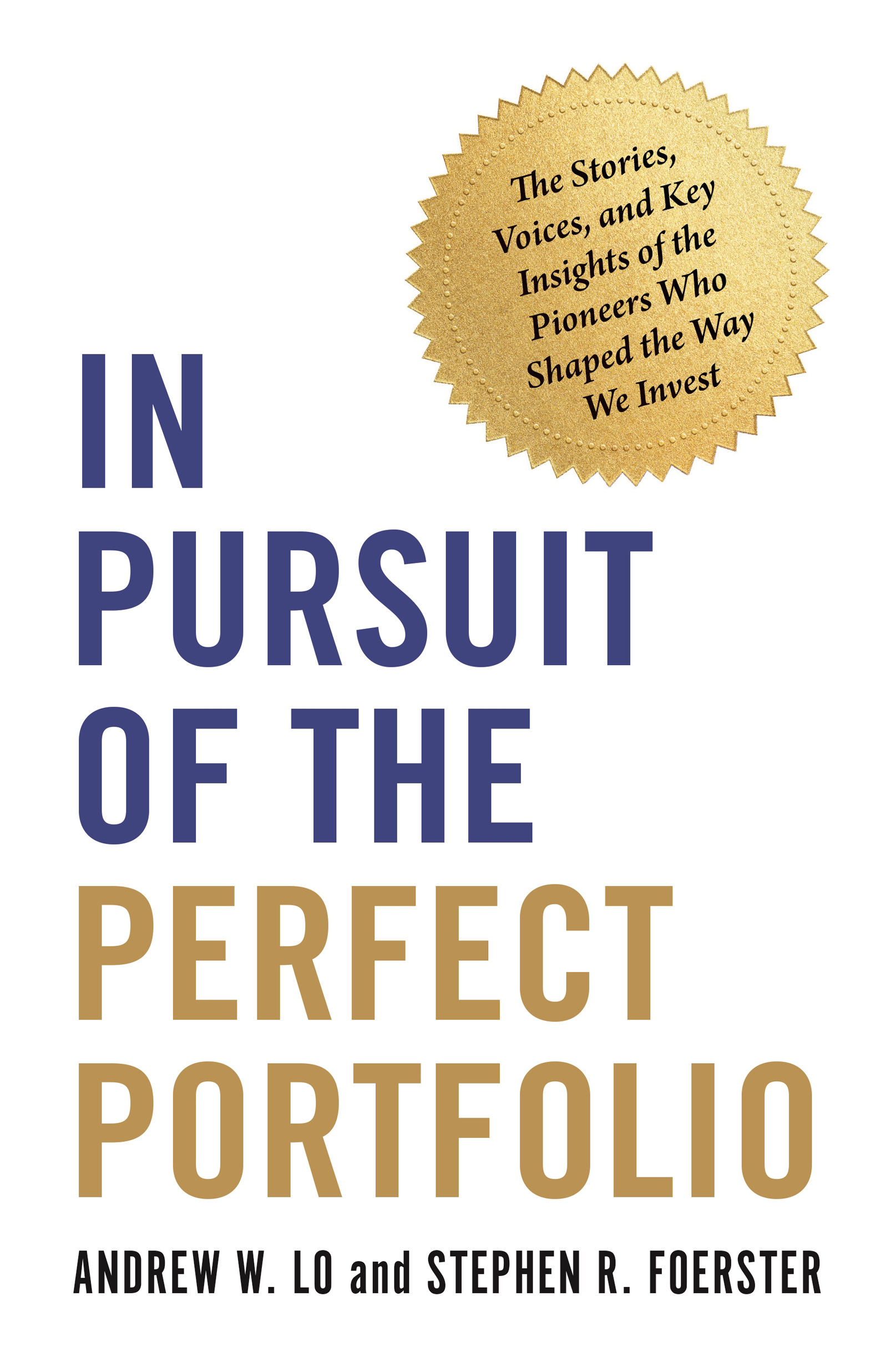

IN PURSUIT OF THE PERFECT PORTFOLIO

IN PURSUIT OF THE PERFECT PORTFOLIO

The Stories, Voices, and Key Insights of the Pioneers Who Shaped the Way We Invest

ANDREW W. LO

and STEPHEN R. FOERSTER

PRINCETON UNIVERSITY PRESS

PRINCETON & OXFORD

Copyright 2021 by Andrew W. Lo and Stephen R. Foerster

Princeton University Press is committed to the protection of copyright and the intellectual property our authors entrust to us. Copyright promotes the progress and integrity of knowledge. Thank you for supporting free speech and the global exchange of ideas by purchasing an authorized edition of this book. If you wish to reproduce or distribute any part of it in any form, please obtain permission.

