Table of Contents

THE PENGUIN PRESS

Published by the Penguin Group

Penguin Group (USA) Inc., 375 Hudson Street, New York, New York 10014, U.S.A. Penguin Group (Canada),

90 Eglinton Avenue East, Suite 700, Toronto, Ontario, Canada M4P 2Y3 (a division of Pearson Penguin Canada

Inc.) Penguin Books Ltd, 80 Strand, London WC2R 0RL, England Penguin Ireland, 25 St. Stephens Green,

Dublin 2, Ireland (a division of Penguin Books Ltd) Penguin Books Australia Ltd, 250 Camberwell Road,

Camberwell, Victoria 3124, Australia (a division of Pearson Australia Group Pty Ltd) Penguin Books India Pvt

Ltd, 11 Community Centre, Panchsheel Park, New Delhi - 110 017, India Penguin Group (NZ), 67 Apollo Drive,

Rosedale, North Shore 0632, New Zealand (a division of Pearson New Zealand Ltd) Penguin Books (South

Africa) (Pty) Ltd, 24 Sturdee Avenue, Rosebank, Johannesburg 2196, South Africa

Penguin Books Ltd, Registered Offices: 80 Strand, London WC2R 0RL, England

First published in 2009 by The Penguin Press, a member of Penguin Group (USA) Inc.

Copyright Liaquat Ahamed, 2009

All rights reserved

Photograph credits

Page xii: J. Gaiger/Hulton Archive/Getty Images; pp. 34, 46, and 154: Bettmann/Corbis; p. 62: Banque de France

Anonyme; pp. 242 and 290: Federal Reserve Bank of New York; p. 346: MPI/Hulton Archive/Getty Images; p. 394:

Hulton Archive/Getty Images; p. 478: Bildarchiv Preussischer Kulturbesitz/Art Resource, N.Y.

LIBRARY of CONGRESS CATALOGING IN PUBLICATION DATA

Ahamed, Liaquat.

Lords of finance : the bankers who broke the world / Liaquat Ahamed.

p. cm.

Includes bibliographical references and index.

eISBN : 978-1-440-69796-8

1. Capitalists and financiersBiography. 2. BankersBiography. I. Title.

HG172.A2A43 2009

332.10922--dc22 2008044512

Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the above publisher of this book.

The scanning, uploading, and distribution of this book via the Internet or via any other means without the permission of the publisher is illegal and punishable by law. Please purchase only authorized electronic editions and do not participate in or encourage electronic piracy of copyrightable materials. Your support of the authors rights is appreciated.

http://us.penguingroup.com

TO MEENA

Read no historynothing but biography, for that is life without theory.

