Walk Away

The Rise and Fall of the Home-Ownership Myth

Douglas E. French

Ludwig

von Mises

Institute

AUBURN, ALABAMA

Copyright 2010 by the Ludwig von Mises Institute

Published under the Creative Commons Attribution License 3.0.

http://creativecommons.org/licenses/by/3.0/

Ludwig von Mises Institute

518 West Magnolia Avenue

Auburn, Alabama 36832

Ph: (334) 844-2500

Fax: (334) 844-2583

mises.org

10 9 8 7 6 5 4 3 2 1

ISBN: 978-1-61016-102-2

Introduction

The idea that a mans house is his castle is attributed to American Revolutionary James Otis from 1761, and his idea was that government should never be permitted to breach its walls. It is a good thought, in context; one that sums up a dogged attachment to the right of private property.

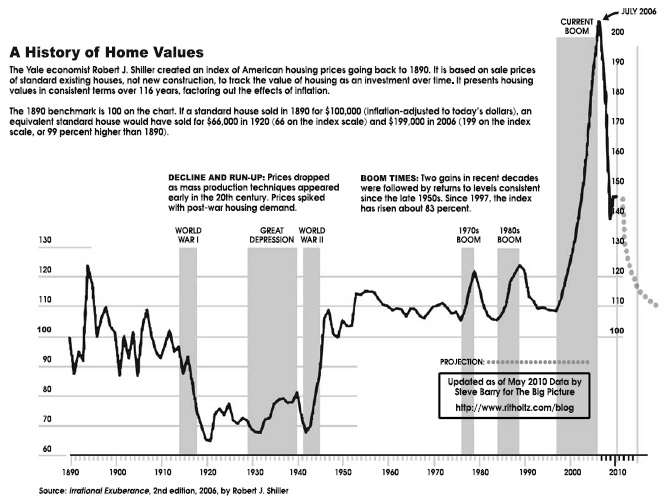

In the 20th century, however, government got behind the idea that every citizen should be provided a castle of his or her own. This is the essence of the good life, we were told, that very core of our material aspirations. The home is the most valuable possession we could ever have. It is the best investment, even better than gold. Government would make us all owners, one way or another, even if it meant violating rights to make it happen.

This became an article of faith, a central tenet of the American civic religion, and one that led to additional spin-off doctrines. We should fill our valuable homes with vast amounts of furniture, large pieces especially, things that suggest permanence and roots. If there were any doubt as to where to put our money, an answer was always ready: put it into the mortgage, where it will surely pay the highest return.

The home itself could provide full-time employment for half of the American citizenry, as all women became home makers who devote themselves to cooking, laundry, and cleaning, while all extra time that the man had should be devoted to lawn care, household repairs, and landscaping. The home was the very foundation of community, of freedom, of the American dream. It embodied who we are and what we do.

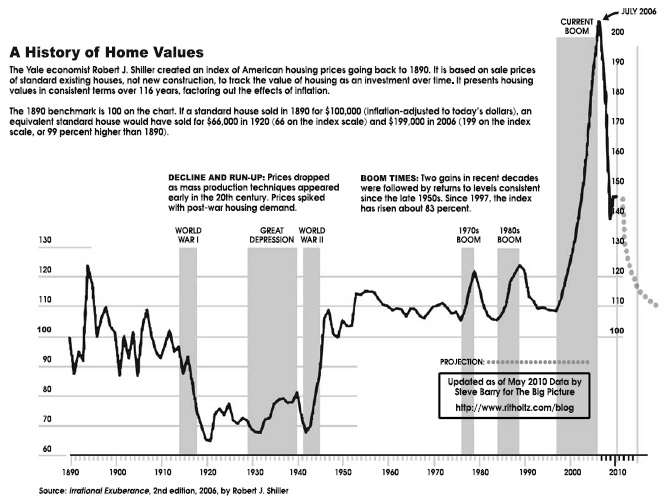

Beginning in 2007 and culminating in 2008 this dream was smashed as home values all over the country plummeted, wiping out a primary means of savings. Some homes fell by as much as 7580%, instilling shock and awe all across the country. The thing that was never supposed to happen had happened. This meant more than mere asset depreciation. An article of faith had fallen, and there were many spillover effects.

