The Author

Doug Nordman retired at the age of 41 after 20 years with the U.S. Navys submarine force. Hes an enthusiastic surfer, an omnivorous reader, a martial arts student, and a veteran of many chaotic home-improvement projects. After eight years of early retirement hes an expert at answering the question But what do you DO all day? He and his spouse, a retired Navy Reservist, are raising a teenager in Hawaii. Life is busier than ever and they cant imagine where they found the time to go to work.

Acknowledgments

Books dont write themselves, and writers dont write by themselves.

My deepest thanks to Bob Clyatt and Billy and Akaisha Kaderli, who showed me the way and made the introductions. They offered many thoughtful comments about the books approach and its audience. And, of course, once I told them what I was going to do, then I actually had to do it.

Big thanks also to SamClem, Bridget Moorman, and Tomcat98. Those seemed like such simple questions! Your thoughts and suggestions helped Bob rip the first draft to shreds, but you made the second draft even better.

Thanks to Ken, Arif, and the rest of the veterans, military families, and early retirees on Early-Retirement.org . You volunteered your stories, offered many topics, and then had to read it all more than once. I may have had a book in me, but you guys pulled it out.

Thanks also to the denizens of The Bar, whove all been there for each other for over half a decade. (You know who you are.) Youve kept me from ripping other things to shreds when I couldnt pull out the words.

Royalty Donations to Military Charities: The author is donating all of this books royalties to military charities chosen by the books contributors. See http//The-Military-Guide.com to learn more about the charities being supported with royalties from this book.

APPENDIX

A

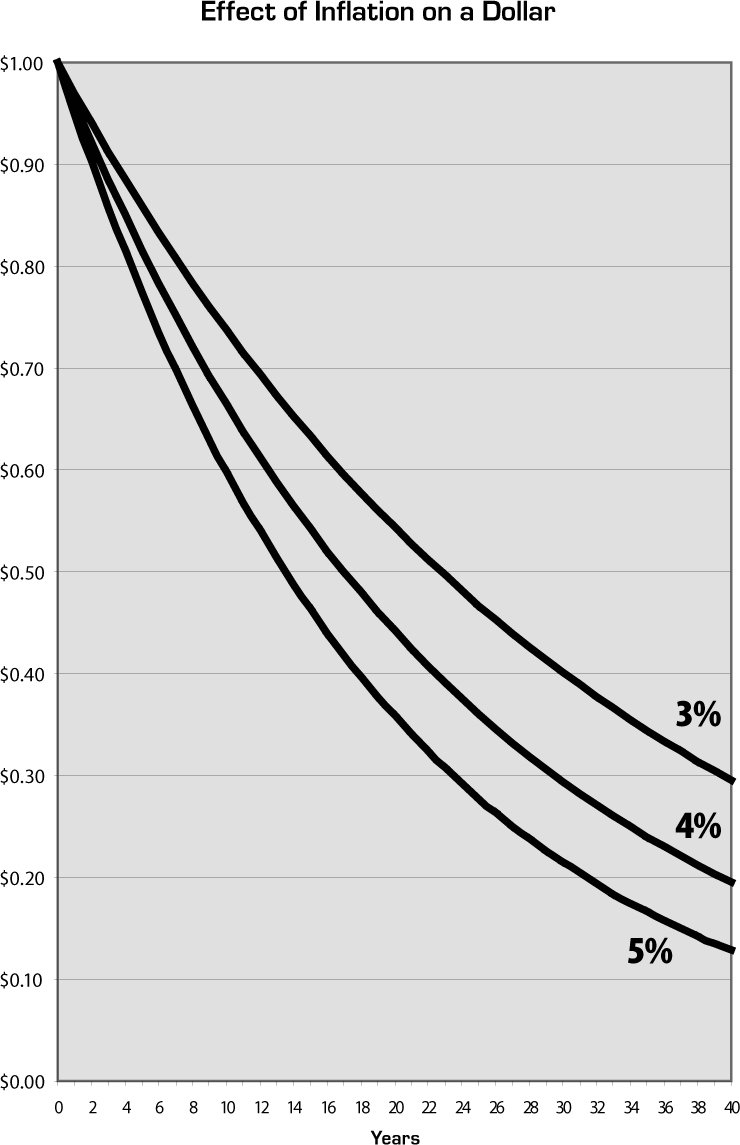

Effect of Inflation on a Dollar

The following graph shows the corrosive effects of inflation over four decades. The lowest rate, 3%, is approximately the average rate of inflation over the 20th century.

