Dedication

For my hope is that all I do is a dedicated honor for all our Lord & Savior has done for us

To my amazingly wonder wife, Denise and awesome daughters, Kyli and Zoe; thank you so much for the loving support you give me daily

For my outstanding clients, this book only exists because of your trust in my knowledge and the experiences we share

Chapter 1 The Shift

Welcome to The Retirement Shift , where we plan for the shift from career to a work optional lifestyle! What is a work optional lifestyle? An interesting new trend, and possibly a new norm. More individuals and couples are deciding that the traditional form of retirement is not the lifestyle of choice today. However, this is not just a trend for those approaching fifty-five or sixty years of age. It is reaching even those in their forties and thirties. More and more individuals and couples are transforming their lifestyle with either part-time work (which affords an earlier retirement), incremental savings with a scheduled activity that provides an active lifestyle outside the homestead, or retire/rehire/retire/rehire phases. The ideas discussed in this book will not just be exclusive to the silver foxes, but also the new generation of work optional lifestyle pursuers.

My nerdy weakness is that I love financial planning. I love to do it, I love to learn about it, and I love to talk about it. In fact, a couple of years ago, I wrote a book about financial planning and gave it to my father to read. He responded that I had developed an excellent sleep aid. Because of its thickness, we decided that if it was a pillow, it would surely be a comfortable one.

I had a challenge and to answer this challenge, I asked myself, If I were asked to do a condensed, and more importantly, easy to understand process for financial planning to and through retirement, what would it look like? Off I went. 60,000 words went to 48,000, then to 35,000, and eventually down to 17,000 words with meaningful content. This was the birth of The Retirement Shift .

This is not your detailed encyclopedia of financial planning, which I do have if youd like to purchase a copy. This is for the average individual or couple considering the transition into a work optional lifestyle.

Progressive results from multiple studies over the last fifteen years, including a report by AARP based on the Pew Research Centers study, show an increase of almost seventy percent of Baby Boomers never want to fully retire. In addition, transitioning into a work optional lifestyle is an increasing trend amongst younger adults. The dynamics of the new retirement shift landscape for all individuals and couples are changing rapidly. The concepts of yesteryears must be adjusted to identify and accommodate for this shift. That is why this book identifies concepts, but is not a play book. Your ideas, and your vision of transition into and going through retirement will be different from the majority of those making the shift. Therefore, the concepts I share in this book should not be considered a to-do list.

The trouble with retirement is you never get a day off Abe Lemons, College Basketball Coach

Throughout this book, you will find QR codes that link to topic related videos and supporting documentation. Use your Smart Phone app to access to all resources on our site preceptwm.com/rspacket or with this QR and other QR codes.

