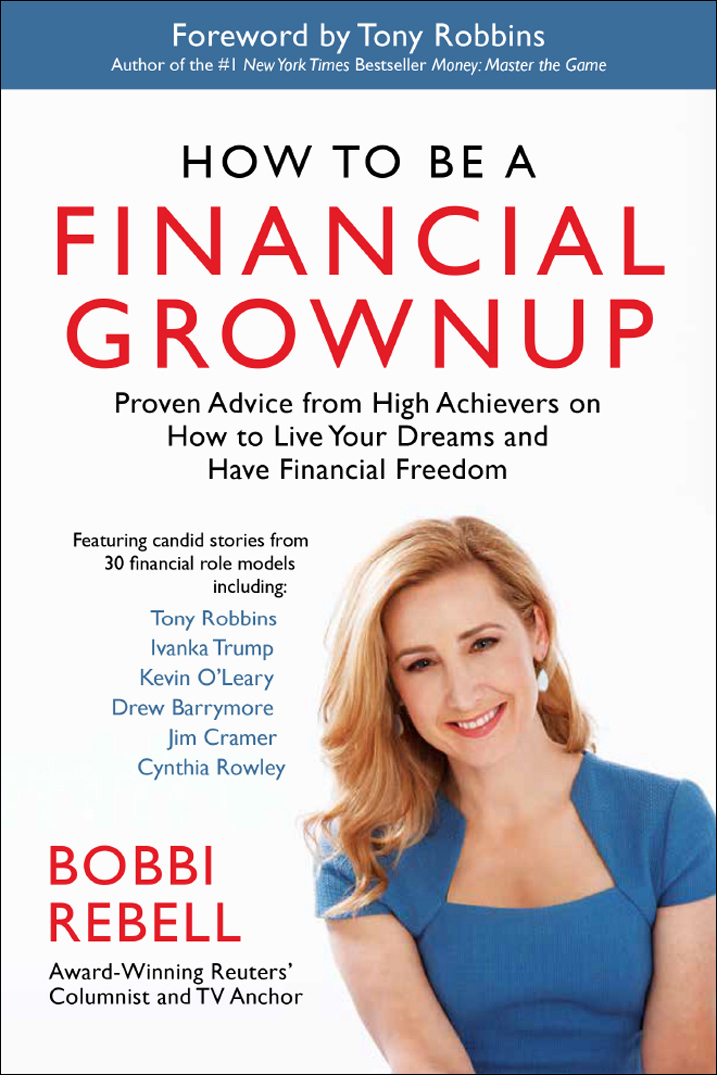

This collection of celebrity anecdotes sometimes funny, sometimes scandalous makes personal finance approachable and easily understandable. Theres a lesson for everyone, whether you make $25,000 or $250,000.

ANDY SERWER, Editor-in-Chief, Yahoo Finance, and former Managing Editor, Fortune Magazine

Whether youre a new grad just embarking on your financial life or a not-so-new one who simply never got your act together, Bobbi Rebell has amassed a list of to-dos that can get you on the right track without being overwhelming. Plus, its a fun read.

JEAN CHATZKY, Financial Editor, NBC Today, and Host, HerMoney (podcast)

Sure it is fun to play all day, but I think Peter Pan never wanted to grow up for another very good reason: there are no credit cards, mortgages, health insurance, or student loans in Neverland. In the real world, however, everyone struggles with these and other financial challenges. How to Be a Financial Grownup is the perfect personal finance storybook with engaging money tales from real, successful people along with actionable advice. Follow their words of wisdom if you want a happy ending, folks!

LAUREN YOUNG, Money Editor, Thomson Reuters, and former Personal Business Editor, BusinessWeek, and Senior Writer, SmartMoney Magazine

As a society, were used to seeking health and lifestyle advice from celebrities. How to Be a Financial Grownup applies that approach to financial health a critical but often overlooked component of overall wellness. The result is a collection of engaging, practically applicable lessons about money from a variety of worthy teachers.

ELLIOT WEISSBLUTH, Founder and CEO, HighTower

To be a success, you need to know the difference between an idea and a gameplan. A lot of people have ideas, but not many have a real plan to bring them to life. Bobbis book is full of successful people whove had a real gameplan. Its full of valuable advice to help make you a success whether youre just starting out or looking to take your game to the next level.

