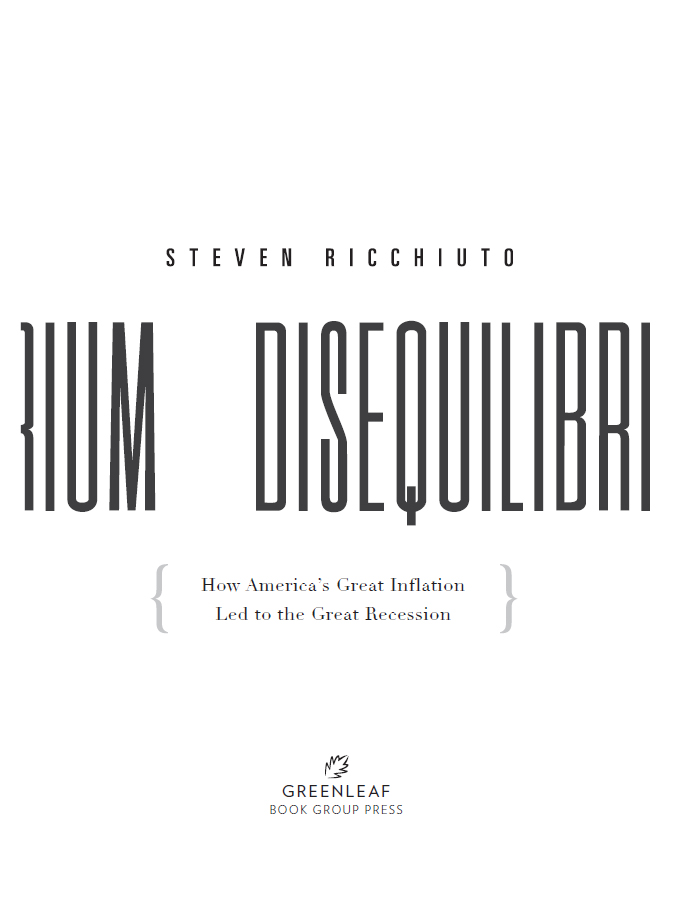

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered It is sold with the understanding that the publisher and author are not engaged in rendering professional services If expert assistance is required, the services of a competent professional should be sought.

Published by Greenleaf Book Group Press

Austin, Texas

www.gbgpress.com

Copyright 2016 Mizuho Securities USA Inc

All rights reserved.

No part of this book may be reproduced, stored in a retrieval system, or transmitted by any means, electronic, mechanical, photocopying, recording, or otherwise, without written permission from the copyright holder.

Distributed by Greenleaf Book Group

For ordering information or special discounts for bulk purchases, please contact Greenleaf Book Group at PO Box 91869, Austin, TX 78709, 512.891.6100.

Design and composition by Greenleaf Book Group

Cover design by Greenleaf Book Group

Cataloging-in-Publication data is available.

Print ISBN: 978-1-62634-396-2

eBook ISBN: 978-1-62634-397-9

Part of the Tree Neutral program, which offsets the number of trees consumed in the production and printing of this book by taking proactive steps, such as planting trees in direct proportion to the number of trees used: www.treeneutral.com

Printed in the United States of America on acid-free paper

16 17 18 19 20 21 10 9 8 7 6 5 4 3 2 1

First Edition

Contents

Preface

The pattern of macroeconomic developments traced out in this book suggests that the world of excess demand that modern macroeconomics is based on no longer exists. Instead, a world of excess supply is the norm, suggesting that many of the macro conceptslike a natural rate of unemployment or an internal speed limit imposed on the domestic economy are no longer viable. Essentially, this interpretation of the postwar developments suggests that a radical rethink of the levers used by policy makers to influence the economy is already long overdue.

How did we get here? That is the question I kept asking myself as the US economy powered through the long 1991 2001 expansion. Despite a series of exogenous events that were broadly expected to tip the economy into recession, the economy was able to keep pace. In fact, it kept on goingsteadily, very much like the Energizer Bunny in the television commercials. The Russian Debacle, the Tequila Crisis, and even the failure of long-term capital management are the key events from this period that were expected to lead to a recession, but they did not. This led me to question why some shocks matter and some do not.

