Irving Fisher - The Money Illusion

Here you can read online Irving Fisher - The Money Illusion full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2009, publisher: www.snowballpublishing.com, genre: Science. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

- Book:The Money Illusion

- Author:

- Publisher:www.snowballpublishing.com

- Genre:

- Year:2009

- Rating:5 / 5

- Favourites:Add to favourites

- Your mark:

- 100

- 1

- 2

- 3

- 4

- 5

The Money Illusion: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "The Money Illusion" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

The Money Illusion — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "The Money Illusion" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

CHAPTER I A GLANCE AT THE MONEY ILLUSION

INTRODUCTION

S I write, your dollar is worth about 70

cents. This means 70 cents of pre-war buying power. In other words 70 cents would buy as much of all commodities in 1913 as 100 cents will buy at present. Your dollar now is not the dollar you knew before the War. The dollar seems always to be the same but it is always changing. It is unstable. So are the British pound, the French franc, the Italian lira, the German mark, and every other unit of money. Important problems grow out of this great fact that units of money are not stable in buying power.

A new interest in these problems has been aroused by the recent upheavals in prices caused by the World War. This interest, nevertheless, is still confined largely to a few special students of economic conditions, while the general public scarcely yet know that such questions exist.

A

Why this oversight? Why is it that we have been so slow to take up these fundamental problems which are of vital concern to all people? It is because of the "Money Illusion"; that is, the failure to perceive that the dollar, or any other unit of money, expands or shrinks in value. We simply take it for granted that "a dollar is a dollar"that "a franc is a franc," that all money is stable, just as centuries ago, before Copernicus, people took it for granted that this earth was stationary, that there was really such a fact as a sunrise or a sunset. We know now that sunrise and sunset are illusions produced by the rotation of the earth around its axis, and yet we still speak of, and even think of, the sun as rising and setting!

We need a somewhat similar change of ideas in thinking about money. Instead of thinking of a "high cost of living" as a rise in price of many separate commodities which simply happen, by coincidence, to rise at the same time, we shall find instead that it is really the dollar, or other money unit, which varies.

THE MONEY ILLUSION WITHIN YOUR COUNTRY

Almost every one is subject to the "Money Illusion" in respect to his own country's currency. This seems to him to be stationary while the money of other countries seems to change. It may seem strange but it is true that we see the rise or fall of foreign money better than we see that of our own.

For instance, after the War, we in America knew that the German mark had fallen, but very few Germans knew it. This was certainly true up to 1922 when with another economist (Professor Frederick W. Roman) I studied price changes in Europe. On my way to Germany I stopped in London and consulted with Lord D'Abernon, then British Ambassador to Germany. He said: "Professor Fisher, you will find that very few Germans think of the mark as having fallen." I said: "That seems incredible. Every schoolboy in the United States knows it." But I found he was right. The Germans thought of commodities as rising and thought of the American gold dollar as rising. They thought we had somehow cornered the gold of the world and were charging an outrageous price for it. But to them the mark was all the time the same mark. They lived and breathed and had their being in an atmosphere of marks, just as we in America live and breathe and have our being in an atmosphere of dollars. Professor

Roman and I talked at length with twenty-four men and women whom we met by chance in our travels in Germany. Among these only one had any idea that the mark had changed.

Of course, all the others knew that prices had risen, but it never occurred to them that this rise had anything to do with the mark. They tried to explain it by the "supply and demand" of other goods; by the blockade; by the destruction wrought by the War; by the American hoard of gold; by all manner of other things, exactly as in America when, a few years ago, we ourselves talked about the "high cost of living," we seldom heard anybody say that a change in the dollar had anything to do with it.

