Global Asset Allocation

A Survey of the Worlds Top Investment Strategies

Meb Faber

Contents

C opyright 2015 The Idea Farm, LP

All rights reserved.

Limit of Liability/Disclaimer of Warranty: While the publisher and the author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specially disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages. No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 Unites States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per copy fee.

ISBN: 978-0-9886799-2-4

To Mom

About the Author

M r. Faber is a co-founder and the Chief Investment Officer of Cambria Investment Management, LP. Faber is the manager of Cambrias ETFs, separate accounts, and private investment funds for accredited investors. Mr. Faber is also the author of the Meb Faber Research blog, Shareholder Yield, Global Value, and the co-author of The Ivy Portfolio: How to Invest Like the Top Endowments and Avoid Bear Markets. He is a frequent speaker and writer on investment strategies and has been featured in Barrons, The New York Times, and The New Yorker. Mr. Faber graduated from the University of Virginia with degrees in Engineering Science and Biology. He is a Chartered Alternative Investment Analyst (CAIA), and Chartered Market Technician (CMT).

Contact Information:

Twitter: @MebFaber

Email:

Phone: 310-683-5500

Blog: mebfaber.com

Research: theideafarm.com

Company: cambriafunds.com

Sign up for our mailing list here

However beautiful the strategy, you should occasionally look at the results.

Winston Churchill

Introduction

T o help put the reader in the right mindset for this book, lets run a little experiment. We want to make sure youre paying attention, so turn off the TV, close your email, and grab a cup of coffee.

Below is a test. It is simple, but requires your utmost concentration. Here is a video for you to watch. So click on this link and then come back to this book after watching its only about 20 seconds long so well wait.

Selective Attention Test Video

Did you watch?

Okay, do you have your number? If you do your job correctly, you learn that the ball is passed 15 times. Did you get the number correct? Congratulations!

But, of course, thats not the whole story.

In this particular experiment, which many of you have probably seen already, while you were fastidiously counting basketball passes, what you might have missed was someone dressed in a gorilla costume walk into the frame, pound his chest, and walk off. Dont feel bad most participants in the experiment dont notice the gorilla at all. While they kept their eye trained on what they assumed to be the most important taskthe passing of the basketballthey simply failed to notice anything else.

Go back and watch again and be amazed that you would have missed this very obvious intruder. What the research actually finds is that when we narrow our focus to one specific task, we tend to overlook other, significant events.

What does this have to do with investing and this book? Conventional wisdom tells us that, as investors, we have to keep our eyes trained on our asset allocation. However, how much time do you spend thinking about the following questions:

Is it the right time to be in stocks, or should I sell?

Should I add gold to my portfolio? If so, how much?

Arent bonds in a bubble?

How much should I put in foreign stocks?

Are central banks manipulating the market?

With all of our focus on assets and how much and when to allocate them are we missing the gorilla in the room?

Our book begins by reviewing the historical performance record of popular assets like stocks, bonds, and cash. We look at the impact inflation has on our money. We then start to examine how diversification through combining assets, in this case a simple stock and bond mix, works to mitigate the extreme drawdowns of risky asset classes.

But we go beyond a limited stock/bond portfolio to consider a more global allocation that also takes into account real assets. We track 13 assets and their returns since 1973, with particular attention to a number of well-known portfolios, like Ray Dalios All Weather portfolio, the Endowment portfolio, Warren Buffetts suggestion, and others. And what we find is that, with a few notable exceptions, many of the allocations have similar exposures.

And yet, while we are all busy paying close attention to our portfolios particular allocation of assets, the greatest impact on our portfolios may be something we fail to notice altogether. In this case, the so-called gorilla are the fees that we often fail to consider. In one shocking example, we find that the best performing strategy underperforms the worst strategy when we tack on advisory fees. Ultimately, smart investing requires that we not only monitor asset allocation, but of equal weight, we focus on the advisory fees associated with the investment strategy.

1

A History of Stocks, Bonds, and Bills

L et s start with a history lesson. Many people begin investing their money without a true understanding of what has happened in the past, and often bias their expectations toward their own personal experiences. My mother always told me the way to invest was to buy some stocks and then just hold on to them. But her experience, living in the United States and investing particularly in the 1980s and 1990s, was very different from her parents generation, which lived through the Great Depression. Both of these experiences would be vastly different from those of the average Japanese, German, or Russian investor.

So what is possible and reasonable to expect from history? We should begin with a discussion about the value of money.

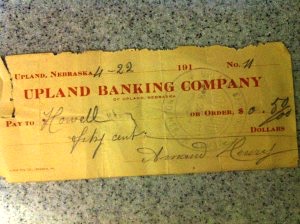

A few years ago, my father and I were talking and he decided to demonstrate a real world example of inflation. A couple weeks later, I received a letter with a check inside written by my great grandfather in the 1910s for $0.50. He was a farmer who immigrated from Les Martigny-Baines, Voges France and ended up in Nebraska. That $0.50 is equivalent to about $13 today and shows a very simple example of inflation. As a side note, look at that penmanship!

FIGURE 1 Real World Inflation

Source: Faber

A more familiar example is the oft-used phrase, I remember when a Coca-Cola cost ten cents. (Another fun example is Superhero Inflation.) Inflation is an emotional topic. It usually goes hand-in-hand with a discussion of The Federal Reserve, and there are not many topics that incite more vitriol in certain economic and political precincts than The Fed and the U.S. dollar.