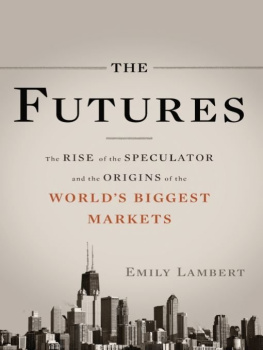

Leo Melamed is a successful speculator and a recognized scholar, a far-out visionary and a down-to-earth realist, a skilled performer in Yiddish, dedicated to preserving that dying language, and an author of science fiction, a mover and a shaker, who has had a major influence on both private institutions and public policy.

He had the independence of mind and foresight to envisage the need for a public market in foreign currency futures, the imagination to invent a mechanism to make such a market feasible, and the courage and leadership ability to persuade his colleagues at the Chicago Mercantile Exchange to establish the International Monetary Market.

Foreword

Keynote address by

Christopher Giancarlo

Chairman of the Commodity Futures Trading Commission (CFTC), the US federal regulator of futures and derivatives, before the Futures Industry Association (FIA), Annual Conference, in Boca Raton, Florida, March 14, 2018.

G ood morning. It is great to be here at FIAs 43rd International Futures Industry Conference. It is certainly the one annual event that brings together all participants in the global derivatives markets.

So, I am delighted to have this opportunity to speak to all of you about our work at the CFTC. Thank you for your attendance.

There is a comment attributed to Isaac Newton. He said that, if he saw farther than others, it was because he stood on the shoulders of giants.

Today, I cant help but think of one of the giants of the derivatives industry: Leo Melamed. We all see farther because of Leo. Many of you know Leo. Some of his colleagues and friends are here today. We have all, directly or indirectly, been influenced by him.

Leo is the Chairman Emeritus of the CME Group and one of the central figures in American commerce and trade. He has just announced his retirement. In the world of derivatives, he has been a leader who shaped and guided our thinking. In electronic commerce, he actually took us into a new world. He is often called the father of financial futures.

Leo Melameds vision, brilliance, and accomplishment have spread out from Chicago to include the entire world, a world that began for him with harsh clarity through escaping with his family from Nazi-invaded Poland. Then, the stuff of legend: crossing wartime Siberia by railroad and then by boat to Japan, crossing the Pacific by ship only months before Pearl Harbor. He and his family eventually found safety in America. From there, he stumbled into the world of finance by mistake, yet by pluck and hard work, he thrived and conceived great innovations in trade and commerce. He founded and chaired the NFA from 1982 through 1989, and provided direction and guidance of the Chicago Merc as it grew into one of the great institutions of American finance.

Leo has been a grand figure striding the worlds financial landscape. A consummate professional, a creative visionary. And, what I admire most: a fearless believer in the promise of tomorrow.

Leo dared to define his own future, not have it defined for him. When he started out in Chicago seventy years ago, he found markets that were small, commodity based, and domestic. He leaves markets that are enormous, diversified and international. And, we are here todaystanding on Leos shouldersparticipating in global derivatives markets that are legacy of a man who was not afraid to envision a brighter and more prosperous future. I dedicate my remarks today to Leo Melamed.

Christopher Giancarlo

March 14, 2019

Boca Raton, Florida

Authors Brag

T he phenomenal success of financial futures exemplified the power of an idea whose time had come. The financial revolution I describe blazed the trail for much of what has since followed in world capital markets. It established that there was a need for a new genre of risk management instruments responsive to investment applications and modern telecommunications. It led to the acceptance and integration of futures and options within the infrastructure of the financial establishment. It became the catalyst for the development of financial futures and derivatives worldwide. And, according to Nobel laureate Merton Miller, it introduced the modern era of finance.

In time, I became a singular voice with the foresight to recognize the gargantuan force of coming technology, as well as its ability to trample everything standing in its way. As I courageously told members in 1987:

Anyone who has not seen the handwriting on the wall is blind to the reality of our times. One can no more deny the fact that technology has and will continue to engulf every aspect of financial markets than one can restrict the use of futures in the management of risk. The markets of the future will be automated. The traders of the future will trade by way of the screen. Those who dare to ignore this reality face extinction.

I took it upon myself to revolutionize the 1,000-year-old open outcry transaction process and replace it with the magic of Globexthe CMEs electronic transaction system.

What I did not set out to do was to make gobs of money. Dont get me wrong. As a trader I always wanted to make winning trades, but that was never the priority in my life. In first place was the drive to leave a mark, to make a difference, to deserve a word or two in history. The Chicago Mercantile Exchange (CME), once the Butter and Egg Board and later the house that pork bellies built, is today known as the house that innovation builtor, as most would say, the house that Leo built. As in most great endeavors, it must be underscored that without the countless devoted and talented people at my side, to whom I am eternally grateful and who I name wherever possible, this result could not have been achieved.

Needless to say, financial derivatives and futures also come with attendant risks and dangers. They are highly sophisticated tools. If used for illicit purposes, or applied in a negligent manner, they can become a causal factor for disastrous results, as the financial breakdown of 2008 demonstrated. Nevertheless, their successful application and efficiency continue to give them an indispensable role in todays trading and risk-management ecosystem.

I confess that some of the recollections in this book have been described in my other books: Leo Melamed on the Markets , Escape to the Futures , and For Crying Out Loud . Why, then, write another book? The answer is simple. My previous memoirs were published in 1996. It was far too early to provide an in-depth assessment of what I had accomplished. So much has happened to markets since then that my achievements take on a much deeper understanding from the perspective of history.

Additionally, Man of the Futures contains a host of events and episodes that I have never shared before. It also is companion to a unique set of photographs taken over the span of five decades. Man of the Futures affords me the chance to delve deeper into past events and assess everything with the benefit of hindsight. In this manner, it represents a rare opportunity to evaluate my original rationale, examine my prognostications and offer a peak into the future.

Sam and I are friends. The fact we both ended up in Chicago is a rare coincidence. Although Sam was born in the US and I in Poland, Chicago was the resting stop for our respective parents, who separately escaped from Poland at the outset of the second world war, they from Sosnowiec, us from Bialystok. Both sets of parents followed the same escape route from Vilnius, Lithuania with a transit visa from one of the worlds righteousJapanese counsel general to Lithuania, Chiune Sugihara. Sam once wrote that as a result of that miraculous escape, he grew up believing that anything is possible.