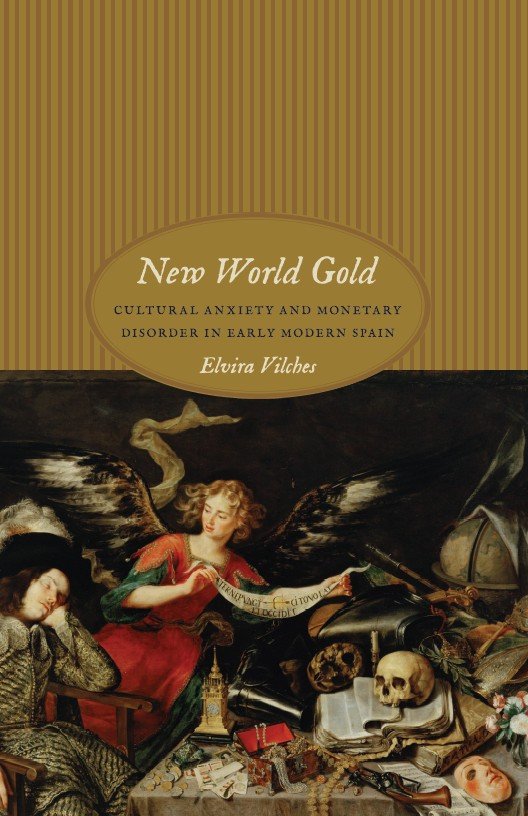

ELVIRA VILCHES is associate professor of Spanish at North Carolina State University.

All rights reserved. Published 2010

The University of Chicago Press gratefully acknowledges the generous support of the Program for Cultural Cooperation between Spains Ministry of Culture and United States Universities toward the publication of this book.

Vilches, Elvira.

New World gold: cultural anxiety and monetary disorder in early modern Spain / Elvira Vilches.

p. cm.

Includes bibliographical references and index.

ISBN-13: 978-0-226-85618-6 (cloth: alk. paper)

ISBN-10: 0-226-85618-6 (cloth: alk. paper) 1. SpainEconomic conditions16th century. 2. SpainEconomic conditions17th century. 3. EconomicsSpainHistory16th century. 4. EconomicsSpainHistory17th century. 5. GoldSpainHistory16th century. 6. GoldSpainHistory17th century. 7. CreditSpainHistory16th century. 8. CreditSpainHistory17th century. I. Title.

Acknowledgments

The research for New World Gold has benefited from the generous support of several institutions. The American Council of Learned Societies made it possible for me to spend a full academic year at the Library of Congress as an International Studies Fellow. I am also indebted to the John Carter Brown Library for funding a fellowship in Comparative New World Studies. I thank the staffs of both institutions. Special thanks go to Prosser Gifford and Les Vogel of the John W. Kluge Center at the Library of Congress, as well as Susan Danforth, Michael T. Hamerly, and Richard J. Ring of the John Carter Brown Library. The College of Humanities and Social Sciences at North Carolina State University granted me research funds to conduct research at the Archivo General de Indias in Seville.

Rolena Adorno, Walter Cohen, and Mary Gaylord nurtured the initial stages of this project. Through the years, Walter and Mary have been the kindest of mentors and sharpest of readers. Mary read the whole manuscript and offered invaluable criticism and guidance. Mara Mercedes Carrin, Harry Vlez-Quiones, and Alison Weber read the whole manuscript and provided important insights. Also, this project owes much to the two anonymous readers at the University of Chicago Press for their incisive criticism, priceless comments, and thoughtful suggestions that, without doubt, have improved this book. My deepest thanks are due to Randy Petilos, my editor at the University of Chicago Press, for his commitment to this book, his kindness, and his great patience during the writing and revising of this book.

During the research for this project, I have been fortunate to benefit from discussions and conversations with caring friends and wonderful colleagues: Laura Bass, Diane Cady, Jos Cartagena-Caldern, Anne Coldiron, Enrique Garca Santo-Toms, Margaret Greer, James Iffland, Domingo Ledezma, Gerardo Leibner, Kathleen Lynch, Gabriela Nouzeilles, Ricardo Padrn, and Carla Rahn Phillips. Natasha Chang and Gina Herrmann read portions of the manuscript and provided invaluable comments, advice, and sustained enthusiasm. John Tallmadge has been my most constant, demanding reader, a supportive critic, a great mentor, and a conscientious editor. Stephanie Sieburth supported me through the writing process with infallible enthusiasm and precious guidance. Louise Salstad generously and meticulously read the whole manuscript, corrected my translations, and provided much joy and encouragement. David Guy, Liz Moore, Patricia Phelan, John C. Pittman, Michael Sharp, ngela Gonzlez, and Dennis Vlez helped me with their wisdom, kindness, and friendship in more ways than they can imagine. Thank you also to Darby Orcutt, the collection manager at D. H. Hill Library, and to my colleagues at North Carolina State University.

I greatly value the patience of my family, whose love has been an inestimable source of happiness and devoted affection. Completing this book would have not been possible without Jordi Mar, my loving husband and best friend. This book is for him.

Earlier versions of portions of were presented at the International Seminar of Atlantic History at the Department of History at Harvard University and profited greatly from the discussion.

Introduction: Money, Credit, and Value

During the sixteenth and seventeenth centuries, there was an explosion of economic writing in Spain. The proliferation of treatises, tracts, and memorials on usury, commerce, and political economy was marked by two major events: the price revolution, which began in the first decades of the sixteenth century; and the fiscal crisis that lingered as the series of royal bankruptcies expanded from 1557 to 1653. Theologians pondered the sudden escalation of prices, which they linked to the development of a sophisticated financial credit system, and the shower of American gold. Mercantile authors discussed measures to save the national economy and debated why the imports of American bullion had brought ruin instead of fortune. As theologians and political economists grappled with the effects of the credit economy, they looked at a host of monetary experiences that, although they were not completely new, surprised everybody. No one could imagine that a kingdom that owned the wealthiest gold and silver mines of the Indies would ever face poverty, scarcity, and debt.

Settlers in the Indies and people in Castile witnessed that gold, either as bullion or in the form of money, did not stand as a reliable center of value. Castilian society observed how the number of money changers and brokers increased, as commercial transactions grew larger and became obscure. Society also witnessed how commerce resulted in a swift accumulation of monetary wealth that surpassed both the value of the awe-inspiring cargoes of the treasure fleet and the worth of large land holdings. Likewise, Castilians saw annuities become popular investments, once the Castilian firms went under and Genoese financiers took control.

The most popular forms of credit in Habsburg Spain included extended payment terms for the sale of merchandise, credit sales, and the censo, which consisted of annual percentage payments for larger sums. Creditors included religious orders, institutions, and private citizens. People from all walks of life contracted censos to borrow money in order to sustain farming, purchase property, arrange extended payment terms for dowries, or manage debt. These ordinary credit practices coexisted with more sophisticated commercial forms of entrepreneurial credit, generally referred to as exchange. In the expanding credit economy, financiers and merchants used exchange to transfer funds between locations and currencies, not for any specific need, but simply to accumulate interest while, temporarily, using someone elses money. In this way, financiers profited from credit, borrowing, and speculation.

The economic writing of the period held that, despite the obvious differences in the art of exchange and

The paper used in this publication meets the minimum requirements of the American National Standard for Information SciencesPermanence of Paper for Printed Library Materials, ANSI Z39.481992.

The paper used in this publication meets the minimum requirements of the American National Standard for Information SciencesPermanence of Paper for Printed Library Materials, ANSI Z39.481992.