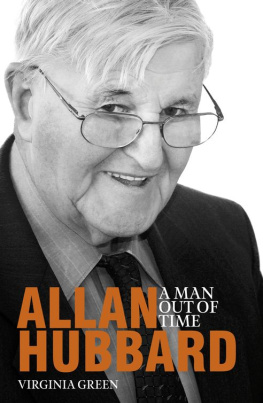

When I was approached by Chris Lee to write the foreword to this book on the South Canterbury Finance Ltd scandal, I was both humbled and flattered. The Billion Dollar Bonfire gives an insight into the facts surrounding the collapse of South Canterbury Finance Ltd and its associated private equity funds and also the thinking and activities of its principal, Allan Hubbard. It encompasses the New Zealand financial markets from the 1970s until now, Chriss own story and, importantly, the various business activities of South Canterbury Finance Ltd and its associates and the actions of its directors and key management, all of which ultimately led to the demise of this once-grand company.

I have been involved in the financial markets for fifty years, was a former shareholder and director of one of New Zealands largest stockbroking firms and was instrumental in establishing the Market Surveillance Panel of the New Zealand Stock Exchange. Indeed, I served as a member of that panel for a period of some nine years, including a stint as deputy chairman.

More significantly, I was a shareholder and chairman of the Timaru-based finance company Mascot Finance Limited. This company was the first to call on the Crown guarantee in 2009, which, at that time, was the subject of some controversy. In defence of Mascots receivership, it should be noted that the receivers recouped 92 cents in the dollar, a satisfactory outcome when compared to amounts subsequently recovered from other finance companies that called on the Crown guarantee. Being based in Timaru and operating under the shadow of South Canterbury Finance Ltd, we were, in effect, mice under the giants table and survived well on the crumbs that fell from that table.

When Chris intimated to me that it was his intention to stand back from his very successful business for a period of up to a year to write this book, and to provide the funding to complete the necessary in-depth research, I had nothing but admiration for him but was doubtful as to whether or not he would succeed. Needless to say, I underestimated his drive and tenacity.

Given the complexity of the South Canterbury Finance Ltd saga, I think he has succeeded in recording and bringing to the forefront highly questionable practices that cost the New Zealand taxpayer in excess of a billion dollars. The imposition of this cost on the taxpayer has not been subjected to independent scrutiny by, for example, a commission of inquiry.

Having had the benefit of reading the draft manuscript, the only matter that still puzzles me is the purported bailout offer to purchase, allegedly made by Duncan Saville and his interests, and the role played by the then government in the rejection of it. While certain details are covered in the book, Treasurys steadfast refusal to accede to any request for information on this matter under the Official Information Act remains mystifying.

Over the years I had a number of dealings with Allan Hubbard, all of which were completed to the satisfaction of those involved, and while the way in which Allan sometimes operated may not have been orthodox, I was of the opinion that he was not a fraudster. The details set out in this book reaffirm that view. That is not to say that he was not party to wrongdoing or questionable financial practices.

The publication of The Billion Dollar Bonfire will doubtless cause some controversy and embarrassment amongst participants in the financial markets, certain former leading politicians who were involved, the supporters of Allan Hubbard and the investors in South Canterbury Finance Ltd and its associates. The public have a right to know what happened and what caused this sorry chain of events. This book is not only an honest attempt to outline what happened but also puts forward Chris Lees views of what needs to be done to avert similar situations in the future.

I would like to congratulate Chris on bringing together a complex story based on meticulous research.

Brian Kreft

Retired Investment Banker

Wanaka

Allan Hubbard lost a fortune and taxpayers paid the bill. Timarus reclusive moneyman still troubles the national memory, years after his death. His recklessness cost hundreds of millions, yet many people think of him as a kind of saint. He gave perhaps $200 million to charity and to Christian causes while gambling with other peoples money. Many lost most of their savings when his finance company, South Canterbury Finance (SCF), failed.

Now his story can be told for the first time in full and from the inside. I knew Hubbard for thirty years, both as a fellow financier and later as a friend. I met him in Timaru in about 1980 while I was working at General Finance, whose original company, Valley Finance, had jump-started Hubbards success. We maintained our working association after I formed my financial advisory company, Chris Lee and Partners Ltd, and developed a friendship which I valued, even after I finally and far too late saw through his veneer. Until his death we spoke regularly, sometimes handwrote letters to each other, and occasionally met for breakfast or dinner in Timaru. Often he forwarded to me internal SCF papers, for my observation and sometimes comment.

Hubbards story is complex and confused, partly because of the mans own contradictions. I had listened to his recollections and I knew that the tales of philanthropy were true. I also thought for quite a while that his businesses were sound. I recommended South Canterbury Finance to the clients of my company. It was only in late 2009 that I began to discover that Hubbards company was really a quasi-Ponzi scheme supported by the state. It slowly became clear to me just how Hubbards business virtues turned into vices, and how his unusual strengths of character could in different circumstances become tragic flaws. I started out as an admirer and ended as a critic. This book explains why I changed my mind. Hubbards catastrophic errors surfaced during the global financial crisis, which in 2008 threatened a meltdown of the worlds financial system and of New Zealands with it. The crisis prompted the New Zealand government in October 2008 to guarantee peoples financial deposits promising, in effect, to repay anyone who lost money if a bank or finance company went bust.

New Zealand had been forced into the deposit guarantee scheme by Australia. In 2008 people throughout the world had lost confidence in banks and finance companies. The banks no longer trusted each other. Their customers were beginning to smell the fear. In early October Australia indicated that it would guarantee all bank deposits, a decision that put New Zealand on the spot. If it didnt guarantee New Zealand banks and finance companies, Kiwis would take their money across the Tasman.

The Labour government, four weeks away from defeat by National, had to act quickly. When the Australian government unveiled its guarantee scheme on Sunday 12 October, New Zealand promptly announced a similar scheme here. It had basically been designed that day, according to a later report by Auditor-General Lyn Provost. Officials had thrown together a scheme which brought a massive and unprecedented change to the finance system.

The Opposition backed the scheme. Cullen had told National leader John Key and shadow finance spokesman Bill English what the Labour government was going to do, and they had agreed. Without the deposit guarantee scheme, Key said in August 2010, there would have been a run on these New Zealand financial institutions, and they would have gone broke. Key would sometimes in the heat of battle blame the later troubles on Labours scheme. But it was Nationals too.

It had always been recognised that the guarantee was dangerous, providing a kind of get out of jail free card for reckless moneylenders. Because their funds were safe from panic withdrawals by investors, entrepreneurs felt freer to take risks and seek adventure. Since investors funding was reliably available, the financier could gamble. And this, as it transpired, was what Hubbard and South Canterbury Finance elected to do.