1. Introduction

The ongoing globalisation and the interrelated trade of goods and services are an integral part of todays business. In particular, the automobile industry plays an important role within the global environment, because of their strong linkages within the global economy (Haugh, Mourougane, and Chatal 2010).

The increased international commitment of car manufacturers is driven by, on the one hand issues of limited opportunities in their respective home markets and, on the other hand, superior opportunities in emerging markets such as China or India (Lang et al. 2010). Therefore, motives for entering new markets can be either proactive, for example, expand market share, lower costs or the availability of resources or they can be reactive, for example, to remain competitive (Rao 2010: 46-47). For instance, German car manufacturers are faced by a highly competitive home market, not only within the mass market, but in the premium market as well (Business Monitor International 2011). BMW, for instance, has been proactive by taking the opportunity to enter new markets such as China where it has produced cars since 2003 (BMW Group 2011). Furthermore, BMW assemblies its cars with a reassembly production process in India, Thailand, Malaysia and Indonesia (BMW Group 2011).

However, these are just a few emerging economies where the company seeks its opportunities. Emerging economies such as Brazil offer auspicious potential for foreign investors as well (Keese and Farinha 2011). Brazil is the eighth largest economy by Gross Domestic Product (GDP), the fifth by population and the fourth largest car market in the world (Economist Intelligence Unit 2011, Euromonitor International 2011, PricewaterhouseCoopers 2011). While other companies just consider investments in emerging markets, BMW already benefits by exporting its cars to Brazil (Reuters 2011). Nevertheless, to take full advantage of the market the company contemplates entering Brazils car market by foreign direct investment. Consequently, BMW has to investigate the Brazilian market very thoughtfully.

The aim of this report is to critically analyse and evaluate the automobile industry as well as the business environment in Brazil with reference to BMW. Furthermore, the report identifies recommendations to develop a long-term market entry strategy in order to act successfully in the market.

2. BMW within the Global Automobile Industry

The global automobile industry is characterised as very capital intensive by means of high material and labour costs (Heneric, Licht and Sofka 2005). Therefore, the industry is very distinctive when it comes to competition and manufacturers have to market their products to a large extent (Datamonitor 2011). This chapter analyses the industry with focus on passenger cars by using Porters Five Forces (Porter 1996) and to point out the opportunities in emerging markets with focus on Brazil.

2.1 Automobile Industry at a Glance

The automobile industry can be differentiated into passenger cars, light trucks and motorcycles (Euromonitor International 2011). The overall market value stepped-up from 2009 to 2010 by approximately 5 per cent and reached a total value of 1,059 billion (Datamonitor 2011). Passenger cars account for roughly 79 per cent of the total value of the industry (Datamonitor 2011). In terms of units sold the global market grew from 2009 to 2010 by 7 per cent and attained a total volume of nearly 108 million units and passenger cars accounted for 85 million units (Datamonitor 2011). It is expected that the global industry will be achieve a total volume of 147 million units by 2015 which equals a rise of approximately 36 per cent since 2010 (Datamonitor 2011). As a result, passenger cars are likely to reach a total of 116 million units with a total value of 1,248 billion (Datamonitor 2011).

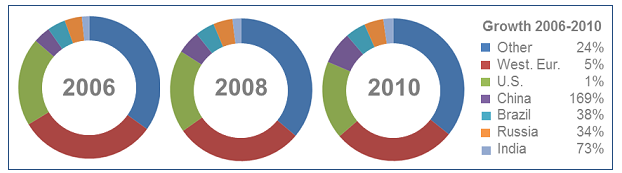

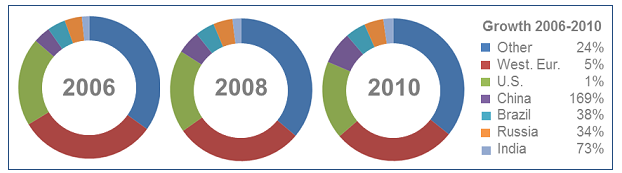

When considering the growth related to their origin it can be pointed out that developed countries are declining, for instance, Europe, while emerging regions like Asia and Latin America are increasing their total volume (Euromonitor International 2011). With focus on Brazil, Russia, India and China (BRIC), figure 1 illustrates the growth of passenger cars compared to Western Europe and the United States. The figure indicates that the BRIC economies gain higher growth rates compared to developed countries and that these countries providing and facilitating very well prospects for car manufacturers, for example, BMW (see appendix for further background on BMW).

Figure 1. Passenger Cars in Use (own figure with data sourced from Euromonitor 2011)

As a result, BRIC economies account for nearly 20 per cent of total passenger cars in 2010 and it is increasing very considerable (Euromonitor International 2011). It is estimated that by 2014 BRIC states will account for 30 per cent of global car sales (Lang et al. 2010). As already pointed out, the opportunities are tremendous.

2.2 Competitors, Suppliers and Potential Entrants

The rivalry between car manufacturers is intensive and increasing prices for raw materials or the pressure from governments to adapt environmental friendly techniques makes the business even more difficult (Ciobanu 2009, Cordonnier 2009, Datamonitor 2011). Global players within the industry are Ford, Toyota and Volkswagen which have a combined market share of roughly 20 per cent of the global automobile market (Datamonitor 2011).

BMW, for example, operates in the premium market and its strongest competitors are Audi, Mercedes Benz and Lexus (BMW Education Programme 2011). Further pressures within the competition are safety, product quality as well as overall efficiency and research and development of alternative drive concepts (Datamonitor 2011). With regard to Brazil, the largest car manufacturers are Fiat, General Motors and Volkswagen (Reuters 2011). Their combined market share in Brazil is estimated to be 60 per cent (KPMG 2007). Apart from that, Mercedes Benz is the only premium manufacturer, but stopped producing its A-Class in Brazil and switched to heavy trucks production (Reuters 2011). This can lead to an advantage for BMW as its overall sales are increasing in Brazil by 50 per cent annually (Reuters 2011). Nevertheless, the production stop of the A-Class could be a signal that the premium market is still not profitable in the country.

The possibility of new entrants is relatively low, because it takes high capital investments to enter the market, for instance, research and development, advertising and buying the facilities (Datamonitor 2011). Furthermore, access to distribution channels may be difficult as manufacturers have integrated backwards. Hence, the likelihood of new entrants who are able to compete is low (Datamonitor 2011).

The bargaining power of suppliers can be contemplated as moderate. Manufacturers are able to source their materials globally. Therefore, they are not reliant to suppliers to a large extent or they form partnerships with suppliers in order to reduce their power. (Datamonitor 2011, Ehmke et al. 2007).

2.3 Buyers and the Risk of Substitutes

The bargaining power of buyers can be considered as moderate. Although buyers can put pressure on manufacturers by ordering large volumes as well as switch to other companies in order to achieve price discounts, buyers tend to be loyal and the forward integration of companies lead to a moderate buying power (Datamonitor 2011). Despite of that, automobile manufacturers have to consider local wants and needs related to the product such as quality, price and features. For example, emerging regions may have other patterns of demand unlike developed countries and should be considered thoughtfully.