Copyright 2021 James G. Miller

All rights reserved.

For my mom, who has never stopped encouraging me to save for the future.

For my dad, who taught me how important it is to make a plan and stick with it.

Foreword

I was first introduced to Jimmy by a mutual client of ours who wanted us to connect and discuss the tax implications of his current retirement strategy. As a tax practitioner specializing in consulting and compliance for US expats, this area can be particularly complex due to multiple taxing jurisdictions and the potential interplay of tax treaties. I jumped on the call expecting the same unsatisfactory outcome as when dealing with most financial service professionals. They normally understand as much of the extensive US tax code as any other US citizen, so that is to say they dont understand a lot!

From our very first phone call together, I knew Jimmy was different than most other professionals in his field. The most difficult part of my job on any given day is turning overly dense tax legalese into digestible explanations for my clients who are looking for guidanceand Jimmy was already several steps ahead. I was relieved to find a financial advisor who could not only grasp the tax consequences of various transactions and investments but actively advise on the ones likely to provide the best outcomes, no matter the goal of the client.

Speaking from the perspective of a practitioner in the tax field, Jimmy Miller is the ideal fiduciary financial advisor to work with and refer clients to. What I appreciate about Jimmy and this book is the holistic, long - term approach that is omnipresent and fundamental to his work. As evidenced by the contents of this book, he has a technical understanding of global tax implications as they relate to investing and retirement planning, which assists him in implementing a curated strategy for each of his clients.

Although a specific, long - term investment strategy is unique and circumstantial for everyone, this book serves as a tremendous resource for those looking to maximize their future retirement draws. You cannot find the valuable retirement tax planning advice packed into this book written as efficiently in any other. Although the themes are complex, Jimmy does a great job of explaining it in straightforward and actionable terms that adults in all phases of life will find useful. In reading this book, you will learn the strategies you should implement today to avoid paying more than necessary taxes to the IRS during your lifetime. Who wouldnt want that?

Nicholas Roscher, CEO and Founder of Revolve Tax

Revolve Tax is a boutique accounting firm specializing in expat and international taxation for US taxpayers and businesses.

revolvetax.com

Introduction

You have probably heard the phrase, Nothing is certain but death and taxes. And while this is true, you may be able to do something about itat least the tax part, anyway.

The United States tax code is over 74,000 pages long and contains over 3 million more words than the Bible. Its no wonder taxes are such a big issue in financial planning and why they are so misunderstood. They dont have to be, though, and its even possible to divorce the Internal Revenue Service (IRS) completely and enjoy a tax - free retirement, if you plan properly.

No matter how patriotic, I have never met anyone who was happy about paying a tax bill, especially one they didnt expect. I suppose its happened, though, like when someone wins the lottery or finds themselves in a similar circumstance. I do meet people all the time who are happy to get money back from the IRS, though. They dont usually understand that its either their own money being returned (without interest) or its a loan they will have to repay one day (most of the time, with interest).

I have been helping people with tax - free retirement planning for over twenty years now as an independent fiduciary financial advisor. I find that most Americans fail to create (or keep) real wealth. Its not that they plan to fail but that they fail to plan. There are a myriad of reasons for this, but the one I help with in this book is among the largest: the IRS.

