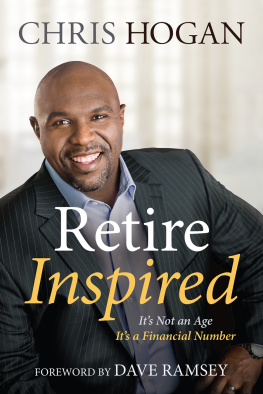

How to Retire Comfortably and Happy on Less Money than the Financial Experts Say You Need

Insider Secrets to Spending Less While Living More

By Connie Brooks

How to Retire Comfortably and Happy on Less Money than the Financial Experts Say You Need: Insider Secrets to Spending Less While Living More

Copyright 2008 by Atlantic Publishing Group, Inc.

1405 SW 6th Ave. Ocala, Florida 34471 800-814-1132 352-622-1875Fax

Web site:

SAN Number: 268-1250

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without the prior written permission of the Publisher. Requests to the Publisher for permission should be sent to Atlantic Publishing Group, Inc., 1405 SW 6th Ave., Ocala, Florida 34471.

This publication is protected under the US Copyright Act of 1976 and all other applicable international, federal, state and local laws, and all rights are reserved, including resale rights: you are not allowed to give or sell this ebook to anyone else. If you received this publication from anyone other than an authorized seller you have received a pirated copy. Please contact us via e-mail at and notify us of the situation.

ISBN-13: 978-1-60138-204-7

ISBN-10: 1-60138-204-9

Library of Congress Cataloging-in-Publication Data

Brooks, Connie, 1980

How to retire comfortably and happy on less money than the financial experts say you need : insider secrets to spending less while living more / by Connie Brooks.

p. cm.

Includes bibliographical references and index.

ISBN-13: 978-1-60138-204-7 (alk. paper)

ISBN-10: 1-60138-204-9 (alk. paper)

1. Retirement income--Planning. 2. Finance, Personal. I. Title.

HG179.B7453 2008

332.024014--dc22

2008030045

LIMIT OF LIABILITY/DISCLAIMER OF WARRANTY: The publisher and the author make no representations or warranties with respect to the accuracy or completeness of the contents of this work and specifically disclaim all warranties, including without limitation warranties of fitness for a particular purpose. No warranty may be created or extended by sales or promotional materials. The advice and strategies contained herein may not be suitable for every situation. This work is sold with the understanding that the publisher is not engaged in rendering legal, accounting, or other professional services. If professional assistance is required, the services of a competent professional should be sought. Neither the publisher nor the author shall be liable for damages arising herefrom. The fact that an organization or Web site is referred to in this work as a citation and/or a potential source of further information does not mean that the author or the publisher endorses the information the organization or Web site may provide or recommendations it may make. Further, readers should be aware that Internet Web sites listed in this work may have changed or disappeared between when this work was written and when it is read.

This Atlantic Publishing eBook was professionally written, edited, fact checked, proofed and designed. Over the years our books have won dozens of book awards for content, cover design and interior design including the prestigious Benjamin Franklin award for excellence in publishing. We are proud of the high quality of our books and hope you will enjoy this eBook version, which is the same content as the print version.

Table of Contents

Dedication

For my husband Allen, our daughter Bella, and our parents: Nancy, Phil, Anita, and Dennie.

Foreword

By Paul Roldan

Managing personal finances for retirement is often a major challenge for most people. Retirement investing is an area of finance typically overlooked because it tends to lack a sense of urgency until later in life. However, those who make it a priority earlier in life rather than later, have a major advantage in their quest to reach financial independence.

Connie Brooks, in How to Retire Comfortably and Happy on Less Money than the Financial Experts Say You Need , provides a comprehensive overview on how to properly manage your personal finances for retirement. She has taken timeless financial principles and has communicated them so well anyone can implement them on their own. This book will equip you with the practical tools and knowledge you need to become well prepared for retirement. It is not only critical to take these principles to heart, it is equally important you execute on the advice Connie gives. Your retirement depends on it!

Starting to invest for your retirement sooner rather than later has tremendous implications on your ability to reach financial independence. Use this book to guide you through how to make retirement investing a priority for you and your family. In addition, by being financially disciplined and instituting sound financial principles it will have a significant impact on you and your familys lifestyle for generations to come.

Paul Roldan, Senior Partner

Allgen Financial Services, Inc.

301 E. Pine Street, Suite 150

Orlando, FL 32801

Phone: 407-210-3888

Toll-free: 800-6ALLGEN

888-6ALLGEN

roldan@allgenfinancial.com

www.allgenfinancial.com

Paul Roldan is Co-Founder of Allgen Financial Services, Inc., a financial services firm focused on helping individuals and businesses better manage their retirement investments. Paul is an undergraduate alumnus of Princeton University and a graduate alumnus of Harvard University.

Pauls career began as a Financial Analyst with the Federal Reserve Bank off Wall Street where he served on the evaluation group for the Orange County Crisis and the Mexican Economic Crisis. Prior to starting Allgen he was an Investment Advisor with Raymond James Financial Services and Equity Services, Inc. He has been an investment advisor since 1996.

Section 1

Eliminate Your Debt Before You Retire

Failing to plan is the same as planning to fail.

~Alan Lakein

Introduction

The choices you make today, tomorrow, and every day will either help you retire or prevent you from doing it.

The earlier you begin planning for retirement, the better off you will be. The longer you wait to plan, the more you will need to save to be financially secure. Some people will take this truth and use it to beat themselves up for not having planned earlier. Others will panic and never face the situation.