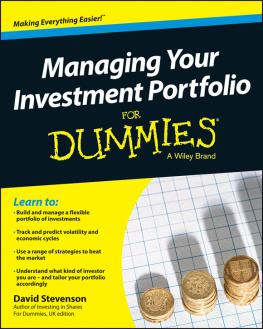

Managing Your Investment Portfolio For Dummies

Published by:

John Wiley & Sons, Ltd.,

The Atrium, Southern Gate, Chichester,

www.wiley.com

This edition first published 2013

2013 John Wiley & Sons, Ltd, Chichester, West Sussex.

Registered office

John Wiley & Sons Ltd, The Atrium, Southern Gate, Chichester, West Sussex, PO19 8SQ, United Kingdom

For details of our global editorial offices, for customer services and for information about how to apply for permission to reuse the copyright material in this book please see our website at www.wiley.com .

The right of the author to be identified as the author of this work has been asserted in accordance with the Copyright, Designs and Patents Act 1988. All rights reserved. No part of this publication may be reproduced, stored in a retrieval system, or transmitted, in any form or by any means, electronic, mechanical, photocopying, recording or otherwise, except as permitted by the UK Copyright, Designs and Patents Act 1988, without the prior permission of the publisher.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com . For more information about Wiley products, visit www.wiley.com .

Designations used by companies to distinguish their products are often claimed as trademarks. All brand names and product names used in this book are trade names, service marks, trademarks or registered trademarks of their respective owners. The publisher is not associated with any product or vendor mentioned in this book.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with the respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. It is sold on the understanding that the publisher is not engaged in rendering professional services and neither the publisher nor the author shall be liable for damages arising herefrom. If professional advice or other expert assistance is required, the services of a competent professional should be sought.

For general information on our other products and services, please contact our Customer Care Department within the U.S. at 877-762-2974, outside the U.S. at (001) 317-572-3993, or fax 317-572-4002. For technical support, please visit www.wiley.com/techsupport .

For technical support, please visit www.wiley.com/techsupport .

A catalogue record for this book is available from the British Library.

ISBN 978-1-118-45709-2 (pbk), ISBN 978-1-118-45713-9 (ebk), ISBN 978-1-118-45711-5 (ebk), ISBN 978-1-118-45712-2 (ebk)

Printed in Great Britain by TJ International Ltd, Padstow, Cornwall

10 9 8 7 6 5 4 3 2 1

Introduction

Investment can be a scary business, with all those self-proclaimed masters of the universe wielding ultimate control over your pension and long-term savings pot. Theyre a worrying bunch and their ability to wreak havoc on the global financial markets and livelihoods worries more than just the Occupy Wall Street mob. Plus, the media doesnt help this sense of foreboding with (scaremongering) stories about unseen powers taking control of peoples financial futures: global financial crises, big blowouts and meltdowns hog the headlines, scaring the wits out of even the smartest private investor.

But heres the good news: investing can be a rewarding pursuit... honest! As a humble private investor you can take control of your financial future, make profits and control the downside risks by leaving behind that fear of big scary markets. Smart, sophisticated investors like yourself can and do build successful and robust investment portfolios, full of ideas that help sustain year-on-year profits.

In this book I show you the route to becoming a more proficient, advanced investor, helping you figure out how to build a well-rounded, thought-through investment plan: in other words, a strong, diversified portfolio of financial assets. My central insight a call to action if you like is that private investors need to think a little bit more like the hedge funds of this world. Dont worry, Im not implying that you sell the family hatchback and invest in a hedge-fund manager style Porsche. I mean that the hedge-fund community is full of smart people with useful information to pass on to you. Their ideas about obtaining absolute returns in all market conditions, controlling the downside, managing risks and understanding trends are simply good, old-fashioned commonsense.

I hope that this book acts as your guide to this advanced form of investing. It brazenly swipes ideas from the hedge-fund masters, acknowledges their failings and weaknesses, and attempts to put the best ideas in a practical context that you can use within your portfolio on a daily basis.

About This Book

Plenty of books about investing promise a magic formula. These get-rich-quick manuals offer some allegedly quick formula or special set of measures that instantly illuminates the darkest corners of the global investment world. Read those instant-promise books if you like, but you may as well just visit the horse races! Instead, I encourage you to be disciplined, careful, cautious and to think like a professional hedge-fund manager. This book doesnt promise to make you rich overnight, but it may help preserve some of your hard-earned wealth by helping you to think intelligently about the downsides of investing and the need to stay disciplined when looking for the upside.

This book may even encourage you to introduce new strategies that painstakingly produce relatively steady profits on a regular basis. After all, thats what some of the most successful investors in the world do many of them hedge-fund managers. They concentrate on getting the small things right, on absolutely making sure that a simple investment insight works like clockwork on a regular basis. They grind out small, regular, steady profits by making sure that they dont have too much at risk in the frightening financial markets. Despite their reputations, hedge-fund managers are frequently cautious, careful types.

This book reveals some of their tried-and-trusted techniques and ideas. It talks about hedging your downside, using options to produce an income from volatile markets and working out which company or share constitutes good value. In sum, this book is about preserving capital and having modest aspirations for making steady positive returns over the long term.

What Youre Not to Read

I heard a rumour that not all readers read every page of every book that they buy. This shocking revelation doesnt leave me in despair, though. I realise that youre a busy person and that every once in a while a more entertaining activity may present itself while youre reading this book.

To help manage this painful neglect (!), this book is designed so that you can just dip in and out; I even highlight certain sections that you dont have to read. Sidebars (those grey boxes of text), for instance, give you a more in-depth look at a certain topic, but arent essential to you understanding the rest of the book. Feel free to read or skip them. Similarly, you can a pass over the text that appears besides the Technical Stuff icons if you prefer. This technical material is interesting and may get you ahead of the pack, but you can still come away with everything you need without reading this text. Honestly, I wont be offended if you quietly skip over them and read the best bits!