The Black Book

of Alternative Investment Strategies

12 Little-known Ways to Invest Outside the Stock Market

Sean Erlenbeck & David S. Risi

Copyright 2014 by Investor Advisory Network, LLC

All rights reserved. No part of this book may be reproduced or used in any manner whatsoever, except in the case of brief quotations embodied in critical articles or reviews, without the express written permission of the Investor Advisory Network, LLC. For more information write to Investor Advisory Network, LLC, 14855 Van Dyke #444, Plainfield, IL 60544 or visit us at www.investoradvisorynetwork.com.

DISCLAIMER

This e-book is for informational purposes only, and is not intended as legal, accounting or investment advice. The information in this e-book is for your general use; it is not advice and should not be considered as such. It should not be taken as legal or investment advice or in the place of legal or investment advice. This publication and the accompanying materials are designed to provide general information in regard to the subject matter covered in it. It is provided with the understanding that the Investor Advisory Network, LLC is not engaged in rendering legal, accounting, investment or other professionals opinions. If legal advice or other expert assistance is required, the service of a competent, qualified professional should be sought. We do not represent, warrant, undertake or guarantee: that the information in this e-book is correct, accurate, complete or not misleading; that the use of the guidance in this e-book will lead to any particular outcome or result; or, in particular, that by using the guidance in the e-book you will increase your cash flow, profits or otherwise experience monetary gain. Investor Advisory Network, LLC will not be liable to you in respect of any losses arising out of any event or events beyond our reasonable control. We will not be liable to you in respect of any business losses, including, without limitation, loss of or damage to profits, income, revenue, use, production, anticipated savings, business, contracts, commercial opportunities or goodwill.

Reproduction or translation of any part of the information contained herein, in any form or by any means, without the written permission of Investor Advisory Network, LLC is unlawful.

Table of Contents

FOREWORD BY ROBERT A. WIEDEMER

Contributor: Robert A. Wiedemer, Managing Partner, Absolute Investment Management

CHAPTER 1: A NOTE FROM SEAN ERLENBECK

Sean Erlenbeck, Co-Founder, Investor Advisory Network

CHAPTER 2: A NOTE FROM DAVE RISI

Dave Risi, Co-Founder, Investment Advisory Network

CHAPTER 3: SELF-MANAGED IRA: TAKING CHARGE OF YOUR RETIREMENT

Contributor: Easy IRA Solutions

CHAPTER 4: STRUCTURED TO WIN: HOW TO MAKE MORE AND KEEP MORE OF YOUR INCOME FOR YOURSELF AND YOUR FAMILY TO ENJOY FOREVER

Contributor: Drew Miles, Esq., President, Pathfinder Business Strategies

CHAPTER 5: WHAT YOU NEED TO KNOW BEFORE INVESTING IN GOLD AND SILVER

Contributor: Doyle Shuler, Gold Silver Alliance

CHAPTER 6: INVESTING IN OIL & GAS: AMERICAS NEW GROWTH ENGINE

Contributor: Chris Faulkner, President & CEO, Breitling Energy Corporation

CHAPTER 7: RESERVE CAPITAL STRATEGY: THE #1 STRATEGY OF THE WEALTHIEST FAMILIES IN AMERICA

Contributor: Sean Briscombe, CLA, CMPS, Senior Consultant & Wealth Strategist, National Institute of Financial Education

CHAPTER 8: THE ASSET OF THE CENTURY

Contributor: Samuel T. Prentice, Barefoot Retirement

CHAPTER 9: INTRODUCTION TO FOREX TRADING

Contributor: Joshua A. Bevan, Managing Director, BlackBox Alpha

CHAPTER 10: THE MOBILE HOME PARK INDUSTRY AS AN INVESTMENT VEHICLE

Contributor: Frank Rolfe, Vice-President, MHP Funds

CHAPTER 11: INVESTING IN SELF STORAGE UNITS

Contributor: Scott Meyers, Owner & President, Alcatraz Storage

CHAPTER 12: THE POWER OF CASH FLOW INVESTING

Contributor: Jeremy Roll, Roll Investment Group & FIBI

Contributor: David Coe, Founder, Freedom Growth

CHAPTER 13: WEALTH THE RIGHT WAY

Contributors: JP Newman and Adrian Lufschanowski, Owners & Operators, Thrive, FP

CHAPTER 14: CREATE AND PROTECT WEALTH WITH REAL ESTATE

Contributor: Jeff Ballard

CHAPTER 15: NO MATTER WHAT IT TAKES STRATEGY FOR REAL ESTATE SUCCESS

Contributor: Peter Vekselman, Real Estate Investing Coach

Stocks will always go up over time. At least thats what just about every stockbroker and financial analyst will tell you. Ignore the valleys, because the peaks will always be higher.

