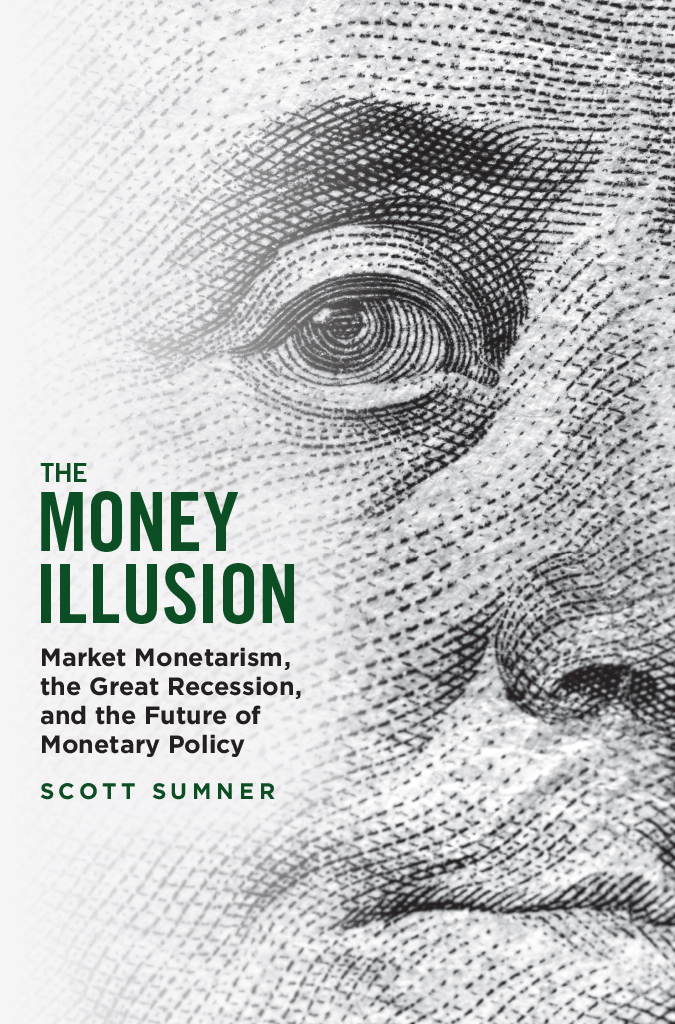

The Money Illusion

The Money Illusion

Market Monetarism, the Great Recession, and the Future of Monetary Policy

SCOTT SUMNER

THE UNIVERSITY OF CHICAGO PRESS

CHICAGO AND LONDON

The University of Chicago Press, Chicago 60637

The University of Chicago Press, Ltd., London

2021 by The University of Chicago

All rights reserved. No part of this book may be used or reproduced in any manner whatsoever without written permission, except in the case of brief quotations in critical articles and reviews. For more information, contact the University of Chicago Press, 1427 E. 60th St., Chicago, IL 60637.

Published 2021

Printed in the United States of America

30 29 28 27 26 25 24 23 22 21 1 2 3 4 5

ISBN -13: 978-0-226-77368-1 (cloth)

ISBN -13: 978-0-226-77371-1 (e-book)

DOI : https://doi.org/10.7208/chicago/9780226773711.001.0001

Library of Congress Cataloging-in-Publication Data

Names: Sumner, Scott, 1955 author.

Title: The money illusion : market monetarism, the Great Recession, and the future of monetary policy / Scott Sumner.

Description: Chicago : University of Chicago Press, 2021. | Includes bibliographical references and index.

Identifiers: LCCN 2020056573 | ISBN 9780226773681 (cloth) | ISBN 9780226773711 (e-book)

Subjects: LCSH : Monetary policyUnited States. | RecessionsEffect of monetary policy onUnited States.

Classification: LCC HG 540. S 94 2021 | DDC 339.5/30973dc23

LC record available at https://lccn.loc.gov/2020056573

This paper meets the requirements of ANSI/NISO Z 39.48-1992 (Permanence of Paper).

This paper meets the requirements of ANSI/NISO Z 39.48-1992 (Permanence of Paper).

Contents

During the 1930s, 1940s, and 1950s, most economists believed that the Great Depression had been caused by financial distress and that monetary policy had been expansionary but largely ineffective. In the 1960s, research by Milton Friedman and Anna Schwartz convinced the profession that monetary policy during the early 1930s had actually been contractionary, and that this had been a major cause of both the Depression and the banking crisis. Further research (including some of my own) established that the monetary failure had been global in nature and linked to flaws in the international gold standard.

