Founded in 1807, John Wiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers' professional and personal knowledge and understanding.

The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to e-commerce, risk management, financial engineering, valuation and financial instrument analysis, as well as much more.

For a list of available titles, please visit our Web site at www.WileyFinance.com .

Copyright 2012 by Morningstar, Inc. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com . Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions .

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley also publishes its books in a variety of electronic formats. Some content that appears in print may not be available in electronic books. For more information about Wiley products, visit our web site at www.wiley.com .

Library of Congress Cataloging-in-Publication Data:

Kaplan, Paul D.

Frontiers of modern asset allocation / Paul D. Kaplan. -- 1st ed.

p. cm. -- (Wiley finance series)

Includes bibliographical references and index.

ISBN 978-1-118-11506-0 (cloth); ISBN 978-1-118-17299-5 (ebk);

ISBN 978-1-118-17300-8 (ebk); ISBN 978-1-118-17301-5 (ebk)

1. Portfolio management. 2. Investments. I. Title.

HG4529.5.K36 2012

332.6dc23 2011029303

ISBN 978-1-118-11506-0

To my children, Ruth, Rachel, and Benjamin.

And to all LGBT people everywhere who serve investors.

Foreword

The breadth and depth of the articles in this book suggest that Paul Kaplan has been thinking about markets for about as long as markets have existed. That's not true, of course; he's only 50. And, in fact, having preceded him into this world and having been the first employee of Ibbotson Associates in 1979, I experienced the pleasure of having Paul work for me in the early years of that organization. We were a small firm, we were young, and we were usually brokethe ideal conditions for pushing the frontiers of knowledge to make new discoveries and bring them to market.

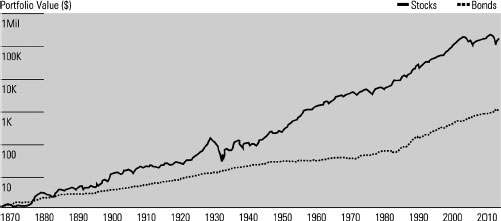

The discovery for which Ibbotson Associates (now a part of Morningstar, Inc.) first became known was the long-run return on equities and the tremendous superiority of that return to the returns of fixed-principal assets, at least in the United States and for the period over which the return was measured (1926 to the present). (The fixed-principal assets with which Ibbotson was concerned were corporate and government bonds, Treasury bills, and a hypothetical asset returning the rate of consumer price inflation: Stocks, Bonds, Bills, and Inflation.) In other words, Ibbotson Associates, drawing on work by Roger Ibbotson and Rex Sinquefield, estimated the equity risk premiumthe extra return that investors had received for taking the risks involved in holding stocks instead of one of the riskless-asset proxies enumerated above. Note the tense of the language: that investors had received. Ibbotson Associates estimated the ex post or realized equity risk premium.

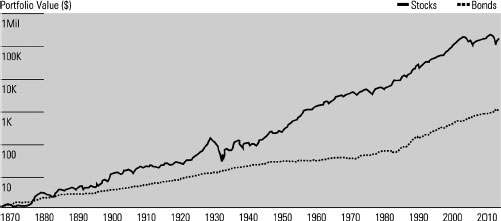

Growth of $1 Invested in U.S. Stocks and Bonds on Dec. 31, 1870

Sources: Stocks: Cowles Foundation at Yale University, 18711925; Morningstar (2011) 19262010. Stocks are all NYSE issues (18711925), S&P 90 (1926February 1957), S&P 500 (March 19572010). Bonds: Homer (1977) Treasury bonds, 187199; corporate bonds, 190025; Morningstar (2011) long-term Treasury bonds, 19262010. For 18711925, yields reported in Homer (1977) were converted to total returns assuming a 20-year maturity.

The stability of the equity risk premium, as thus measured, was remarkable. Looking at What does change as you vary the time window is the return on bonds , so the equity risk premium over bonds does change, a little.

Hadn't anyone before Ibbotson Associates, or Roger Ibbotson and Rex Sinquefield, estimated the equity risk premium? Of course the thought had occurred to many, but the preexisting methodologyto use a kind of Dividend Discount Model (DDM) for the aggregate of all stocks in the marketgave forecasts, or estimates of the ex ante or expected risk premium, not backward looks at history. Hindsight showed that DDM-based forecasts had been much too low. A typical DDM estimate of the forward-looking, or expected, equity risk premium over bonds was in the range of 2 to 3 percent. In contrast, Ibbotson Associates showed that stocks had out-returned intermediate-term Treasury bonds by much more, 5.4 percent, using 1926 to 1979 as the measurement period (1979 being very early in the history of the firm).

Drawing on a variety of logical arguments, Ibbotson Associates supported the use of the historically achieved risk premium as the best forecast of the future, and subsequent events supported this method. By 1999, the historical (1926 to 1999) equity risk premium over bonds had swelled slightly, to 5.7 percent, as the bull market in equities outpaced the contemporaneous bull market in bonds. (These numbers are all compound annual returns, or geometric means. The Ibbotson forecasts used arithmetic means; in other words, they said that the future arithmetic mean risk premium would equal the past arithmetic mean. But this is a minor technical point.)

The Ibbotson forecasts became the linchpin of financial planning, asset allocation for institutions, cost-of-capital estimation, and a host of other practices. The equity risk premium is arguably the most important single variable in finance, because it helps you plan ahead and decide how much to save and invest, and Ibbotson found what appeared to be a reliable estimator of it.