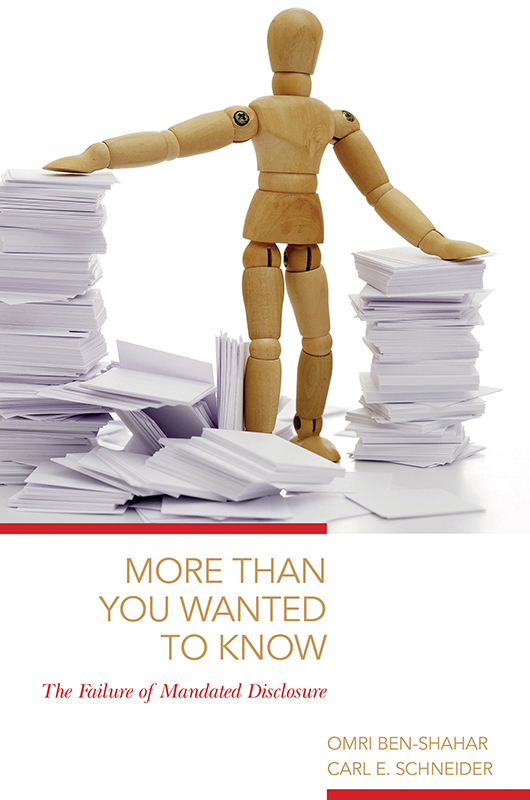

MORE THAN YOU WANTED TO KNOW

MORE THAN YOU WANTED TO KNOW

THE FAILURE OF MANDATED DISCLOSURE

Omri Ben-Shahar

Carl E. Schneider

Princeton University Press

Princeton and Oxford

Copyright 2014 by Princeton University Press

Published by Princeton University Press, 41 William Street, Princeton, New Jersey 08540

In the United Kingdom: Princeton University Press, 6 Oxford Street, Woodstock, Oxfordshire OX20 1TW

press.princeton.edu

Jacket art JosA Carlos Pires Pereira/Getty Images. Jacket design by Marcella Engel Roberts. Jacket front cover by Wanda Espaa.

All Rights Reserved

Library of Congress Cataloging-in-Publication Data

Ben-Shahar, Omri, author.

More than you wanted to know : the failure of mandated disclosure /

Omri Ben-Shahar, Carl E. Schneider.

pages cm

Includes bibliographical references and index.

ISBN 978-0-691-16170-9 (hardcover)

1. Disclosure of informationLaw and legislationUnited States.

2. Consumer protectionLaw and legislationUnited States.

3. Decision makingUnited States. I. Schneider, Carl, 1948 author. II. Title.

KF1609.B46 2014

346.73021dc23

2013034453

British Library Cataloging-in-Publication Data is available

This book has been composed in Minion Pro

Printed on acid-free paper.

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

To Sarah

Who sets no terms or conditions

Omri Ben-Shahar

To Joan

Oh ye gods, render me worthy of this noble wife.

Carl E. Schneider

PREFACE

This book began at lunch. We were casually discussing our research, which we had thought must be far apart. What could two scholars, one of law-and-economics and private law (Ben-Shahar) and the other of health law and bioethics (Schneider) have in common? To our surprise and pleasure we realized we were pursing the same core thesis. Ben-Shahar had just published an article, titled The Myth of Opportunity to Read in Contract Law, arguing that advance disclosure of fine print to consumers is pointless. Schneiders book The Practice of Autonomy had argued that informed consent has failed to improve patients medical decisions. As lunch progressed we discovered that we shared a fundamental skepticism about two different aspects of the same method of regulationmandated disclosure. And we soon realized that both the structure of the arguments we were developing and the kinds of empirical support we were recruiting had many similarities.

In the spring of 2008, we decided to write an article making our joint case against mandated disclosure in our two areasconsumer law and health law. To write it, we searched electronically for all the disclosure statutes in three states (Illinois, Michigan, and California). We were startled to find that disclosures were mandated almost wherever we looked. There were hundreds of statutes, regulations, and rulings mandating countless disclosures, all trying to do the same thing: give lay people information to help them make better decisions as consumers, cardholders, patients, employees, tenants, policyholders, travelers, and citizens. It was that revelationthe ubiquity of mandated disclosurethat set us on the course to this book.