KENNY DICHTER, Founder and CEO, Wheels Up

Published by Maven House Press, 4 Snead Ct., Palmyra, VA 22963 610.883.7988,

Special discounts on bulk quantities of Maven House Press books are available to corporations, professional associations, and other organizations. For details contact the publisher.

Copyright 2016 by Bobbi Rebell. All rights reserved. No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted in any form or by any means (electronic, mechanical, photocopying, recording, or otherwise) without either the prior permission of the publisher or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, 222 Rosewood Drive, Danvers, MA 01923; 978.750.8400; fax 978.646.8600; or on the web at www.copyright.com.

While this publication is designed to provide accurate and authoritative information in regard to the subject matter covered, it is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional service. If legal advice or other expert assistance is required, the services of a competent professional person should be sought. From the Declaration of Principles jointly adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations

Cover photo by Claudio Marinesco. Makeup/hair style by Tonia Ciccone.

Library of Congress Control Number: 2016932955

ePUB ISBN: 978-1-938548-67-3

10 9 8 7 6 5 4 3 2 1

For Neil

Table of Contents

Guide

CONTENTS

Chapter 1: Be A Financial Grownup

Chapter 2: A Debt Primer

Chapter 3: Careers Are for Making Money

Chapter 4: How to Spend Money

Chapter 5: Investing Starts Now

Chapter 6: Family Matters

Chapter 7: Consider Your Real Estate Options

Chapter 8: Mixing Friends and Finances

Chapter 9: Wealth and Wellness

Chapter 10: Educate Yourself, Then Others

T HE CAREFREE AND UNBRIDLED JOY OF A CHILD is a beautiful thing. Its that enviable innocence that makes us smile. Its their rightful, age-appropriate ignorance of the worlds challenges that allows us to revel in their happiness. Every child deserves this season of life, but as time goes on, if they dont grow up emotionally and intellectually if they continue in their childhood ignorance they will experience the full breadth of lifes challenges. Contrary to popular belief, ignorance is not bliss. Ignorance is pain. And in the category of personal finance, ignorance can mean poverty.

Unfortunately, financial grownups are rare in our society (for a whole host of complex reasons). This is not meant to be a condescending statement. Its simply a fact of the state of affairs. Forty-six percent of Americans cant cover a $400 emergency expense. Sadly, its taking a toll on our physical, emotional, and relational selves.

A recent Forbes article came across my desk with a frightening title: 1 in 4 Americans Have PTSD-Like Symptoms from Financial Stress. As someone whose lifes work is committed to ending suffering, this makes me extremely frustrated. Frustrated because this is one area where people dont have to suffer. We are living in a time when all the tools and information you need to make wise financial decisions are quite literally at your fingertips. So why are so many people stressed to the hilt?

Whether its your mind, your body, your relationships, or your finances, its rarely for lack of information that most people suffer, or stay in the rut of wanting to change but not being willing to do what it takes. Take weight loss, for example: There are more how-to diet books, supplements, and websites than ever, but over 50 percent of the U.S. population is considered overweight.

No matter the area of life, people suffer or dont make the shifts they want to because they have embraced damaging stories: false narratives about themselves or their circumstances that inform their personal identities. I was 30 pounds overweight in my twenties, and my story was I am big-boned. Nonsense! There are no fat skeletons! The story was there as my excuse not to face the uncomfortable truth that I was simply fat.

When it comes to money and personal finance, I often hear stories like I am not good with money, or I am not a numbers person, or money is evil, or money is not a worthwhile area to focus on. These, too, are nonsense. Stories like these are the stumbling blocks of change. And most people feel the subconscious tension of wanting to change their circumstances, but the stories they cling to are taking over their minds like weeds choking out a garden.

When people want change in a specific area of life, the first thing I do is help them uncover the damaging stories they have been telling themselves. I want them to begin to question whether those stories are really true. Without shifting your story and embracing a new, empowering narrative, more information and tools wont create lasting change.

In the pages ahead, Bobbi has done a wonderful job of laying the groundwork for a new narrative for anyone willing to take the journey. If you picked up this book, it might be because you are sick of the story youve been telling yourself about money, and the time has come to make a shift. Thats a great place to be, as frustration is a launch pad to change. Or maybe you are simply in a phase of life where the pages are blank and you get to write your own financial grownup story. Either way, this book is a great place to begin.