Requests for permission to reproduce material from this work should be sent to

Published by Princeton University Press

41 William Street, Princeton, New Jersey 08540

6 Oxford Street, Woodstock, Oxfordshire OX20 1TR

press.princeton.edu

All Rights Reserved

ISBN 9780691215204

ISBN (e-book) 9780691222684

Version 1.0

Library of Congress Control Number: 2021935291

British Library Cataloging-in-Publication Data is available

Jacket image: Shutterstock

Note to Readers

The information presented in this book is made available solely for general informational and educational purposes and is not intended to constitute legal, tax, investment, financial, or other advice. Neither Princeton University Press, the authors, nor the interview subjects warrant the accuracy, completeness, or usefulness of the information contained herein. The information, opinions, and views contained in this book have not been tailored to the investment objectives of any one individual, are current only as of the date of original publication, and are subject to change at any time without prior notice. All investment strategies and investments involve risk of loss. Nothing contained in this book should be construed as a recommendation, professional or financial advice, an endorsement, or favoring by Princeton University Press, the authors, or the interview subjects. Any reference to an investments past or potential performance is not, and should not be construed as, a recommendation or as a guarantee of any specific outcome or profit. Any ideas or strategies discussed in this book should not be undertaken by any individual without prior consultation with a financial professional for the purpose of assessing whether the ideas or strategies that are discussed are suitable to you based on your own personal financial objectives, needs, and risk tolerance. Princeton University Press, the authors, and the subjects of this book expressly disclaim any liability for loss incurred by any person who acts on the information, ideas, or strategies discussed herein.

We dedicate this book to the most perfect of all portfolios, our families:

Nancy, Derek, and Wesley Linda, Jennifer, Christopher, Thomas, and Melanie

CONTENTS

- ix

- xiv

PREFACE

AT THE CONCLUSION of a conference in 2011 honoring the contributions of Harry Markowitz to the world of finance, one of the conference organizers speculated what the investment world would be like without Markowitzs contribution to portfolio theory. Imagine, the organizer wondered, if Markowitz had approached the great investor, Warren Buffett, asking for advice on how to invest. Buffetts likely response would be Give me your money, and Ill manage it. Clearly, given his track record, Buffett would have done an exceptional job. But where would that have left other investors, ones who werent so fortunate to have Buffett as their money manager? Now imagine if Buffett were to approach Markowitz, asking What could you do to help me? Markowitzs response would be Here is a framework and an approach for portfolio management.

We readily acknowledge the investment success of Buffett, John Templeton, Peter Lynch, David Shaw, Jim Simons, George Soros, and many other great investors whose styles and approaches to investment arent easily replicated. However, the academic financial research by Markowitz as well as his fellow Nobel laureates such as James Tobin, Paul Samuelson, Bill Sharpe, Myron Scholes, Bob Merton, Gene Fama, and Bob Shiller and by other exceptional researchers has created a framework and repeatable process for investors that has led to the democratization of investment management. This book is about their contributions to portfolio management.

Is there a Perfect Portfolio of assets for investors, one that offers the ideal mix of risk and reward? Over the past decade of our journey, we asked this question to ten prominent iconic figures and thought leaders in the industryHarry Markowitz, Bill Sharpe, Gene Fama, Jack Bogle, Myron Scholes, Bob Merton, Marty Leibowitz, Bob Shiller, Charley Ellis, and Jeremy Siegeland their answers were both expected and unexpected. Our pioneers, while admittedly not a diverse group (and, as youll see in the chart in a few pages, a group with many interconnections), were reflective of the field at the time. Thankfully, the investment community is much more diverse today, and we hope our book will inspire an even more diverse group of pioneers in the next generation. While we may never reach such an elusive and shifting target as the Perfect Portfolio in the constantly evolving world of investment, this book is about the people and their pursuit of such a portfolio. Like John Lockes constant pursuit of true and solid happiness, we examine how academic and practitioner research has contributed to the evolution and understanding of what the Perfect Portfolio might look like and the key lessons learned from it.

As individual investors and professional portfolio managers alike search for the right mix of investments that will provide as high an expected return as possible for a given level of risk, they face a number of important questions:

- What do we really mean by diversification, and why is it important?

- How should we combine riskless assets such as Treasury bills with risky assets such as stocks?

- Should investors simply invest in index funds, or should they actively manage a portfolio?

- How important are security selection and market timing?

- How should performance be measured?

- How important are foreign versus domestic investments?

- What are derivative securities, and what role do such nontraditional assets play?

- How important are different equity styles, such as small cap and value?

- How should one approach investing when other investors may not be acting rationally?

In Pursuit of the Perfect Portfolio provides insight into these questions and more. We examine the key contributions to portfolio management in these areas from both academic researchers and industry-leading practitioners. Were writing for a general audienceincluding novice and professional investors alikeas well as those taking investment or portfolio management courses. We review the intellectual history and evolution of portfolio management by highlighting and explaining the key contributions of some of its most significant researchers over the past seventy yearsthe era known as modern portfolio theory. We have added color and context through interviewswhich took place in San Diego, Monterey, San Francisco, New York, Cambridge, Chicago, Malvern, and Philadelphiawith a different academic or industry thought leader featured in each chapter. We integrate the lessons learned from our interviews with these key portfolio management players in the concluding chapter and present an investing checklist to help you develop your own investment philosophy so you can determine the Perfect Portfolio thats right for you.