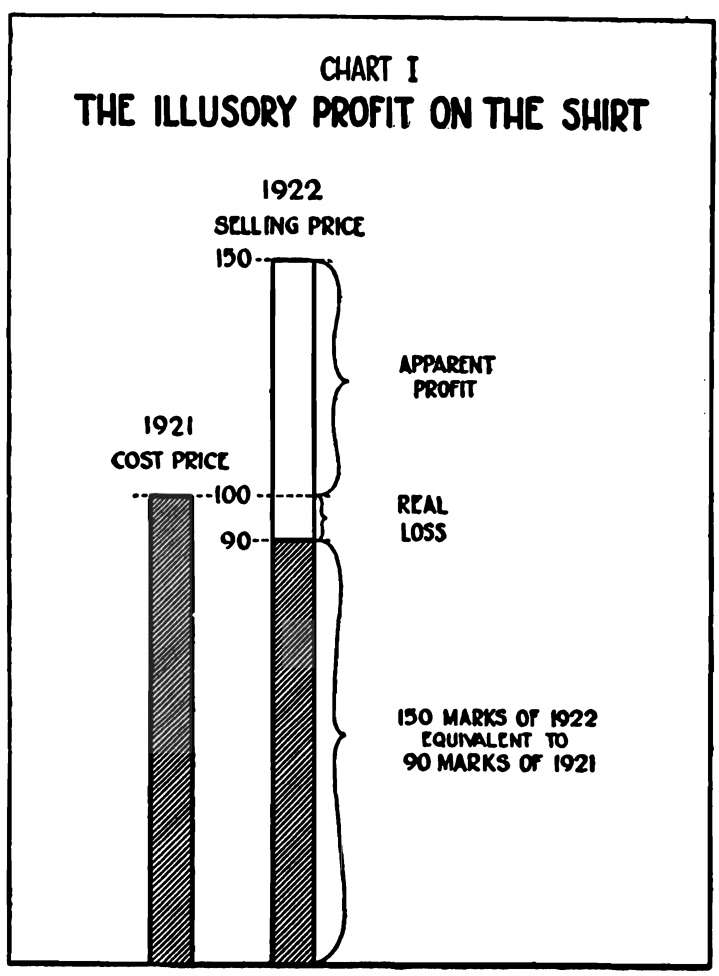

I remember particularly a long talk with one very intelligent German woman who kept a shop in the outskirts of Berlin. She gave all kinds of trivial reasons for the high prices. iThere was a grain of truth in some of them, just as there is a grain of truth in the idea that a small part of the seeming motion of the stars is real. But the main fact of the tremendous increase in the volume of "marks" and of the action of this paper money inflation on prices was not even glimpsed by the German shop woman. For eight years she had been victimized by the changing mark but had never once suspected the true causeinflation. When I talked with her the inflation had gone on until the mark had depreciated by more than ninety-eight per cent, so that it was only a fiftieth of its original value (that is, the price level had risen about fifty fold), and yet she had not been aware of what had really happened. Fearing to be thought a profiteer, she said: "That shirt I sold you will cost me just as much to replace as I am charging you." Before I could ask her why, then, she sold it at so low a price, she continued: "But I have made a profit on that shirt because I bought

She had made no profit; she had made a loss. She thought she had made a profit only because she was deceived by the "Money Illusion." She had assumed that the marks she had paid for the shirt a year ago were the same sort of marks as the marks I was paying her, just as, in America, we assume that the dollar is the same at one time as another. She had kept her accounts in what was in reality a fluctuating unit, the mark. In terms of this changing unit her accounts did indeed show a profit; but if she had translated her accounts into dollars, they would have shown a large loss, and if she had translated them into units of commodities in general she would have shown a still larger lossbecause the dollar, too, had fallen.

Chart I shows her apparent gain and actual loss.

We found the same complacent assumption of stability in other countries. Austrians, Italians, French, English,all peoples assumed that their own respective moneys had not fallen in value, but that goods had risen.

WHEN TWO COUNTRIES COMPARE NOTES

It follows, of course, that when people from different countries with different moneys compare notes they find that their ideas are in conflict. This is well illustrated by the case of an American woman who owed money on a mortgage in Germany. The World War came and she had no communication with Germany for two years. After the War she visited Germany, intending to pay the mortgage. She had always thought of it as a debt of $7,000. It was legally a debt of 28,000 marks, in terms of German money. She went to the banker who had the matter in charge and said: "I want to pay that mortgage of $7,000." He replied: "The amount isn't $7,000; it is 28,000 marks; that sum today

a glance at money illusion

is about $250." She said: "Oh! I am not going to take advantage of the fall of the mark. I insist upon paying the $7,000." The banker could not see the point; he showed that legally this was not necessary and he could not understand her scruples. As a matter of fact, however, she herself failed to take account of a corresponding, though lesser, change in the dollar. She was thinking in terms of American dollars, just as the banker was thinking in terms of German marks. She insisted on paying $7,000 instead of paying $250, but she would have rebelled if she had been told that the dollar also had fallen, that the equivalent in buying power of the original debt was not $7,000, but $12,000, and that she ought, therefore, to pay $12,000! Then she would not have seen the point!

THE MONEY ILLUSION IN AMERICA

Thus, we Americans are no exception in regard to the "Money Illusion." An American is quite lost if he tries to think of the dollar as varying. He cannot easily think of anything by which to measure it. Even with our gold standard we have a dollar fluctuating in buying power. Yet we think of the dollar as fixed. It is fixed only in the sense that it is redeemable in a fixed number of grains of gold. It is not fixed in the amount of goods and benefits it can command.

Next pageFont size:

Interval:

Bookmark:

Similar books «The Money Illusion»

Look at similar books to The Money Illusion. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book The Money Illusion and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.