Part I

The Essentials of Investing in Shares

In this part...

M any investors do things in reverse; they buy shares first and learn some lessons afterwards. Your success is dependent on doing your homework before you invest your first pound in shares. Most investors dont realise that they should be scrutinising their own situations and financial goals at least as much as they scrutinise shares. But how else can you know which shares are right for you? Too many people risk too much simply because they dont take stock of their current needs, goals and risk tolerance before they invest. The chapters in this part tell you what you need to know to choose the stocks that best suit you.

Chapter 1

Exploring the Basics

In This Chapter

Knowing the essentials

Knowing the essentials

Doing your own research

Doing your own research

Recognising winners

Recognising winners

Exploring investment strategies

Exploring investment strategies

R emember Sid? Back in the 1980s and 1990s investing in shares briefly became insanely popular in the UK. Most cynical Brits had grown up believing that shares were a slightly brutish thing, traded by spivs and sleek stockbrokers and only the preserve of the inveterate gambler. The privatisation of the major utilities (Sid was invoked by the Thatcher government to encourage us to invest in the likes of British Gas and British Telecom) changed everything. Suddenly we all seemed to have amassed a small portfolio of privatised companies as well as shares in building societies such as Halifax whod chosen to demutualise and list their shares on the stock market. Private investors piled into shares in the 1990s as the stock market reached the mania stage at the tail-end of an 18-year upswing (or bull market : See Chapter 15 for more information on bull markets). Some especially adventurous types even took to investing in the companies of tomorrow think Amazon or Cisco pumping up an enormous technology-based stock market bubble that eventually burst in spectacular style in the first years of the new millennium (we call this a bear market see Chapter 15 for more on these). Share prices tumbled worldwide and everyone declared that they were much the wiser. Now, of course, we all know that that was an illusion. Shares picked up in value again in the first decade of the new millennium, especially as investors piled into bank shares tempted by the juicy dividends on offer. And then the GFC the Global Financial Crisis came along and the rest is history. Perhaps this time weve all learned our lesson... or perhaps not! Shares have bounced back in value, which rather suggests that the animal spirits of investing are alive and kicking. One might rather cynically conclude after these serial booms and busts that many investors really hadnt known exactly what they were investing in. If theyd had a rudimentary understanding of what shares really are, perhaps they could have avoided some expensive mistakes. The purpose of this book is not only to tell you about the basics of investing in shares but also to let you in on some solid strategies that can help you profit from the stock market. Before you invest your first fiver, you need to understand the basics of investing in shares.

Understanding the Basics

The basics are so basic that few people are doing them. Perhaps the most basic (and therefore most important) thing to grasp is the risk you face whenever you do anything (like putting your hard-earned money in an investment like shares). When you lose track of the basics, you lose track of why you invested to begin with. Find out more about risk (and the different kinds of risk) in Chapter 4.

In an old stand-up routine, the comic was asked How is your wife? He responded Compared to what? You need to apply the same attitude to stocks. When youre asked how are your shares?, you may be able to say that theyre doing well especially when compared to an acceptable yardstick like an index (such as the FTSE 100). Find out more about indices in Chapter 5.

The bottom line is that the first thing you do when investing in shares is not to send your money straight into a stockbrokers account or go to a website to click buy shares. The first thing you do is find out as much as you can about what shares are and how you can use them to boost your wealth.

Getting Prepared before You Get Started

Gathering information is critical to your plans for investing in shares. You need to gather information on the shares you are planning to buy twice: before you invest... and after. You obviously should become more informed before you invest your first few quid. But you also need to stay informed about whats happening to the company whose shares youre buying, about the industry or sector that company is in and about the economy in general. To find the best information sources, check out Chapter 6.

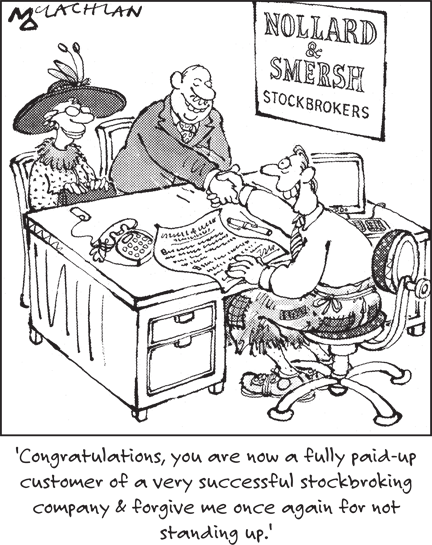

When youre ready to invest, you need an account with a stockbroker. How do you know which broker to use and whether to go online or use paper certificates? Chapter 7 provides some answers and resources to help you choose a broker.

Knowing How to Pick Winners

Once you get past the basics, you can get to the meat of picking shares. Successful share picking is not mysterious, but it does take some time, effort and analysis. This may sound like a lot of work but its worth it, because shares are a convenient and important part of most investors portfolios. Read the following section and be sure to leap frog to the relevant chapters.

Recognising the value of shares

Imagine that you like eggs and youre willing to buy them at the supermarket. In this example, the eggs are like companies, and the prices represent the prices that you would pay for the companies shares. The supermarket is the stock market. What if two brands of eggs are similar, but one costs 1 while the other costs 1.50? Which would you choose? Odds are that you would look at both brands, judge their quality and, if they were indeed similar, take the cheaper eggs. The eggs at 1.50 are overpriced. The same principle applies to shares. What if you compare two companies that are similar in every respect but have different share prices? All things being equal, the cheaper price has greater value for the investor. But the egg example has another side.

What if the quality of the two brands of eggs is significantly different but their prices are the same? If one brand of eggs is old, of poor quality and priced at 1 and the other brand is fresher, of superior quality and also priced at 1, which would you buy? Of course, youd take the good brand because theyre better eggs. Perhaps the lesser eggs are an acceptable purchase at 50 pence, but theyre definitely overpriced at 1. The same example works with shares. A badly run company isnt a good choice if you can buy a better company in the marketplace at the same or a better price.

Comparing the value of eggs may seem overly simplistic, but doing so does cut to the heart of investing in shares. Eggs and egg prices can be as varied as companies and share prices. As an investor, you must make it your job to find the best value for your investment cash. (Otherwise you get egg on your face. We bet you saw that one coming.)

Knowing the essentials

Knowing the essentials