The home was the foundation of our financial strategy, our love of accumulating large things, the core of our strategic outlook for our lives. Once that goes, much more goes besides. The things in the home suddenly become devalued. We look around us in astonishment at how much stuff we have, and we are weighed down by the very prospect of moving. We are longing for a different way, perhaps for the first time in a century.

We are beginning to see the response in the new behavior of some younger people. The New York Times, the Wall Street Journal, and other major media outlets are starting to cover the trend of what we might call the new mobility. Young couples are selling off their possessions: their large furniture, their china and crystal, their enormous bedrooms suites, and even their cars. They are lightening the load, preparing for a life of mobility, even international mobility.

The collapse of the housing marketwhich has occurred despite every effort by the government to prevent itcoincides with the highest rate of unemployment among young people that weve seen in many generations. Economic opportunity is dwindling, at least in traditional jobs. The advance of digital technology has made it possible to do untraditional jobs while living anywhere, and perhaps changing ones location every year or two.

Millions have walked away from their mortgages. Those who have swear that they will never again be tricked by the great housing myth that this one asset is guaranteed to go up and up forever. The new source of value is not something attached to the biggest thing we own but rather in the most fundamental unit of all: ourselves, and what we can do. This change represents a dramatic change not just for one generation but for an entire ethos that has defined what it means to be an American for about a century.

To walk away might at first seem like a post-modern activity, one that disconnects us with history and community. We might just as easily see it as a recapturing and redefining of an older tradition that shaped the American ethos from the colonial period through the latter part of the 19th century: the pioneer spirit. Our ancestors moved freely, across great distances, beginning with oceans and then continuing across great masses of land, from New England to the West, all in search of economic opportunity and the fulfillment of a different American dream, defined by freedom itself.

This change begins with a single realization: Im paying more for my house than my house is worth. What precisely is the downside of walking away, of going into a strategic default? I lose my house. Good. Thats better than losing money on my house. But what are the economic and ethical implications of this? Americans havent faced this dilemma in at least a century. But now they are, by the millions. They are awakening to the reality that the house is no different from any other physical possession. It has no magical properties and it embodies no high ideals. It is just sticks and bricks.

This book examines the background to the case of strategic default and considers its implications from a variety of different perspectives. The thesis here is that there is nothing ominous or evil about this practice. It is an extension of economic rationality.

But what about the idea that our home is our castle? My thesis is that the essence of freedom is to come to understand that the real castle is to be found within.

CHAPTER

ONE

What is Strategic Default?

Strategic default is when homeowners stop paying on their mortgages when, in fact, they can afford to make payments, but choose not to because the house that serves as collateral for the loan is worth considerably less than the loan balance.

These are not people who take out a mortgage and never make a payment. Strategic defaulters borrowed the money in good faith to buy or refinance a home during the housing bubble of the mid-2000s. They made their payments until they realized it didnt make sense to feed a mortgage on a house worth a fraction of what they owe.

CBSs 60 Minutes aired a story on strategic defaults in May of 2009 and estimated that a million homeowners who could pay chose to walk away instead. Nearly a third of all foreclosures in 2010 are believed to strategic defaults, up from 22 percent in the first quarter of 2009.

Academics like Professor Luigi Zingales at the University of Chicago worry that as more people strategic default, the stigma once attached to it will fall away, and [t]he risk that the number of people doing this might explode is significant, says the professor.

A hypothetical example, created by Brent T. White in his Arizona Legal Studies Discussion Paper, would be that a young couple buys a 3-bedroom, 1380 square foot home in Salinas, California for $585,000 in January 2006, which was the average home price in Salinas at that time. The couple had excellent credit and qualified for a no-money down fixed interest rate 30-year loan at 6.5% with a total payment of $4,300 per month (P & I, taxes, mortgage, and homeowners insurance). This was 31% of their gross monthly income and thus was considered affordable by the lender. With the couples other living expenses they struggled to break even each month, but were comfortable stretching to make the purchase, believing the home would increase in value. And the lender was comfortable enough to make the loan.