When the Great Recession of 20082009 hit the global economy, I immediately noticed that many pundits were once again misdiagnosing the crisis, in ways eerily similar to the original (mistaken) view of the Great Depression. By this time, I had already spent several decades studying and teaching monetary economics. My research had focused on a number of topics with particular relevance to understanding the ongoing crisis, including the Great Depression, the Japanese liquidity trap of the late 1990s, and various proposals for reforming monetary policy. This gave me a unique vantage point in terms of seeing what others had missed.

In some respects, I was an unlikely contrarian, as before 2008, my views were not out of the mainstream. Indeed, for nearly a quarter century I had been reasonably satisfied with Federal Reserve policy. After Lehman Brothers failed, however, I realized that monetary policy had suddenly become much too tight, and I began trying to convince my fellow economists of the need for a much more expansionary policy. More importantly, I tried to show that the conventional wisdom was wrong. It wasnt just that policy had drifted off course in 2008economists as a profession were thinking about the entire issue in the wrong way.

In early 2009, these convictions pushed me to start a blog called TheMoneyIllusiona move that ended up reshaping my career. By 2010, I and several bloggers who shared a similar outlook had coalesced into a school of thought dubbed market monetarism, which focused on the need to provide stable growth in nominal gross domestic product. These writers included David Beckworth, Nick Rowe, David Glasner, Marcus Nunes, and Lars Christensen, among others. The mainstream media started paying more attention to our ideas, and people I met began asking me to recommend books with market-monetarist ideas. Unfortunately, I wasnt able to cite a book that provided the sort of comprehensive treatment of market monetarism that Friedman and Schwartz had provided for the earlier versions of monetarism.

One can think of Friedman and Schwartzs A Monetary History of the United States as a treatise on monetarist ideas, a revisionist explanation of the Great Depression, and a rationale for monetarist policy recommendations, all in one big book. In this book, The Money Illusion, I intend to provide a treatise on market-monetarist ideas, a revisionist explanation of the Great Recession, and a defense of market-monetarist policy recommendations.

Lots of people have contrarian views about current events. So why should you read this alternative account of the Great Recession? The best answer I can give is to point to the surprising number of instances when recent events played out in a way that supports market monetarism. Here are just a few:

- When I complained in late 2008 that money was too tight, almost no one else was making that claim. Today that view is widely held, and even former chair of the Federal Reserve Ben Bernanke admitted (in his memoir) that the Fed erred in not cutting rates after Lehman Brothers failed.

- When I suggested in early 2009 that Fed policy could be much more expansionary, most observers were skeptical. When the Fed eventually tried unconventional stimulus such as quantitative easing (even if this response was still inadequate), the United States performed much better than the eurozone, which did not try such policies until much later.

- When I proposed that banks adopt negative interest rates for bank reserves in January 2009, the idea was widely viewed as impractical. Today, many important central banks have adopted negative interest rates on bank reserves.

- After I suggested in late 2012 that monetary offset would prevent fiscal austerity in the US from having the contractionary impact that was widely predicted, prominent economists dismissed my argument. My view, though, turned out to be correct: growth picked up in 2013. The consensus view was wrong.

- In early 2009, I advocated nominal-GDP-level targeting. In subsequent years, many of the top macroeconomists in America endorsed this policy. Christina Romer, who had been head of the Council of Economic Advisers under President Obama, cited my research as providing the logic behind nominal GDP targeting in her New York Times piece endorsing the concept.

- An important component of market monetarism is the idea that Fed policy should be guided by market forecasts, not by the Feds complex mathematical models of the economy. By 2019, it was clear that Fed policy is increasingly guided by market forecasts, because the Feds internal models have proved unreliable.

These examples dont prove that market monetarists are right about everything. But surely the fact that so many of our claims have become increasingly accepted among respected macroeconomists is reason enough to take the ideas seriously. I hope this book provides readers with a better understanding both of what market monetarism is all about and of why we hold such unconventional views about what went wrong during the Great Recession.

This book has two primary goals. One goal is to provide an explanation of basic monetary theory and of the specific perspective called market monetarism. Fulfilling this goal occupies roughly the first half of the book, which includes some technical material at the level of undergraduate economics students. The second goal (addressed in the second half of this book) is to apply these ideas to the Great Recession, which provides an alternative narrative that I believe is superior to the conventional explanation. This narrative makes it easier to see what is distinctive about the market-monetarist approach.

Next page

This paper meets the requirements of ANSI/NISO Z 39.48-1992 (Permanence of Paper).

This paper meets the requirements of ANSI/NISO Z 39.48-1992 (Permanence of Paper).