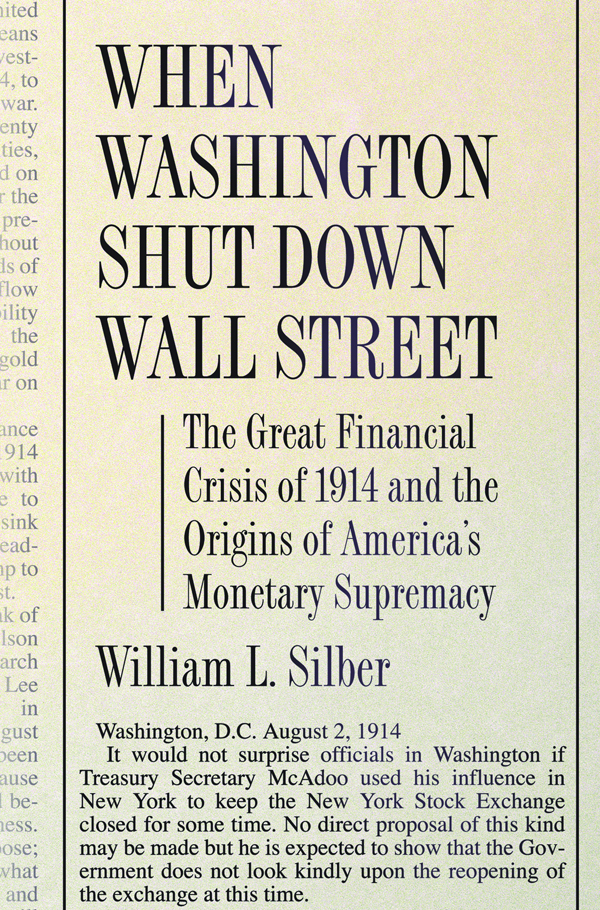

When Washington Shut Down Wall Street

When Washington Shut Down Wall Street

THE GREAT FINANCIAL CRISIS OF 1914 AND THE ORIGINS OF AMERICAS MONETARY SUPREMACY

William L. Silber

PRINCETON UNIVERSITY PRESS

PRINCETON AND OXFORD

Copyright 2007 by Princeton University Press

Requests for permission to reproduce material from this work should be sent to Permissions, Princeton University Press

Published by Princeton University Press, 41 William Street, Princeton, New Jersey 08540

In the United Kingdom: Princeton University Press, 3 Market Place, Woodstock, Oxfordshire OX20 1SY

All Rights Reserved

Library of Congress Cataloging-in-Publication Data

Silber, William L.

When Washington shut down Wall Street : the great financial crisis of 1914 and the origins of Americas monetary supremacy / William L. Silber.

p. cm.

Includes bibliographical references.

ISBN-13: 978-0-691-12747-7 ((hardcover) : alk. paper)

ISBN-10: 0-691-12747-6 ((hardcover) : alk. paper)

1. Currency crisesUnited StatesCase studies. 2. Currency question. 3. World War, 19141918Finance. 4. McAdoo, William Gibbs, 18631941 5. Gold standard. I. Title.

HG3903.S54 2007

332.097309041dc22 | 2006013076 |

British Library Cataloging-in-Publication Data is available

This book has been composed in Sabon

Printed on acid-free paper.

pup.princeton.edu

Printed in the United States of America

10 9 8 7 6 5 4 3 2 1

For

Talia

Leora

Danielle

Arianna

Rebecca | Joseph

Joshua

Jacob

Jack

Evan |

and

Lillian

With Love

It is impossible to be sure that a decision in August 1914 to suspend gold payments, even with the purpose of subsequently resuming them, would not have given to at least our immediately subsequent financial history a very different turn from that which it actually took.

Alexander Noyes, The War Period of American Finance, 1926

Acknowledgments

HISTORICAL RESEARCH requires the help of dedicated individuals who pay attention to the details. I would like to thank my research assistants Yang Lu, Steven M. Pawliczek, and Josh Sullivan for helping to collect data and archival material. They cheerfully accommodated my numerous requests to revisit the same documents. Bruce Kirby of the Library of Congress, Nancy Paley of JP Morgan Chase, and Steven Wheeler of the New York Stock Exchange went out of their way to provide source material. This project could not have been completed without their enthusiastic assistance.