At the time, I was involved with building an investment-grade research department at the securities firm where I was employed. This meant I had to figure out what these credit analysts really did. Back then I tended to be a bit of a quant; I have since realized the limitations of that discipline.

As I learned about credit analysis, however, it became apparent to me that exogenous shockslike the Russian Debaclematter only when the flow of liquidity dries up in their wake; and this happens only when balance sheets are stretched. In other words, what looks like a calamitous event becomes calamitous only if businesses or consumers stop spending moneyand they dont stop unless their access to funding has been restricted.

This assessment seemed to contradict the general description of how business cycles evolve. The textbook story is that the economy gets overheated, and, as a result, inflation begins to rise. The Fed reacts to the upward pressure on inflation by tightening reserve market conditionsi.e., raising short ratesand the economy slows. A slower economy leads to lower inflation, allowing the Fed to reverse gears, and the whole process starts over again.

The 10-year expansion of the 1990s may have been triggered by the Fed, and yet the recovery that followed was anything but typical. The 2001 recession was the result of a forced corporate-sector balance sheet restructuring. That is when it became apparent that there were two fundamental changes that had coalesced to change the very nature of the business cycle. First, the Reagan supply-side revolution had finally kicked in with the help of Al Gores Internet; and, as a result, the economy was shifting from being driven by excess demand to excess supply.

The dampening of inflation that followed meant that the business cycle could now last long enough that balance sheets could deteriorate and determine when a recession was possible. In retrospect, this changed dynamic had been evident in the 19911993 period as well. But because the credit problems were concentrated in the thrift industry, it had the look and feel of a more traditional cycleeven though it was actually the first of three credit cycles in the postwar period.

The following is not a rigorous economic analysis of the new macro dynamic facing the domestic and global economies. We have not built a model of the economy showing the channels through which the transition to excess supply came about. Rather, it is the observation of someone who has worked in the financial services industry since 1980, and it is presented as a straightforward assessment of the key events that led to the transition from excess demand and inflation cycles to excess supply and credit cycles. Essentially this is the story of the transition from one disequilibriumexcess demandto another disequilibriumexcess supply.

Along the way, I will also present a simple method for assessing macroeconomic credit quality, along with some suggestions as to how policymakers should alter their behavior in order to better handle new macro dynamics, and what trends to consider to determine whether the economy is beginning to swing back from excess supply. I also make no claim to the originality of anything other than putting the events of the past 3040 years into perspective; this new assessment is truly my own.

Section 1

The Financial Crisis of 20072009 Reflects a Bigger Fundamental Imbalance

Introduction

Volumes have been written about the financial crisisthe collapse of Lehman Brothers, the governments bailout of AIG and the auto industry, the failure of the Government-Sponsored Enterprises (GSEs), and a number of other domestic financial institutions caught in the grip of a recent economic catharsis. Most of the published analyses tend to deal with either the adverse direct consequences of the crisis or the regulatory failure that allowed the problems to develop in the first place. The social consequences of the crises seem to have received the majority of the media attention. The press focused primarily on the decline in home prices, household wealth, and the resulting rise in structural unemployment in both the construction industry and in the overall economy.

The economic community has also analyzed the social consequences of the crisis, but most studies have tended to look into the effects on bank lending, the linkage between the contraction in credit and the nature of the downturn, and the recovery. Although it is understandable why the analysis of the crisis has gone in this direction, I am afraid people may be missing the forest for the trees. Whats lackingthe big-picture forest, in this caseis the fundamental shift in the economy from excess demand to excess supply and from inflation to credit cycles. Moreover, the perceived regulatory failure that led to the crisis resulted in the DoddFrank legislation, which is in the process of fundamentally altering the way banks and the financial services industry will function for years to come. The so-called Volcker Rule restrictions on investment banking and the SECs decision to change the rules governing the net asset value of institutional prime money market mutual funds are additional examples of the regulatory response to the financial crisis, and volumes have been and will continue to be written on these topics.

Next page