The long tail theory for business

Key information

- Name: long tail theory.

- Uses: this concept refers to all of the products offered by a company that only sell a few units, but where the sum of their sales may exceed the revenue made from the top-selling products. This is the same as saying that the most popular and best-selling items only contribute to a minority of turnover, the mass effect playing strongly in favour of the more marginalised products.

- Why is it effective? The inclusion of such a strategy allows a company to benefit from constant sales from its entire product portfolio.

- Key words:

- Bestseller : a flagship product, often assigned a high advertising budget, which achieves record revenues.

- E-commerce : online commerce (via the internet).

- Opportunity cost : indication of the loss caused by investing resources into one function more than another.

- Profit : financial gain from an action. For example, a sale is an action that can generate profit or loss.

- Profitable : something that generates reward or a certain amount of profit.

- Statistics : a set of data relating to a group of individuals or units that allows for observing trends.

- Turnover : cumulative and recorded value usually over a period of one year from the sales of goods and services offered by a company.

Introduction

The long tail theory was introduced in 2004 by Chris Anderson (editor of Wired magazine, born in 1961) and resulted from an essay written by Clay Shirky (a specialist in new information and communication technology, born in 1964) which states that some blogs have a significant number of web links pointing to them while the majority of blogs only have a very small number of links pointing to them.

Chris Anderson builds on this thinking to try and explain present and future economic models (as part of the digital economy). He describes how, in his opinion, all products with low demand can collectively generate significant turnover.

However, it is the emergence and increasing use of digital technologies that make the economic model of the long tail possible: entrepreneurs who benefit from very low storage costs, sometimes zero or virtual, when marketing digital products (e-books, online movies, music, etc.), can now offer a wide catalogue online, which diversifies supply and pleases those who prefer marginal assets.

Definition of the model

The long tail is an economic and statistical concept that illustrates the distribution of a companys turnover for all of its products, including the most popular products the bestsellers as well as the more specific and marginal products. Therefore, this is a tool for developing commercial and marketing strategies.

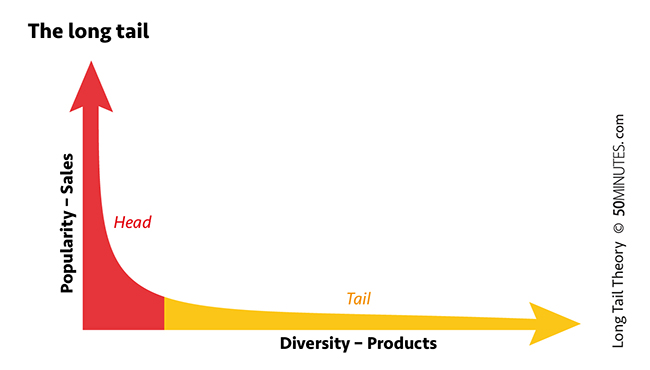

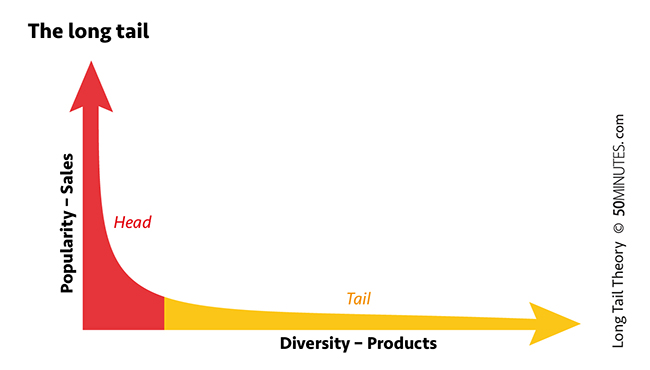

The model consists of two elements:

- the head, characterised by a limited number of popular or high-demand products, each generating a high sales rate;

- the tail, characterised by a large number of niche or low-demand products, each generating a low sales rate.

Theory

The long tail theory was popularised by Chris Anderson following his analysis of several e-commerce sites such as Amazon (notably for books), Rhapsody (online music downloads), eBay (second-hand products) and Netflix (movie streaming). This sharp analyst actually noted, in the cases studied, that the sales of the most popular items only represented a part of total turnover: i.e. the profitability of sales does not depend only on the top items. To demonstrate this phenomenon, he wrote his bestseller The Long Tail .

From the outset, the new concept challenged many business strategies and economic models, as the author claims that it is sometimes more profitable to not only sell bestsellers; an argument that is certainly supported by evidence.

Components

The long tail: the head and the tail

Both statistical and strategic, this concept is often represented as a graph that shows the products sold on the horizontal axis (X) and the number of sales on the vertical axis (Y).

The blue section the head shows that only a few of the items are generating a record number of sales, while the yellow section the tail shows that most of the products are sold in very small quantities.

The 80-20 rule and the long tail

The 80-20 rule, also known as the Pareto Principle, which claims that 80% of turnover is generated by the sales of 20% of products, is called into doubt by the long tail theory. In fact, Chris Anderson demonstrates that the 80-20 rule only applies to niche markets that have not been fully exploited.

Today, thanks to NITC (new information and communication technology), we can reduce the production scale, differentiate goods and use new information technologies to take advantage of favourable storage costs. Moreover, thanks to search engines, consumer choice is facilitated and the range of products on offer allows the consumer to find what they are looking for. All of these low-demand products on a non-digital market become, on an internet scale and thus, a global scale products with a number of customers. These products can then be just as beneficial for turnover as the popular products and even reverse the 80-20 rule.

Before radically disproving a theory such as Paretos, one must first be able to demonstrate that all the intrinsic rules of the theory no longer apply when the context changes. According to Anderson, once all the constraints of supply and demand are eliminated and the consumer has access to all products, the long tail is automatically plotted.

However, the reality of this appears much more complex: it is not the case that the market ignores the attractiveness of the long tail, but rather the target market does not allow for its benefits. This is the case for products for which demand is very low and for which costs can hardly be optimised (logistics costs, communication, etc.). The 80-20 rule can only be denied for some markets and products: those that are digital. It is mainly IT markets that benefit from this reality.

In summary

- The products concerned in the long tail theory are essentially the products that can be digitalised, such as books, music, movies, etc. As stated earlier, it is difficult for some goods e.g. food to enjoy the inherent advantages of digital products.

- Therefore, it is assumed that companies with a business model like that of the long tail advocate diversification and the digitalisation of their products.

The long tail phenomenon assumes that digitalised items improve profitability by reducing costs. Several costs faced by entrepreneurs are influenced by this downward trend. These costs are mainly those related to production, storage and distribution.