It was good advicefor about 20 years. Between 1980 and 2000, picking stocks was easy. A broker could pick a portfolio of stocks by throwing darts and probably earn 10 to 15 percent returns every year. No wonder expert analysts rated 95 percent of stocks a buy. It was a great time to be a Wall Street broker.

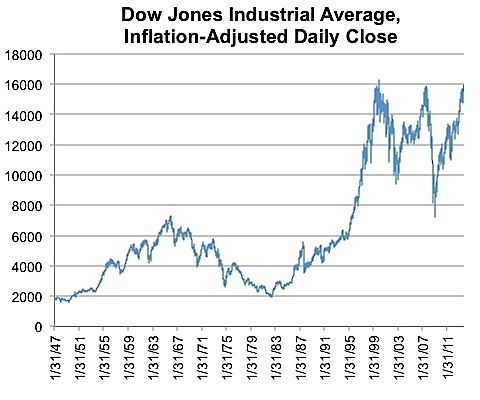

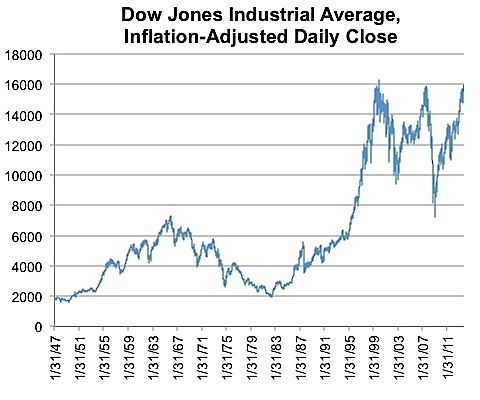

But consider this: when adjusted for inflation, the Dow in early 2014 is more or less where it was in 2000. In the last 14 years, stocks have essentially gone nowhere. In fact, if you look at the chart below, youll see thatwhen adjusted for inflationnearly all the growth in the stock market in the last 65 years came between 1980 and 2000. In the other 45 years, stocks have barely grown at all.

Still, you might argue, theres something to be said for keeping your money current - better for an investment to keep up with inflation than to be losing value. Thats true; but consider how precarious even the stock markets modest gains are. The U.S. Federal Reserve is currently pumping $75 billion dollars every month into the economy in order to boost activity in the stock market. Thats $900 billion a year. You would think with all that stimulus, the stock market would be soaring.

Stocks will always go up over time, we are told. But the 1980s and 90s were not normal. Adjusted for inflation, stocks have gone nowhere since 2000.

But thats because were still recovering from the 2008 financial crisis, you might say. First of all, the financial crisis was more than five years ago now. Arent you a little tired of waiting for this so-called recovery to make its way into your portfolio?

Secondly, and more importantly, back up a few years from the 2008 crash and what do you see? Another crash we had to recover from. That time it was the Internet bubble, the bubble no one saw coming until it was too late, the bubble that would never happen again. Sound familiar?

Now lets take a look at the facts on the ground in 2014. The Fed has created a massive dollar bubble, quadrupling the money supply in six years. The national debt is exploding, now over $17 trillion in early 2014 and still accumulating by more than a half-trillion dollars each year. The stock market appears to be increasingly divorced from reality, with nearly 30 percent price gains for the S&P 500 in 2013 in spite of single-digit earnings growth. Its easy to understand why there is growing concern that stock prices are reaching unsustainable levels, and that another crash might not be too far off.

You may share that concern and you may not. Either way, if my investment is only keeping pace with inflation over a 14-year period, I expect a lot less risk than that.

Wait a second. If stocks in general arent growing much, then the key is just to pick the right stocks, right? Well, yes and no. Its true that some stocks do better than others. Its great to invest in a Coca-Cola or McDonalds in the early days and watch it take off. However, when stock prices drop, they tend to drop across the board. If you have a diversified portfolio of stocksas most stock owners doyour portfolio will tend to go up and down with the stock market in general.

Next page