Pond - Retail banking.

Here you can read online Pond - Retail banking. full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2014, publisher: Global Professional Publishing, genre: Romance novel. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:Retail banking.

- Author:

- Publisher:Global Professional Publishing

- Genre:

- Year:2014

- Rating:4 / 5

- Favourites:Add to favourites

- Your mark:

- 80

- 1

- 2

- 3

- 4

- 5

Retail banking.: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Retail banking." wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Pond: author's other books

Who wrote Retail banking.? Find out the surname, the name of the author of the book and a list of all author's works by series.

Retail banking. — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Retail banking." online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

Retail Banking

3rd edition

Keith Pond, PH.D., FCIB, FHEA

Senior Lecturer in Banking and Economics, Loughborough University

Retail Banking

Global Professional Publishing Ltd 2014

Apart from any fair dealing for the purpose of research or private study, or criticism or review, as permitted under the Copyright, Designs and Patents Act 1988, this publication may only be reproduced, stored or transmitted, in any form or by any means, with the prior permission in writing of the publisher, or in the case of reprographic reproduction in accordance with the terms and licences issued by the Copyright Licensing Agency. Enquiries concerning reproduction outside those terms should be addressed to the publisher. The address is below:

Global Professional Publishing Ltd

Random Acres

Slip Mill Lane

Hawkhurst

Cranbrook

Kent TN18 5AD

Email:

Global Professional Publishing believes that the sources of information upon which the book is based are reliable, and has made every effort to ensure the complete accuracy of the text. However, neither Global Professional Publishing, the authors nor any contributors can accept any legal responsibility whatsoever for consequences that may arise from errors or omissions or any opinion or advice given.

ISBN 978-1-906403-98-0

Printed in the United Kingdom by 4Edge

For full details of Global Professional Publishing titles in Finance, Banking and Management see our website at:

www.gppbooks.com

My main aim in writing and updating this text is to provide a basic introduction to retail banking and to give the book an international appeal.

The text draws on the inspiration provided by The Business of Banking that I co-wrote and updated with Geoff Lipscombe in 1998 and 2002. Retail banks have undergone considerable changes in the last twenty years, their capacity to react to economic, environmental, political, social and technological pressures will guarantee further changes in the decades to come. This text substantially revises the earlier versions of the book in its treatment of issues surrounding the industry in .

The text itself is divided into two sections covering banking concepts and the current banking environment and key retail banking operations respectively.

considers what banking actually is and what banks do. Some key economic concepts that underpin much banking activity are discussed in both historical and modern-day contexts. Banking risks are examined as are some of the ways in which banks overcome or minimise the adverse impact of such risks. The section goes on to review the position of banks in the economy, their regulation by national and international bodies and looks at bank profitability from the perspective of bank annual accounts.

covers the key banking transactions, from the basic contract between the banker and customer via the different types of bank account and product offered to the use of payment systems (a necessary adjunct to intermediation). The section goes on to introduce the topic of lending, where some key credit risk tools are reviewed and applied and basic securities, a vital secondary repayment method if credit default occurs.

In both sections it is necessary to focus on particular examples of practice in their own national and regulatory environments. Often the differences in law, history and geography result in different banking responses to familiar questions and challenges. This text cannot promise to be an exhaustive review of all practice but uses specific examples to highlight generic principles and common responses to them. Often the default setting is UK and EU practice as much international law has been inherited by Imperial connections in former times.

Particular attention is drawn to the Further reading and web-links sections at the end of each chapter. The texts and links cited are widely available and often provide more detailed coverage, or specific examples, of the topics in the chapters themselves.

Whilst I have made every effort to ensure that the information contained in the text is accurate and up to date errors will remain and I take full responsibility for them. Feedback on the text is welcomed.

Keith Pond

Loughborough

January 2014

Disclaimer

Throughout the text reference is made to fictitious organisations including Countryside Bank plc and Riverside Bank Pte Limited. These organisations are pure inventions by the author and any resemblance to any organisation carrying these names or any similar names is purely coincidental.

Dedication

To Judy

First, last and always. My inspiration for everything I do.

Acknowledgements

I am grateful to the School of Business and Economics at Loughborough University for allowing re-publication of materials previously used in teaching at that institution.

The Retail Banking Environment

Objectives

After studying this chapter you should be able to:

Describe the environments within which retail banks operate in a number of countries.

Describe the environments within which retail banks operate in a number of countries.

Outline the key Political, Legal and Economic issues that impact on bank strategies.

Outline the key Political, Legal and Economic issues that impact on bank strategies.

Outline the key Social and Technological issues that help to frame trends in retail banking.

Outline the key Social and Technological issues that help to frame trends in retail banking.

Explain what this book is all about.

Explain what this book is all about.

Introduction

This opening chapter in analysis of retail banking, drawing together a number of themes from different countries around the world, most of which are to be expanded upon in later chapters.

Key drivers for change during the last 30 years have been regulation and technology. The focus in the immediate aftermath of the credit-crunch of 2007/08 is also regulation. To this analysis are added the areas of macroeconomics, competition and sociological features, including ethical and green issues.

Although the chapter reviews these areas and issues the picture is dynamic and what have been influential issues in the past may not be so in the future. In addition it should be noted that some issues are predictable and long-term in nature, such as population and demographic issues whilst others are less predictable and fast-moving, such as a bank failure. Many issues are complex and interrelated, defying categorisation in the PEST formula. In the EU it can be seen that a social issue, such as the ageing population and pensions crisis, can become a political issue and may result in new legislation or regulation. The political significance is clear, the social feeling intense and the economic impact vital to understand.

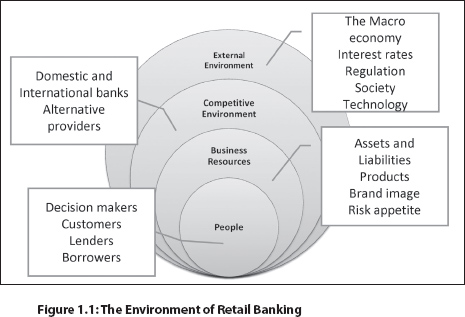

Overall, the analysis should set the scene for understanding how and why bank strategies shift in the medium and longer terms and where and how the retail banking features described in this book gain significance. However, retail banking should not be seen from the perspective of the banks alone. Retail banking is about people bank staff and customers, shareholders and pensioners, borrowers and lenders. provides a schematic diagram attempting to show that banks, and their people, are nested within a business framework that exists within a market that is influenced by external forces.

Font size:

Interval:

Bookmark:

Similar books «Retail banking.»

Look at similar books to Retail banking.. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Retail banking. and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.