The highest rate, 5%, is the approximate average inflation rate over 1970-2000. These years are notable for the 1970s oil embargo and 1973-4 stock market crash, as well as the October 1987 stock markets one-day drop of 25% and the 1990s run-up of technology stocks. Annual inflation rates reached double digits in the 1970s-80s and required extraordinarily aggressive intervention by the Federal Reserve to return inflation to historic levels. During one year of this time, military pensions even received two cost-of-living-adjustment raises in the same year!

Early retirees have to consider the effect of inflation for two reasons. First, they will spend a significantly longer time in retirement as much as 40 years and during that time will see inflation erode their original early-retirement dollars to as little as 13-30 cents. The COLA in a military pension goes a long way toward neutralizing inflation.

The second important point about inflation is investment asset allocation. Only one asset class has historically beaten inflation over the long run of 20-40 years of retirement: equities. An early retirement depends on multiple streams of income from pensions, Social Security, and investments. Most early-retirement survival projections expect to consume at least a portion of the early-retirement investment portfolios principal and not to just live off dividends. Early retirees cannot hope to keep up with inflation by investing their portfolio in only TIPS or I bonds. The length of retirement will exceed the maturity of the securities, and theres no guarantee that replacement securities will be readily available when the portfolio expires. TIPS do not include a portion of their inflation adjustment until final maturity, and the Treasury restricts the amount of I bonds that individual investors can purchase each year. Theyll either need to reduce their lifestyle to stay within the income of their pension/Social Security or to assume greater market risk (volatility and loss) by investing in stocks.

Theres one other aspect of inflation to consider for service members tempted by the REDUX retirement system. One feature of a REDUX retirement is that COLA increases are 1% less than the CPI. That doesnt sound like much of a loss next to the prospect of receiving $30,000 five years before retiring, but the reality is that it equates to 1% higher inflation for at least 20 years of retirement. The difference between 3% inflation and 4% inflation for 20 years amounts to 10 cents out of every early-retirement dollar. After the first 20 years of early retirement, a $20,000/year REDUX pension loses over $2,000/year every year over a High-Three pension and, throughout an early retirees lifetime, will add up to far greater losses than the prospective gains of the $30,000 REDUX bonus. See Appendix D (Effect of Inflation on a REDUX Military Pension) on page 160 for more details.

Average inflation rates and historic stock returns are obtained from Dimson and Marshs Triumph of the Optimists. See the Bibliography on page 177 for more information on this book and other investment information.

APPENDIX

B

Saving Base Pay and Promotion Raises

Retirement dates are accelerated by saving as much as possible in the Thrift Savings Plan, IRAs, and taxable accounts. Aspiring early retirees have two ways to boost their savings: earn more or spend less.

Military earnings rise with each new pay table, longevity raise, or promotion, but its all too easy to let lifestyle spending take over the higher income. The raises in each years annual pay tables generally go up at the rate of the Employment Cost Index, hopefully keeping up with inflation but rarely exceeding it. Just boosting TSP contributions by the annual pay increase is not enough to attain early retirement.

Aggressive savers should invest as much as possible of both their base pay and every promotions pay raises while holding their spending below the previous pay grade. Saving for early retirement would be easy if an E-7 could hold the expenses of an E-1, but this is unrealistic. (Its deprivation, too!) A more achievable E-7 goal would be holding spending at the pay grade of an E-6 and banking the pay difference between E-7 and E-6.

The graph on page 152 shows how quickly that savings can compound. It uses the 2009 pay tables and assumes that military pay keeps up with inflation over a 20-year career. It assumes reasonable promotion rates for E-2 through E-7 and O-2 through O-5. It also assumes that the servicemember saves 10% of their base pay at one pay grade below their current rank, and 80% of their pay raise from their latest promotion.

Savings are invested over 20 years and compounded at a conservative 3% over inflation in the TSP, IRAs, and taxable accounts. Three percent over inflation is a reasonable rate of return for an investment portfolio concentrated at least 80% in equities.