I imposed the task of reading my work in progress on a number of colleagues and friends. Adam Brandenberger, Allan Meltzer, Anna Schwartz, Thomas Sargent, Joachim Voth, Paul Wachtel, and Eugene White read the manuscript and offered thoughtful comments. I especially appreciated the memos they wrote that bristled. Steve Cecchetti, author of an excellent new textbook on money and banking, read the book in one sitting. I benefited from his enthusiasm and perceptive suggestions. I inflicted the first draft of every chapter on Dick Sylla. He took time away from his work on Alexander Hamilton to give me encouragement, advice, and lessons in grammar and history. Niall Ferguson read the manuscript as though it were his own. He explained what I really said in the eyes of a professional historian. I thank him for being a role model. My friend, David Weisbrot, a distinguished biologist, commented with his usual intellectual curiosity. I will miss his input in the future. Kenneth Garbade read and reread every single sentence and forced me to purge the fuzzy logic from every argument. He imposed a standard of rigor that, after more than thirty years of friendship, I recognize as a sign of affection. I have received far more than I have given during our lifetime collaboration.

The conversational style of this book benefited from years of training by the master of exposition, my late coauthor, friend, and mentor, Larry Ritter. The prose would have been clearer had he been able to comment. Peter Dougherty, the Director of Princeton University Press, and my editor, picked up some of the slack. And so did my wife, Lillian. She read all of the chapters and cleansed the manuscript of every misplaced metaphor she could find (I slipped in a few after her final review). The errors that remain reflect a stubborn streak that I try to suppress only moderately.

When Washington Shut Down Wall Street

INTRODUCTION

The Legacy of 1914

THE GREAT WAR threatened the United States with financial disaster. During the last week of July 1914, Europeans began to liquidate their Wall Street investments and transfer gold to Europe to pay for the war. Foreign investors owned more than 20 percent of American railroad securities, the largest category of securities traded on the New York Stock Exchange. Under the gold standard, they could demand the precious metal in exchange for the proceeds of their stock sales. The biggest gold outflow in a generation imperiled Americas ability to repay its debts abroad. Fear that the United States would abandon the gold standard pushed the dollar to unprecedented depths on world markets.

The European assault on American finance brought danger and opportunity. In 1914 the United States was a debtor nation with a history of financial crises. Failure to meet its foreign obligations could sink American dreams of world monetary leadership. If it passed the test, however, the United States could jump to the head of the class.

Less than three weeks after the outbreak of the European conflict, Woodrow Wilson reviewed a road map for Americas march to world financial supremacy. Henry Lee Higginson, an investment banker in Boston, wrote to the president on August 20, 1914, that England has been the exchange place of the world, because of living up to every engagement, and because the power grew with the business. Today we can take this place if we choose; but courage, willingness to part with what we dont need at once, real character, and the living up to all our debts promptly will give us this power; and nothing else will. I repeat that it is our chance to take first place.

McAdoo had, in fact, launched a plan to defend American financial honor before he received Higginsons letter from Wilson. This book traces William G. McAdoos battle for American financial credibility during four months in 1914, from the end of July through the middle of November, a brief period that changed the course of U.S. financial history. McAdoos strategy turned the financial crisis into a monetary triumph, and the story of his success provides a blueprint for crisis control that merits attention today.

In 1914 most developed countriesincluding Austria, Belgium, Britain, France, Germany, Italy, Japan, and Spaincould rely on central banks to fight their financial battles. Even Czar Nicholas II had the Imperial Bank of Russia. The United States, without a central bank since 1836, after Andrew Jackson scuttled the Second Bank of the United States, resembled a headless financial giant. The Federal Reserve System, authorized by Congress on December 23, 1913, remained on the drawing board. It could have been a classic power vacuum, especially with President Woodrow Wilson distracted by his wifes fatal illness.

McAdoo seized the opportunity to confront the panic. He maintained Americas commitment to the gold standard while every other country of the world, save for Britain, abandoned it because of the war. The boost to the dollars credibility helped America challenge Britain as the financial capital of the world. November 11, 1914, the day the dollars discount disappeared on world markets, and four years to the day before the Armistice, marks the turning point in Americas battle for international financial leadership. In January 1915 the New York capital market replaced London as money lender to the world. Argentina, Canada, and China, traditional British clients, visited Wall Street to raise capital. A decade would pass before the transfer of financial power was complete, but a tectonic shift in monetary supremacy had begun.

Next page