SUPER VOLATILITY

OPTION TRADING PROGRAM

Copyright James F. Coyle 2011

Founder and editor of the AUSTRALASIAN LATERAL THINKING NEWSLETTER.

Author BEYOND BELIEF;The Ultimate Mindpower Instruction Manual Amazon..com

Part of the james coyle mental magic series available on Amazon Kindle.

I developed my original volatility based option trading system some years ago and slowly refined it.

My methodology is based on market-maker inertia. I noticed early in the piece that market makers in general were not right on the ball and in many instances lagged behind the market. I considered this to be psychologically advantageousif I could figure a way to use it. And eventually I did exactly this! I based my options play on way-out-of-the-money contracts which were dead cheap. So I had little to lose but a lot to gainand this is exactly what happened.

The system worked brilliantly and better still it seemed that nobody anywhere had picked up on it. I even incorporated a form of insurance so that even if the market went the wrong way (and it sometimes did) I would lose very little. The options market can be financially dangerous for the inexperienced but with the low dollar outlays required for this volatility playing the risks are smaller. But be warned.they are still there!

The abbreviated initial method is shown below then I explain my super-volatility method.

VOLATILITY TRADING REPORT

Options are third dimensional..like a helicopter in flight. They have underlying price , time and volatility . Beginners generally do not hear about volatility until way down the track.

However, the options trader needs to understand volatility and appreciate its effects. No alert trader ever buys or sells an option without awareness of the current volatility scenario.

Many sophisticated options traders go beyond that, choosing to focus on volatility as the main aspect of their trading.

The essence of volatility based trading, or V-trading for short, is buying options when they are cheap and selling options when they are dear.

The volatility trader typically uses puts and calls in combination, selecting the most appropriate strikes, durations, and quantities, to construct a position that is said to be delta neutral. A delta neutral position has nearly zero exposure to small price changes in the underlying. Sometimes the trader has a directional opinion and deliberately biases his position in favor of the expected underlying trend. However, more often the V-trader is focused on making money just from volatility, and is not interested in trying to make money from underlying price changes.

Since options are extremely sensitive to volatility, trading options on the basis of volatility can be lucrative. Occasionally, options become way too expensive or way too cheap. In these situations the V-trader has a considerable edge.

Out-of-the-money options are preferable because it gives the underlying some room to wander, and increases the likelihood of realizing a profit. Generally, the farther out-of-the-money you go, the lower your returns, but the greater the probability of achieving those returns. By giving the underlying room to move, the trader minimizes his chances of having to make costly adjustments.

Volatility is basically the velocity with which a share jumps up or down.

A share which moves either sideways for a month or has very little price movement over the same period is said to have a low volatility.

At the other extreme a share which has a sudden quick movement (like NAB with the terrorist strike) is said to have a high volatility.

Obviously a vast profit can be made if you are lucky enough to own options when these massive price jumps occur.

For example if, when NAB was recently around $33, you bought a batch of $31 PUT options you would have made an excellent profit as this stock fell to around the $26 mark.

But the interesting thing here is that if you had bought way-out-of-the-money PUT options (say $28 ones) at around 10c each, you would have been able to cash them out at around $2 each, which would have shown you a massive 2000% profit.

The VOLATILITY TRADING PROGRAM I have researched enables you to make substantial profits no matter which way the market goesproviding it is highly volatile.

Take a look at the ANZ chart below. It shows a double peak at around the $16 mark. Just before it reached the second peak (indicated by the arrow) the $14 PUT option prices (with about 6 weeks to expiry)

Had a spread of 3-8 cents. (They are regarded as way-out-of-the-money).

So you could have bought a batch at 6 cents or thereabouts.

The prices were cheap because the share was still going up. PUTs were not the flavour-of-the-month, so to speak.

Now what happens when a couple of days later the share peaks and starts to drop in price?

The market-makers say to themselves uh-ohlooks like a downerbetter raise the price of those cheap options in case the price suddenly dumps and I lose money ..

And all of a suddenout of the blueyour 6 cent option becomes worth a nominal 12 cents.

Which is very strange, because the share might have moved down by only 40 cents or so.

The bottom line is that the market makers have suddenly suspected that the upward trending share is about to reverse and have taken moves to protect themselves against a loss.

What does this mean to you?

It means that you have made close to 100% profit even though the shares have hardly moved at all!

Now if you had bought at-the-money $16 PUTs your profit would have been less than 10%.probably more like 5% as the actual share price moved very little.

You are taking advantage of a strange psychological

situation which Ive called Market-Maker Inertia.

.........................................................................................................

The SUPER VOLATILITY

TRADING SYSTEM

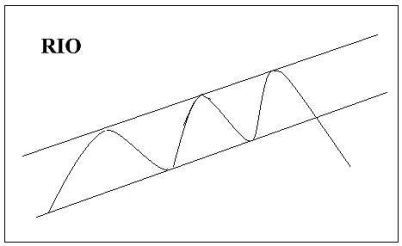

Before we delve into this new program take a look at the chart below:

(FIG 1)

It clearly shows a volatile upward trend with a "breakout" downwards recently.

Over the past 6 months I have researched volatile shares like RIO with a view to creating high level profits even if the share breaks out unpredictably !

In conjunction with my original Volatility Trading method I have come up with a solution that appears to produce winning (or at least no-loss) trades close to 90% of the time.

The original Volatility method made use of an "anomaly" in the market-makers psychology and this new method adds a unique perspective which capitalises on this anomaly by arranging trades in a manner that virtually wipes out losses.

The original method called for the investor to buy out-of-the-money options....sometimes as much as $3 dollars out. This meant that the cost of each option was measured in cents, rather than dollars as these way-out-of-the-money options can be incredibly cheap.

If the share moved even slightly in the required direction this way-out-of-the-money option often doubled in price (i.e. from 4c to 8c) as the market-makers suddenly "woke up". And if the share then climbed a dollar or more then the original 4 cent option suddenly became worth 20-25 cents, which is a massive percentage increase in price.