Copyright 2014 by McGraw-Hill Education. All rights reserved. Except as permitted under the Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a database or retrieval system, without the prior written permission of publisher.

e-ISBN 978-0-07-180978-8

e-MHID 0-07-180978-3

The material in this eBook also appears in the print version of this title: 978-0-07-180977-1, 0-07-180977-5

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill Education books are available at special quantity discounts to use as premiums and sales promotions, or for use in corporate training programs. To contact a special sales representative, please visit the Contact Us page at www.mhprofessional.com.

TERMS OF USE

This is a copyrighted work and The McGraw-Hill Companies, Inc. (McGraw-Hill) and its licensors reserve all rights in and to the work. Use of this work is subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hills prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED AS IS. McGRAW-HILL AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. McGraw-Hill and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. McGraw-Hill has no responsibility for the content of any information accessed through the work. Under no circumstances shall McGraw-Hill and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

To obtain the downloadable PDF format of this eBook, please .

Contents

chapter

What Is Asset Allocation?

Ask any pastry chef or baker: What would happen if you gathered together all the best ingredients in the worldvanilla from Madagascar, chocolate from Oaxaca, chir butter from Francebut failed to take the time to mix them together properly? Youd end up with an expensive but decidedly disappointing dessert, right? Ask any construction worker: What would happen if you were to combine water, sand, and cement together, but in incorrect proportions? Youd most likely get a weak batch of concrete, and a potentially dangerous foundation for your structure.

In a nutshell, thats what asset allocation is all about. It is the process by which investors can build a safe, solid foundation for their investment portfolio by making sure not only that they own sound investments, but that those assetsranging from stocks to bonds to cash to real estate to gold and other commoditiesare held in the proper proportion based on their circumstances.

What Defines Proper Asset Allocation?

Should you invest for capital appreciation (a fancy way of saying growth) by loading up on assets that increase in value quickly? For instance, should you keep, say, 75 percent of your money in stocks, with 15 percent in real estate and 10 percent in bonds? Or should your goal be capital preservation (i.e., safety at all costs) by keeping all or most of your money in relatively stable investmentsfor instance, 50 percent of your money in bonds, 25 percent in gold, and 25 percent in cash?

There are a whole host of factors that go into answering this question and establishing what the proper mix of stocks, bonds, real estate, gold, and other assets is for you and your portfolio.

For starters, there are the variables you hear about most often from the personal financial media and the financial services industry: your age and the approximate year in which you intend to retire. In the parlance of personal finance, this is referred to as your time horizon. These factors are indeed quite important. After all, youre investing for a goal, and for most Americans, the biggest goal is likely to be the ability to pay for a long and comfortable retirement in the future.

A Key Fact to Consider: The more time you have before youll need to spend the money youre investing, the more risk you can afford toand shouldtake with your portfolio. Often, that means the greater exposure your portfolio ought to have to stocks, especially fast-growing shares.

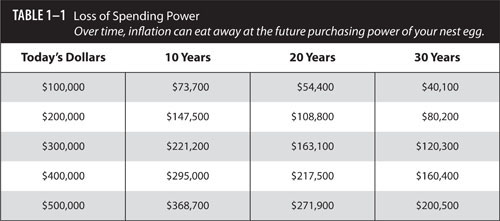

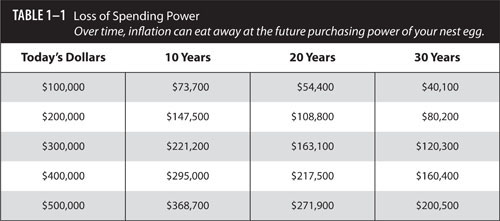

This is true not only because a person with a long time horizon can afford to take more investment risk, since he or she would have time to make up for any short-term setbacks the portfolio might suffer early on. Its also because time has a funny way of eroding the value of anyones portfolio through the deleterious force known as inflation, which chips away at the purchasing power of ones money over time. And over extremely long periods of time, the compounding effects of inflation every year can really put a dent in your portfolio ().

Personal Sensibilities

You cannot ignore other variables that are more personalthat speak to who you are as an individual and what your circumstances are now and could be in the future. For instance, how would you describe yourself as an investor? Are you a risk taker by nature, or do you feel more comfortable playing it safe? What is your psychological tolerance for risk? When faced with unexpected bad news, are you likely to double down your resolve and stick to your guns? Or are you much more likely to panic at the earliest signs of bad news?

All of this matters in establishing the right investment strategy for you, because the worst thing you can do is set forth an investment plan early onfor instance, one that requires you to be heavily weighted toward stocks, and not just any equities, but the riskiest types of shares, such as those of a tiny start-upthat you know in your heart of hearts youll ignore or upend down the road when the pressure is on (for instance, should the stock market run into a hiccup or a sustained downturn).

Next page