Table of Contents

TO MEENA

Read no historynothing but biography, for that is life without theory.

BENJAMIN DISRAELI

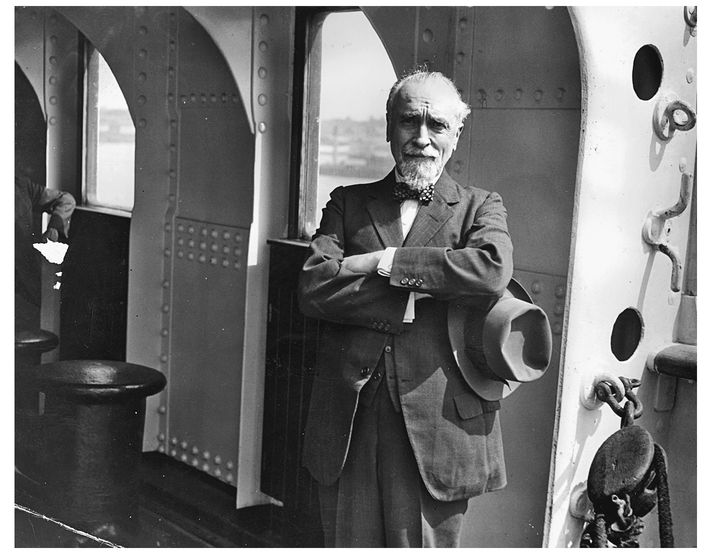

Montagu Norman on the Duchess of York, August 15, 1931

INTRODUCTION

ON AUGUST 15, 1931, the following press statement was issued: The Governor of the Bank of England has been indisposed as a result of the exceptional strain to which he has been subjected in recent months. Acting on medical advice he has abandoned all work and has gone abroad for rest and change. The governor was Montagu Collet Norman, D.S.O.having repeatedly turned down a title, he was not, as so many people assumed, Sir Montagu Norman or Lord Norman. Nevertheless, he did take great pride in that D.S.O after his namethe Distinguished Service Order, the second highest decoration for bravery by a military officer.

Norman was generally wary of the press and was infamous for the lengths to which he would go to escape prying reporterstraveling under a false identity; skipping off trains; even once, slipping over the side of an ocean vessel by way of a rope ladder in rough seas. On this occasion, however, as he prepared to board the liner Duchess of York for Canada, he was unusually forthcoming. With that talent for understatement that came so naturally to his class and country, he declared to the reporters gathered at dockside, I feel I want a rest because I have had a very hard time lately. I have not been quite as well as I would like and I think a trip on this fine boat will do me good.

The fragility of his mental constitution had long been an open secret within financial circles. Few members of the public knew the real truththat for the last two weeks, as the world financial crisis had reached a crescendo and the European banking system teetered on the edge of collapse, the governor had been incapacitated by a nervous breakdown, brought on by extreme stress. The Bank press release, carried in newspapers from San Francisco to Shanghai, therefore came as a great shock to investors everywhere.

It is difficult so many years after these events to recapture the power and prestige of Montagu Norman in that period between the warshis name carries little resonance now. But at the time, he was considered the most influential central banker in the world, according to the New York Times, the monarch of [an] invisible empire. For Jean Monnet, godfather of the European Union, the Bank of England was then the citadel of citadels and Montagu Norman was the man who governed the citadel. He was redoubtable.

Over the previous decade, he and the heads of the three other major central banks had been part of what the newspapers had dubbed the most exclusive club in the world. Norman, Benjamin Strong of the New York Federal Reserve Bank, Hjalmar Schacht of the Reichsbank, and mile Moreau of the Banque de France had formed a quartet of central bankers who had taken on the job of reconstructing the global financial machinery after the First World War.

But by the middle of 1931, Norman was the only remaining member of the original foursome. Strong had died in 1928 at the age of fifty-five, Moreau had retired in 1930, and Schacht had resigned in a dispute with his own government in 1930 and was flirting with Adolf Hitler and the Nazi Party. And so the mantle of leadership of the financial world had fallen on the shoulders of this colorful but enigmatic Englishman with his waggish smile, his theatrical air of mystery, his Van Dyke beard, and his conspiratorial costume: broad-brimmed hat, flowing cape, and sparkling emerald tie pin.

For the worlds most important central banker to have a nervous breakdown as the global economy sank yet deeper into the second year of an unprecedented depression was truly unfortunate. Production in almost every country had collapsedin the two worst hit, the United States and Germany, it had fallen 40 percent. Factories throughout the industrial worldfrom the car plants of Detroit to the steel mills of the Ruhr, from the silk mills of Lyons to the shipyards of Tynesidewere shuttered or working at a fraction of capacity. Faced with shrinking demand, businesses had cut prices by 25 percent in the two years since the slump had begun.

Armies of the unemployed now haunted the towns and cities of the industrial nations. In the United States, the worlds largest economy, some 8 million men and women, close to 15 percent of the labor force, were out of work. Another 2.5 million men in Britain and 5 million in Germany, the second and third largest economies in the world, had joined the unemployment lines. Of the four great economic powers, only France seemed to have been somewhat protected from the ravages of the storm sweeping the world, but even it was now beginning to slide downward.

Gangs of unemployed youths and men with nothing to do loitered aimlessly at street corners, in parks, in bars and cafs. As more and more people were thrown out of work and unable to afford a decent place to live, grim jerry-built shantytowns constructed of packing cases, scrap iron, grease drums, tarpaulins, and even of motor car bodies had sprung up in cities such as New York and Chicagothere was even an encampment in Central Park. Similar makeshift colonies littered the fringes of Berlin, Hamburg, and Dresden. In the United States, millions of vagrants, escaping the blight of inner-city poverty, had taken to the road in search of some kindany kindof work.

Unemployment led to violence and revolt. In the United States, food riots broke out in Arkansas, Oklahoma, and across the central and south-western states. In Britain, the miners went out on strike, followed by the cotton mill workers and the weavers. Berlin was almost in a state of civil war. During the elections of September 1930, the Nazis, playing on the fears and frustrations of the unemployed and blaming everyone elsethe Allies, the Communists, and the Jewsfor the misery of Germany, gained close to 6.5 million votes, increasing their seats in the Reichstag from 12 to 107 and making them the second largest parliamentary party after the Social Democrats. Meanwhile in the streets, Nazi and Communist gangs clashed daily. There were coups in Portugal, Brazil, Argentina, Peru, and Spain.

The biggest economic threat now came from the collapsing banking system. In December 1930, the Bank of United States, which despite its name was a private bank with no official status, went down in the largest single bank failure in U.S. history, leaving frozen some $200 million in depositors funds. In May 1931, the biggest bank in Austria, the Creditanstalt, owned by the Rothschilds no less, with $250 million in assets, closed its doors. On June 20, President Herbert Hoover announced a one-year moratorium on all payments of debts and reparations stemming from the war. In July, the Danatbank, the third largest in Germany, foundered, precipitating a run on the whole German banking system and a tidal wave of capital out of the country. The chancellor, Heinrich Brning, declared a bank holiday, restricted how much German citizens could withdraw from their bank accounts, and suspended payments on Germanys short-term foreign debt. Later that month the crisis spread to the City of London, which, having lent heavily to Germany, found these claims now frozen. Suddenly, faced with the previously unthinkable prospect that Britain itself might be unable to meet its obligations, investors around the world started withdrawing funds from London. The Bank of England was forced to borrow $650 million from banks in France and the United States, including the Banque de France and the New York Federal Reserve Bank, to prevent its gold reserves from being completely depleted.