Numerous academics have contributed to our thinking about our topic. We acknowledge in the footnotes the writings of hundreds of researchers who have spent their careers examining disclosures of many kinds. In addition, we have presented versions of the manuscript to our colleagues at Chicago and Michigan and to workshops at NYU, UCLA, the universities of Pennsylvania and Washington, Tel-Aviv and Vanderbilt Universities, Academia Sinica in Taipei, and Universitat de Valncia. Special thanks for extended discussions and comments are due to Ryan Calo, Sarah Clarke, Richard Craswell, Bob Hillman, Florencia Marotta-Wurgler, Chuck Myers, Ariel Porat, Joan Schneider, and Doron Teichman. Ben-Shahar acknowledges the invaluable critique and feedback from his long time academic collaborator and friend, Oren Bar-Gill.

PART I

THE UBIQUITY OF MANDATED DISCLOSURE

CHAPTER 1

INTRODUCTION

Publicity is justly commended as a remedy for social and industrial diseases. Sunlight is said to be the best of disinfectants; electric light the most efficient policeman. And publicity must, in the impending struggle, be utilized in many ways as a continuous remedial measure.

Louis Brandeis, Other Peoples Money

Mandated disclosure may be the most common and least successful regulatory technique in American law. It aspires to help people making unfamiliar and complex decisions while dealing with specialists by requiring the latter (disclosers) to give the former (disclosees) information so that disclosees choose sensibly and disclosers do not abuse their position.

For example: You are mortgaging your new house. Or considering prostate-cancer surgery. Or buying software on line. Or being questioned by the police. Youve never faced your choice before. It turns on much you do not understand. The specialists youre dealing withlenders, doctors, vendors, and policeunderstand it well. Mandated disclosure requires the specialists to tell you what you must know to choose well. Thus truth-in-lending laws oblige your lender to describe its credit terms. Informed-consent doctrine obliges your doctor to describe treatments for prostate cancer. Contract law obliges your vendor to reveal terms like warranties and mandatory arbitration. Miranda obliges the police to recite your rights. Thus informed, you are supposed to understand your choices well enough to make sound decisions about your credit, your cancer, your computer, or your confession.

Mandated disclosure has been the principal regulatory answer to some of the principal policy questions of recent decades. A core response to financial crisis is to ratchet up (already considerable) disclosure mandates. Much health-care reform requires that patients be told about health plans, insurance, doctors, hospitals, treatments, and costs so that they can choose thoughtfully and thriftily. Much Internet commerce is regulated by disclosure mandates. So are many kinds of privacy. Several constitutional rights are guarded through disclosures like the Miranda warning. Campaign-finance regulation is now largely about disclosure.

These are just a few peaks in a mountain range. Undisclosed contract terms are generally unenforceablehence fine print. So every I agree clicked, every dotted line signed is a disclosure moment. Vast stretches of consumer-protection law mandate disclosures. Mortgages, savings accounts, checking accounts, retirement accounts, credit cards, pawnshops, and rent-to-own plans are subject to disclosure mandates. Health law abounds in disclosuresin informed consent, drug labeling, research regulation, health insurance, living wills, and medical privacy. Mandated disclosures adorn food labels, travel tickets, leases, copyright warnings, time-share agreements, house sales, store return policies, school enrollment and graduation data, college crime reports, flight-safety announcements, parking-garage stubs, product and environmental hazards, and car and home repairs.

Nevertheless, mandated disclosure is a Lorelei, luring lawmakers onto the rocks of regulatory failure. This book hopes to silence its siren song. First, by identifying mandated disclosure as a distinctive regulatory method. Second, by describing its almost incontinent use. Third, by showing that it routinely fails to achieve its goals. Fourth, by explaining why it fails and cannot be fixed.

Mandated disclosure is alluring because it addresses a real problem: Modernity showers you with unfamiliar and complex decisions. Knowing little, you depend on specialists. Only a few decades ago, you made fewer choices about fewer things. You got a black telephone from AT&T. You got a mortgage from the First Local Bank, which offered only a few kinds of mortgages on quite limiting conditions. You got (often) the medical treatment your doctor thought you needed. You got a pension only if you worked many years for one company, and you got the pension the company designed.

Next page

![Maurice Osborn - Deeper Disclosures; David Wilcock interviews Corey Goode on Cosmic Disclosure [Season 1&2]](/uploads/posts/book/124017/thumbs/maurice-osborn-deeper-disclosures-david-wilcock.jpg)