WAR AND GOLD

BY THE SAME AUTHOR

Ghosts of Empire

Copyright 2014 by Kwasi Kwarteng.

First published in Great Britain in 2014 by Bloomsbury Publishing.

Published in the United States in 2014 by PublicAffairs, a Member of the Perseus Books Group

All rights reserved.

No part of this book may be reproduced in any manner whatsoever without written permission except in the case of brief quotations embodied in critical articles and reviews. For information, address PublicAffairs, 250 West 57th Street, 15th Floor, New York, NY 10107.

PublicAffairs books are available at special discounts for bulk purchases in the U.S. by corporations, institutions, and other organizations. For more information, please contact the Special Markets Department at the Perseus Books Group, 2300 Chestnut Street, Suite 200, Philadelphia, PA 19103, call (800) 8104145, ext. 5000, or e-mail .

Typeset by Hewer Text UK Ltd, Edinburgh.

Library of Congress Control Number: 2013952850

ISBN 9781-610391962 (EB)

First Edition

10 9 8 7 6 5 4 3 2 1

Contents

Photo insert between pages 170171

The financial crisis of 2008 spawned an enormous amount of literature, in journalism and in books. Many of these works dealt with the fine details of the conferences, the highly dramatic meetings which took place surrounding the fall of Lehmans, that weekend in September 2008, when global finance itself seemed to be on the verge of the abyss. Many treatments of the crisis have described the aggressive culture of the banks themselves. They have depicted the fabulous wealth of the hedge-fund owners who made, or lost, millions as a result of the credit bubble and bust. Other writers have concentrated on the high level of government indebtedness which existed after the crisis began, as governments poured billions into supporting the financial system. Some observers have even questioned the nature of paper money and credit itself, suggesting that the adoption of paper money led inevitably to the collapse of 2008.

This book adopts a longer view of the events surrounding the financial crisis and its consequences. The financial crisis naturally elicited many reflections on the nature of money and credit, on the nature of the banking system, and even on the future of capitalism. To anybody interested in a wider context, the events of 2008 also prompted some consideration of how such a fragile system had developed. It was partly motivated by a desire to understand this background that I began research for this book. War and Gold attempts to tell a narrative story about the history of money from the time of the Spanish conquistadors and their discovery of the New World.

Of course, anyone so bold as to attempt a history of money needs to decide where to start. Accounts of money and currencies have sometimes started with the Old Testament, with the Greeks; some have even found This influx of gold and silver which led to higher prices is consequently the subject of the first chapter of this book.

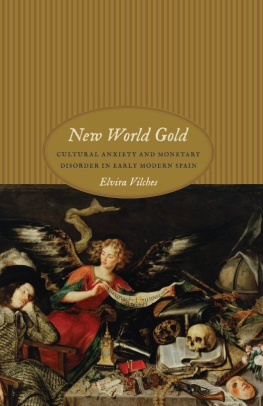

The Spanish conquest of parts of the New World is often cited as the most extreme example of the Wests colonial expansion. The ruthless single-mindedness with which the Spanish sought gold and silver led to tragic scenes of devastation, both social and physical, in Central and Southern America. From the point of view of the historian of finance, the scene is more prosaic. Inca gold and silver were used to support the spending of the Habsburg monarchs of Spain. It was in this respect that the conquistadors efforts were both significant for the history of money and paradoxical, since the Spanish monarchy, despite the wealth it had acquired in the New World, was almost always indebted and often was compelled to declare bankruptcy.

It is a premise of this book that government finance, the need to accumulate treasure, whether by conquest, by borrowing or by taxation, provides a powerful impetus behind developments in society. This idea was expressed by the great Austrian economist Joseph Schumpeter in his article The Crisis of the Tax State, published in 1919.just as central a role in the lives of most citizens. This fact establishes what may be termed the primacy of fiscal policy and is a reason why much of the political debate in Western democracies is centred on the nature of public spending: how much should be spent? How much should the government borrow? What should the government spend this money on? What tax levels are best suited to maximizing government income?

By contrast, monetary debates, regarding levels of interest rates and, even more technically, quantities of money which should be injected into the economy, tend to be the preserve of a specialist cadre of central bankers and, occasionally, politicians who have arrogated to themselves the responsibility in such matters. The historic record on what I call the primacy of fiscal policy is clear. It was under pressure to defend militarily their vast dominions that the Habsburgs of Spain promoted gold and silver exploration in the New World. It was under pressure to finance the Nine Years War, which lasted from 1688 to 1697, that William IIIs government established the Bank of England. John Laws fantastic scheme of paper money was a failed attempt to convert French government debt into equity. Law was attempting to restore Frances public finances after two decades of war.

Similarly, the pressures of revolutionary wars forced both the Americans and the French to issue paper money in unprecedented amounts. The British suspended gold payments in 1797, under pressure of war. It is often forgotten that it was only after these experiments in paper money during the eighteenth century that the famous stability of the gold standard was reached. The gold standard, itself a symbol of permanence and immutability, was developed after the relative chaos generated by the paper currencies of the American and French Revolutions, and the suspension of gold payments by the Bank of England. The gold standard seemed, to contemporaries and supporters, a simple, almost natural idea, an expression of the spontaneous order of the free-market system. Yet the almost universal adoption of the gold standard at the end of the nineteenth century is an excellent example of the dictum uttered by the great British legal historian F. W. Maitland: Simplicity is the outcome of technical subtlety; it is the goal not the starting point.simplicity with which the gold standard was believed to operate marked the end, and not the beginning, of a process which had evolved over 200 years.

It was a world war which first overturned the certainties of the nineteenth-century gold standard. Governments, under the immense pressure of unprecedented industrialized warfare, were forced to spend colossal quantities of money. These sums of money were found by borrowing and printing money. Gold payments were suspended. The gold standard was put to one side, as governments borrowed ever greater sums and issued paper money. A partial result of all this paper money was a hyperinflation in Germany in the 1920s which even today symbolizes the chaos of runaway inflation and continues to influence German politicians and the German people. The people and politicians were, however, so attached to the memory of the gold standard that many attempted to bring it back. Winston Churchill, as Britains Chancellor of the Exchequer, famously went back to gold in 1925 at the same rate of $4.86 to 1 which had prevailed before 1914.

The Depression of the 1930s and the exigencies of another world war seemed finally to resolve any lingering doubts about the efficacy of a gold standard. The Second World War was financed by borrowing, unbacked by any form of commodity standard. At the end of the war, all the belligerents faced an enormous burden of public debt. Yet, rather to the surprise of many politicians at the time, the monetary arrangements established by the Bretton Woods Agreement of 1944 still put gold at the centre of the system. This time it would be the dollar, and not the pound sterling, which would be the anchor of the new monetary order. But it was significant that a role was still envisaged for gold. After the stresses of two world wars and the trauma of the Depression, it was remarkable that any role for gold was found in the new international currency arrangements.

Next page