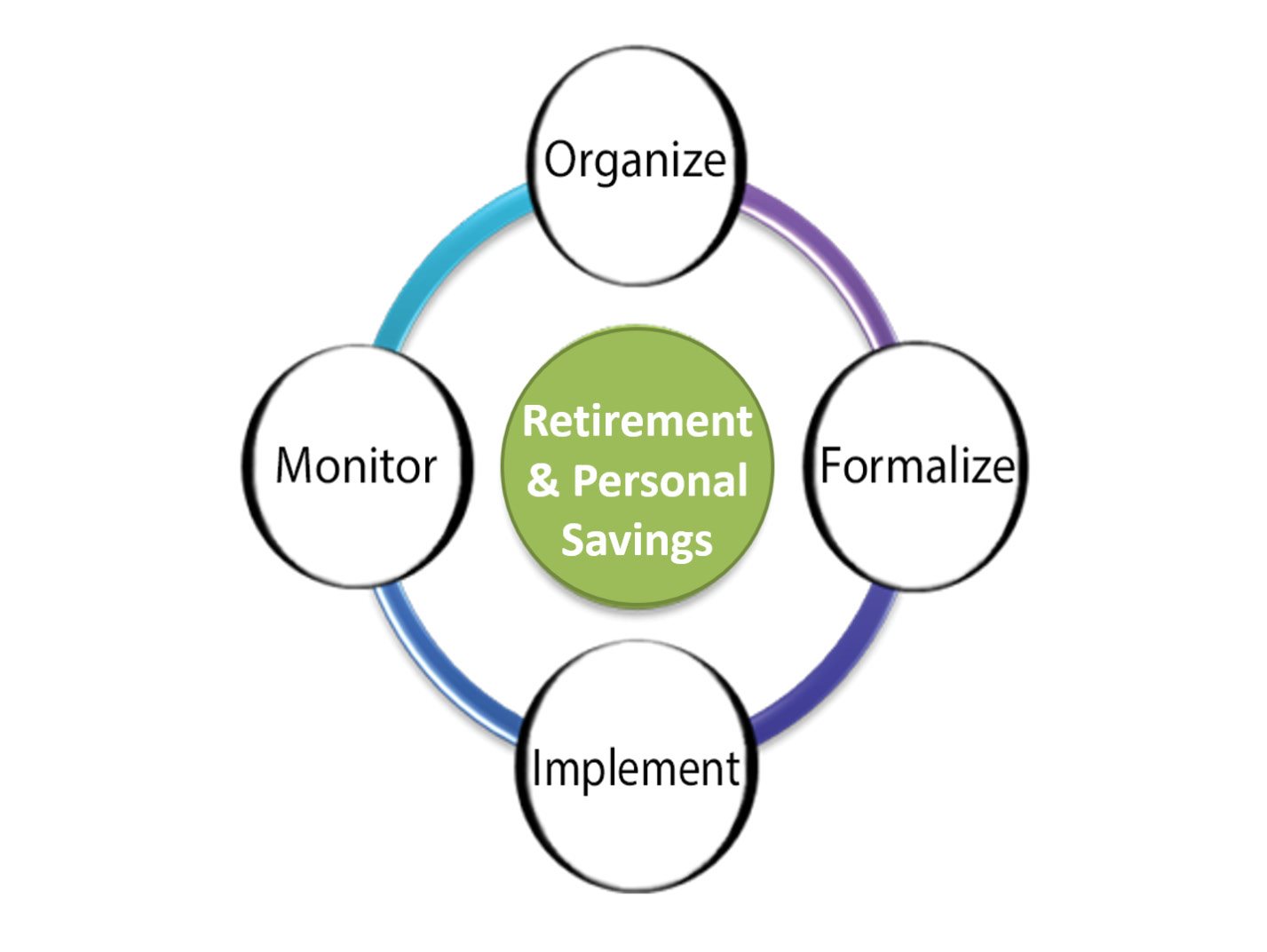

The Planning Cycle of Retirement

Along my twenty-five year career path in the financial industry, I have picked up many techniques that are technical. If I were to write them as they had been presented to me, well, I would have a snooze fest. Every industry has technical terms which will put you to sleep within moments if you arent familiar with them. Over the years, I have adopted a process of Organize Formalize, Implement, and Monitor.

I do not want to harp on the process model. Keep in mind as we go through this book, and through the retirement process, we will be utilizing these topics and applying them to the appropriate process throughout.

The reason you are reading this book is because your focus is on retirement and personal savings . We all agree that we have goals and investment objectives for our assets. These can range from living life on a beach to passing a legacy to our children and grandchildren. There is a natural process in place to effectively achieve these goals and investment objectives, which you may already be following (knowingly or unknowingly). I have outlined this process so that you can develop a full understanding of the decision-making process for this Retirement Shift .

Chapter 2 Pre-Retirement

Envisioning Your Retirement Shift

As with any great idea, dream, goal etc., there is a beginning. The beginning is just an idea. To take this idea and formulate it into a reality such as a dream or goal, we must first organize.

ORGANIZING is important to discovering where you stand in your current financial planning process. It includes understanding your financial requirements, and making sure your current investment objectives are in-line with your life goals, retirement objectives and risk tolerance. This initial step is the foundation to building the rest of your plan.

What might be some investment objectives you may have with regards to your retirement shift? Years ago, I met with a gentleman who defined his investment objective as, to make money. He never achieved this objective because it was too broad a topic. He took so much risk with his money, but never accumulated any more. In spite of this, I am going to create a category for the to make money objective, because it is a logical request. This category is Capital Appreciation . What are some other defined investment objectives?

- Be comfortable?

- Maintain current standard of living?

- No worries?

Take a moment. Where do you picture yourself during the three phases of retirement: onset, intermediate term, and long term? I want you to think through your wildest dream destination. What will it take to get there? Before you give up on this idea and you say, Oh, that is too expensive, please ponder these words of wisdom that were once shared with me. Cost is only relevant in the absence of value.

For a retiree, would I be safe to assume that the investment objective of your plan foundation can be described as: My/Our investment objective encompasses a relative current income source in line with our lifestyle expectation. This income source would maintain a modest growth rate with a core focus on my/our risk tolerance to assist and ensure that my/our nest egg outlives our life needs.

Wow! Plop that down in front of a financial professional and get them to make sure they understand you completely! The plan is not going to work. You do not want to create a plan to just see what retirement might looks like, nor do you want to create a plan based on unrealistic expectations.