / by Chad Carson.

Description: Includes bibliographical references. | Denver, CO: BiggerPockets Publishing, LLC, 2018

Identifiers: ISBN 978-1-947200-03-6 (pbk.) | 978-1-947200-02-9 (ebook) | LCCN 2018944519

Subjects: LCSH Real estate investment--United States. | Finance, personal. | Retirement. | BISAC BUSINESS & ECONOMICS / Real Estate / Buying and Selling Houses

Classification: LCC HD1382.5.C364 2018 | DDC 332.63/24

Published in the United States of America

10 9 8 7 6 5 4 3 2 1

Dedication

For Kari, Serena, and Ali.

Our incredible life journey together is the inspiration for this book.

INTRODUCTION

If you have built castles in the air, your work need not be lost; that is where they should be. Now put the foundations under them.

HENRY DAVID THOREAU

Beginnings

Welcome to the Book on Real Estate Early Retirement! The primary purpose of this book is to help you retire earlier and more confidently by using the fantastic tool of real estate investing. Look at this as your step-by-step guide to climb the mountain of an early retirement (aka achieve financial independence) using real estate.

The early in the title of the book could mean 30 years old, 45 years old, or 55 years old. Or it could just mean sooner and more comfortably than you would have otherwise. And the retirement in the title could mean a point where you stop working. Or just as likely, it could mean a point where you no longer need to work for money, yet you continue with a job, a business, or projects that you love. That second idea of early retirement has been my own personal preference.

Whatever early retirement means to you will work just fine with the content of this book. But before we get into the nuts and bolts of a real estate early retirement, I want to share with you my bigger reason for writing this book. The book is about more than real estate investing and money. Its actually about life.

My Motivation to Retire Early Using Real Estate

I chose to begin investing in real estate as a full-time entrepreneur at 22 years old right after college. Looking back, I now realize why I made that choice. I was afraid of giving away my independence, my flexibility, and my ability to create a life that mattered to me.

It wasnt that I was afraid to work. I actually love working on interesting and meaningful projects. The issue was freedom. My particular career optionsworking for a big company or going to medical schoolbasically gave control of my life to those particular career paths for a very long time.

Have you discovered the same lack of freedom in your career? Do you feel like the need to work for money really controls your life? Even with a job you enjoy, wouldnt it be better if you had the wealth to work on a schedule and on terms that you choose?

Because of that initial motivation, I began investing in real estate as a career. And over the last fifteen years, Ive used it to pay my bills, build wealth, and eventually create passive income streams that replaced my need to trade time for dollars. Real estate investing and the wealth it built have given me control over my life.

And thats exactly what I want to help you do with this book. Real estate investing is the vehicle. And taking control of money and your life is the destination.

Put Money in Its Place

So, my goal with the book is to help you put money back in its place. And its place is not at the center of all your decisions. Instead, I would love your values, your friends and family, your personal goals, and your life aspirations to guide all your decisions.

Instead of working eight- to ten-hour days just for money, I want to help you spend eight- to ten-hour days on projects that fire you up in the morning. If these projects still pay you money, fine. But if they pay you little or no money, thats fine, too.

The projects could be about contributing, like spending more time raising your kids or helping those in need. They could also be about doing things purely for enjoyment and growth, like traveling or learning something new. Or they could mean continuing to pursue a career or business you love.

The difference will be, as Warren Buffett says, that youll tap dance to work every day because youre doing it for love and not for a paycheck. And if someone or some company changes the rules of work in a way you dont like, youll be free to walk away.

I hope all of that sounds good to you. But I realize that the grind and hectic schedule of a career may have made it difficult to think about life after mandatory work. What would you even do with your life if you didnt have to get up every day and trade your time for money?

To help spark some ideas, I wrote the Money-Life Manifesto, which is about how to stop selling out for money. I originally published it on my personal website, but I felt it was important to include it here.

The Money-Life Manifesto: Do What Matters

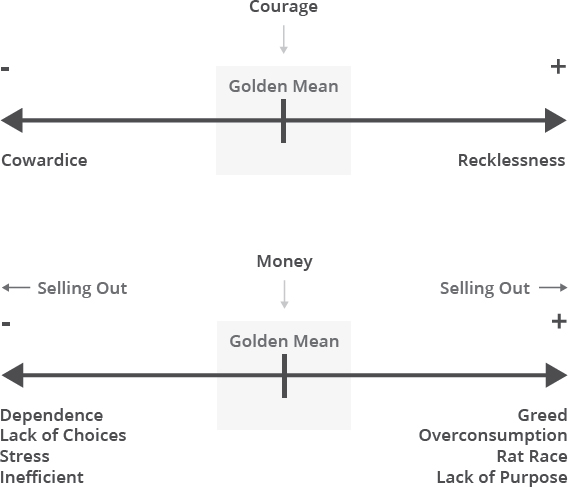

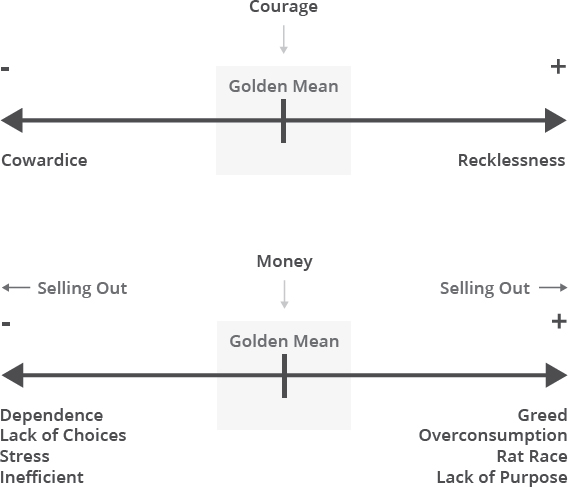

Ancient Greek philosopher Aristotle once coined the term The Golden Mean. It suggests that any virtue can become a vice when theres too much or too little of it. For example, courage is a virtue. But too much courage makes you rash and foolhardy, and too little courage makes you a coward. This manifesto is about the magical middle ground of money. You could call it the Golden Mean of Money. Here is how I see it:

Next page