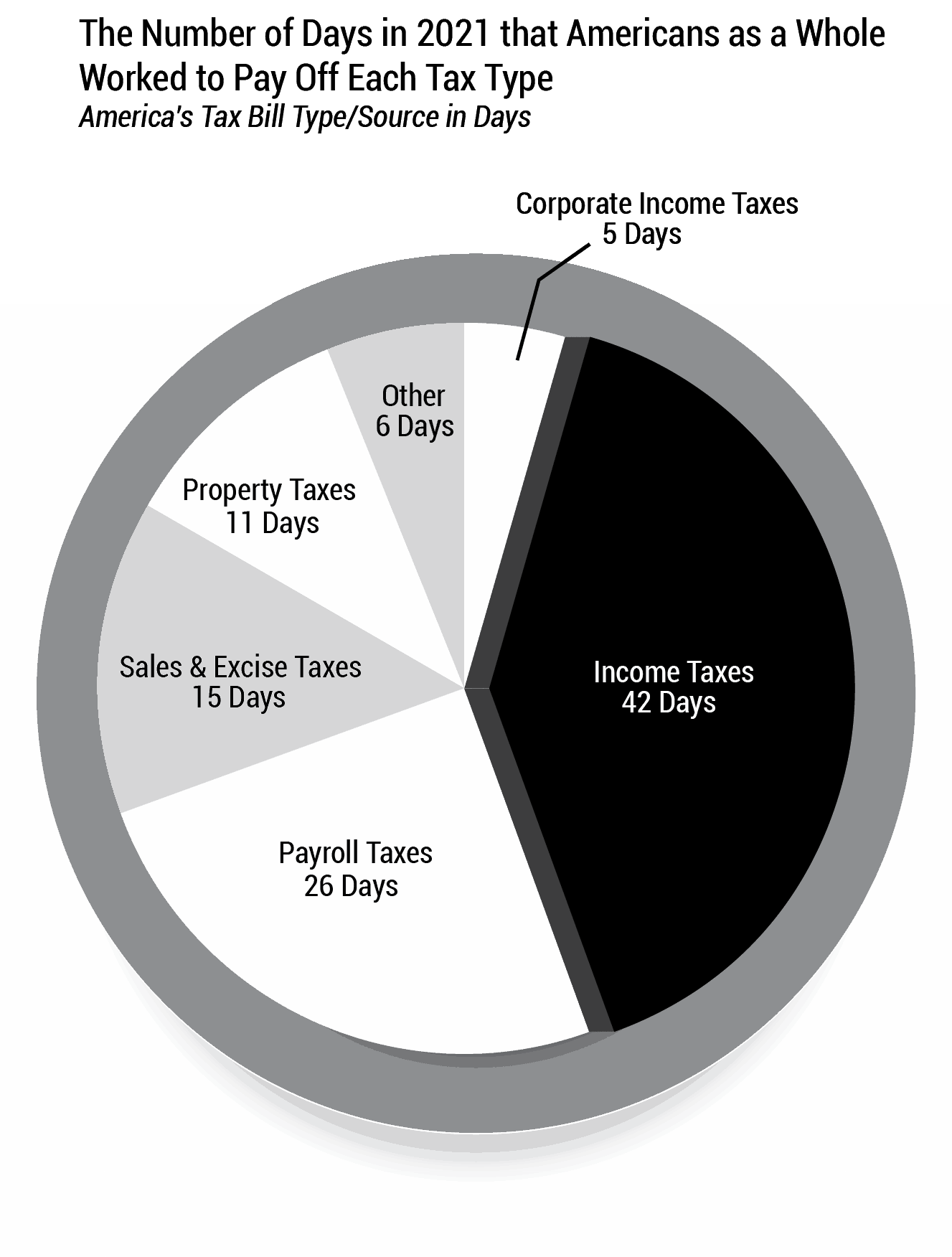

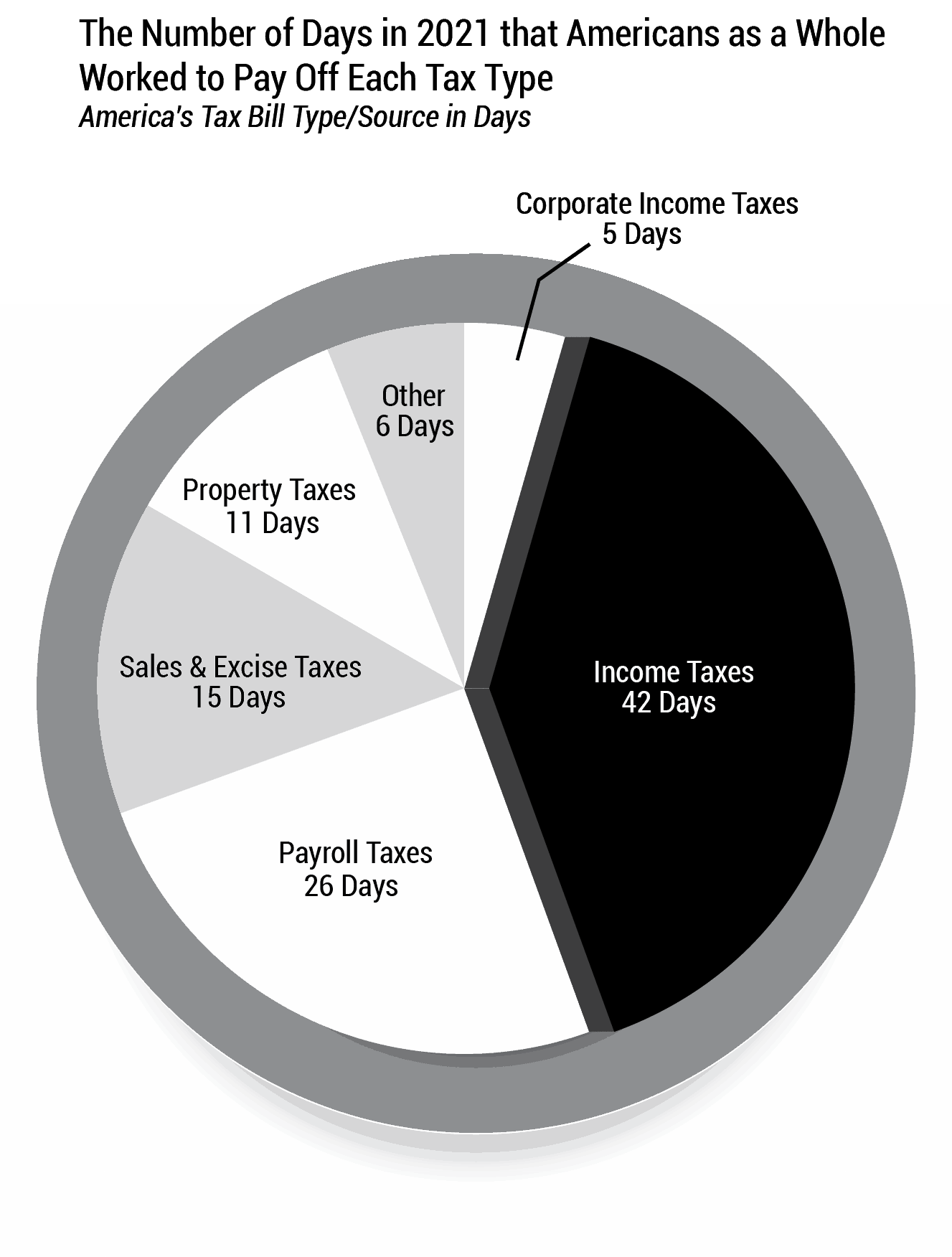

Americans have to work, on average, the first 111 days of each year just to take care of their tax burden. You can find out more about this on this books Resources page at Divorce - The - IRS .com. However, its enough to know this led to The Tax Foundation creating Tax Freedom Day in Americathe day when the nation as a whole has earned enough money to pay its total tax bill for the year. In 2021, Tax Freedom Day will fall on April 17. This fact, along with tax trapsor tax time bombs waiting for the unpreparedhas led to the IRS taking a larger share of peoples money than needed.

Have you ever noticed the words the and IRS combine to spell theirs ? It doesnt have to be that way, though. Not completely, anyway.

This book is for those interested in a journey to a specific destination: divorcing the IRS on retirement day and enjoying a tax - free retirement.

This is a path to success, as defined by you, that can only be achieved with proper, modern financial planning and forward thinking. It requires you to save as much as possible through the lens of your entire life ahead, not just this year or the next. It needs a deliberate direction to minimize your obligation to the IRS, both in life and after. It will be an odyssey, preparing you financially for all the things life may throw at you so your wealth creation has minimal interruptions and no fatal experiences.

This journey will take you to a destination where you get to enjoy the fruits of your labor to the maximum, without the IRS interfering. Youll enjoy the feeling that comes with knowing you did things right and youre ahead of the game. Its a place where your delayed gratification and smart financial moves pay off exponentially.

There is a peace of mind that comes with knowing there wont be any hidden financial surprises in retirement with respect to tax bills and knowing that even if tax rates increase, you wont be affected.

If you want to understand (and avoid) the most common tax problems (or tax time bombs, as I think of them) that seriously impede the wealth creation and retention process in America, this book is for you. The IRS has become very good at figuring out ways to tax you and take your money. Some of their rules (tricks) deliberately entice you to set yourself up to pay them even more when you least expect it.