BENJAMIN DISRAELI

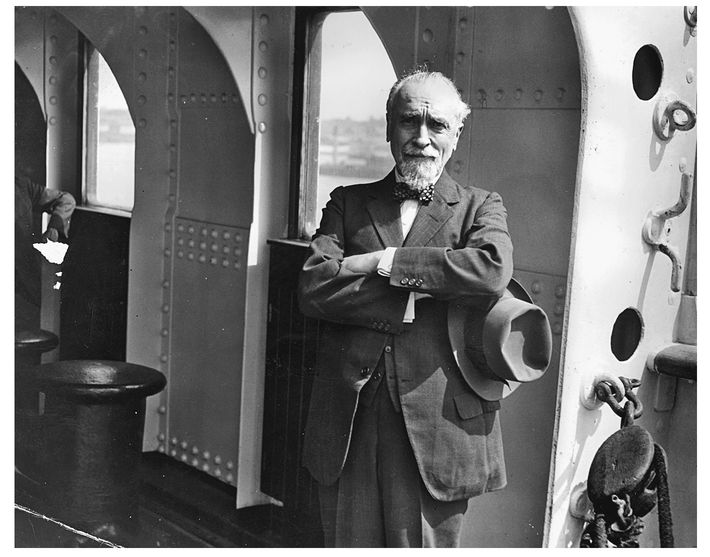

Montagu Norman on the Duchess of York, August 15, 1931

INTRODUCTION

ON AUGUST 15, 1931, the following press statement was issued: The Governor of the Bank of England has been indisposed as a result of the exceptional strain to which he has been subjected in recent months. Acting on medical advice he has abandoned all work and has gone abroad for rest and change. The governor was Montagu Collet Norman, D.S.O.having repeatedly turned down a title, he was not, as so many people assumed, Sir Montagu Norman or Lord Norman. Nevertheless, he did take great pride in that D.S.O after his namethe Distinguished Service Order, the second highest decoration for bravery by a military officer.

Norman was generally wary of the press and was infamous for the lengths to which he would go to escape prying reporterstraveling under a false identity; skipping off trains; even once, slipping over the side of an ocean vessel by way of a rope ladder in rough seas. On this occasion, however, as he prepared to board the liner Duchess of York for Canada, he was unusually forthcoming. With that talent for understatement that came so naturally to his class and country, he declared to the reporters gathered at dockside, I feel I want a rest because I have had a very hard time lately. I have not been quite as well as I would like and I think a trip on this fine boat will do me good.

The fragility of his mental constitution had long been an open secret within financial circles. Few members of the public knew the real truththat for the last two weeks, as the world financial crisis had reached a crescendo and the European banking system teetered on the edge of collapse, the governor had been incapacitated by a nervous breakdown, brought on by extreme stress. The Bank press release, carried in newspapers from San Francisco to Shanghai, therefore came as a great shock to investors everywhere.

It is difficult so many years after these events to recapture the power and prestige of Montagu Norman in that period between the warshis name carries little resonance now. But at the time, he was considered the most influential central banker in the world, according to the New York Times, the monarch of [an] invisible empire. For Jean Monnet, godfather of the European Union, the Bank of England was then the citadel of citadels and Montagu Norman was the man who governed the citadel. He was redoubtable.

Over the previous decade, he and the heads of the three other major central banks had been part of what the newspapers had dubbed the most exclusive club in the world. Norman, Benjamin Strong of the New York Federal Reserve Bank, Hjalmar Schacht of the Reichsbank, and mile Moreau of the Banque de France had formed a quartet of central bankers who had taken on the job of reconstructing the global financial machinery after the First World War.

But by the middle of 1931, Norman was the only remaining member of the original foursome. Strong had died in 1928 at the age of fifty-five, Moreau had retired in 1930, and Schacht had resigned in a dispute with his own government in 1930 and was flirting with Adolf Hitler and the Nazi Party. And so the mantle of leadership of the financial world had fallen on the shoulders of this colorful but enigmatic Englishman with his waggish smile, his theatrical air of mystery, his Van Dyke beard, and his conspiratorial costume: broad-brimmed hat, flowing cape, and sparkling emerald tie pin.

For the worlds most important central banker to have a nervous breakdown as the global economy sank yet deeper into the second year of an unprecedented depression was truly unfortunate. Production in almost every country had collapsedin the two worst hit, the United States and Germany, it had fallen 40 percent. Factories throughout the industrial worldfrom the car plants of Detroit to the steel mills of the Ruhr, from the silk mills of Lyons to the shipyards of Tynesidewere shuttered or working at a fraction of capacity. Faced with shrinking demand, businesses had cut prices by 25 percent in the two years since the slump had begun.

Armies of the unemployed now haunted the towns and cities of the industrial nations. In the United States, the worlds largest economy, some 8 million men and women, close to 15 percent of the labor force, were out of work. Another 2.5 million men in Britain and 5 million in Germany, the second and third largest economies in the world, had joined the unemployment lines. Of the four great economic powers, only France seemed to have been somewhat protected from the ravages of the storm sweeping the world, but even it was now beginning to slide downward.