DECARBONOMICS

DECARBONOMICS

& THE POST-PANDEMIC WORLD

Charles Dumas

First published in Great Britain in 2021 by

Profile Books Ltd

29 Cloth Fair

London EC1A 7JQ

www.profilebooks.com

Copyright TSL Research Group Limited, 2021

The moral right of the author has been asserted.

All rights reserved. Without limiting the rights under copyright reserved above, no part of this publication may be reproduced, stored or introduced into a retrieval system, or transmitted, in any form or by any means (electronic, mechanical, photocopying, recording or otherwise), without the prior written permission of both the copyright owner and the publisher of this book.

Typeset in Garamond by MacGuru Ltd

Printed and bound in Britain by

CPI Group (UK) Ltd, Croydon, CR0 4YY

A CIP catalogue record for this book is available from the British Library.

ISBN 978 1 80081 059 4

eISBN 978 1 80081 060 0

Introduction: From sacrifice to opportunity

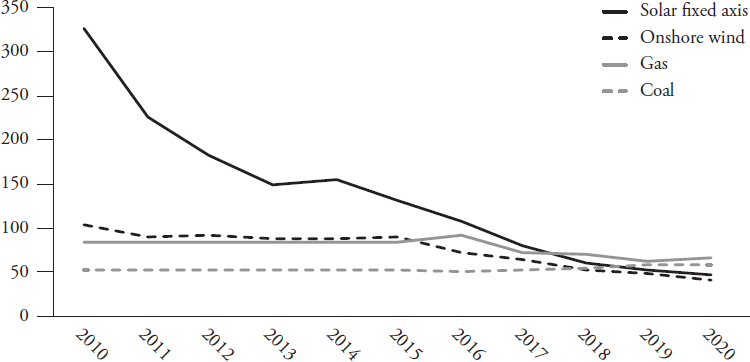

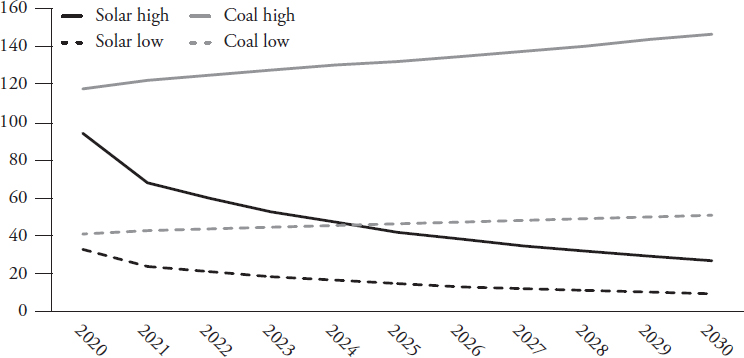

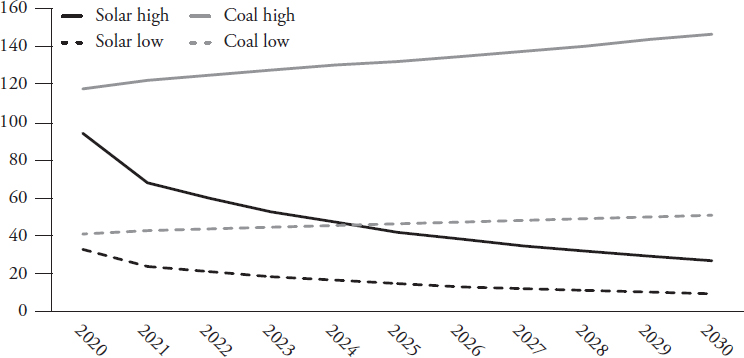

The cost of electricity generated by solar panels and (onshore) wind turbines fell below its cost using coal and natural gas in 201819. This shift, with similar, tech-driven cuts in battery costs, transforms climate-change economics from a story of necessary sacrifice at least partly to one of opportunity. As shows for projected renewables-electricity costs, improved technology should reduce a host of green costs as a result of the combat with climate change over forthcoming decades.

In this book, Essay 1 covers the post-pandemic economy, and Essay 2 the economics of climate change. The linkage between the two parts is not just that they are both important and follow on from one another. It has become clear that despite the boost to potential growth arising from the benefits of tech-sector progress, advanced economies have become anaemic, with budget deficits apparently indispensable to ensuring adequate demand. Prosperity throughout the twentieth century depended not just on supply-side progress and productivity growth; it also arose from the world being transformed by the destruction of assets in two world wars, and by the rebalancing of political power that ensued.

Figure 1 Electricity costs per megawatt-hour

Various energy sources (averaged)

Sources: Carbon Tracker, Bloomberg, TS Lombard

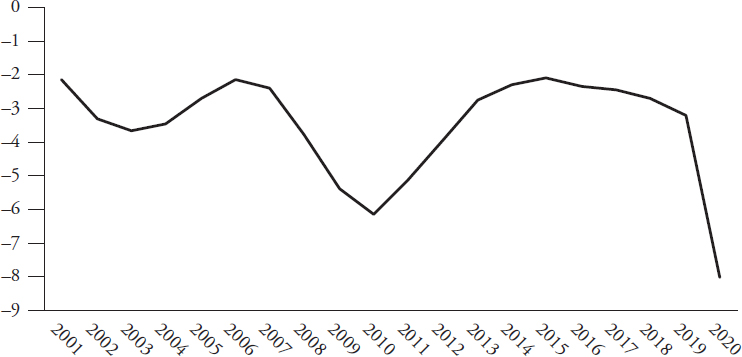

Figure 2 High and low prospective solar and coal costs of electricity

$/MWh

Sources: Carbon Tracker, TS Lombard

Commentators and analysts in the first half of the nineteenth century, including Karl Marx in his productive early years, worried that in a capitalist economy demand might fall short of fully utilising potential supply. Their intuition was sound. In 1928 Frank Ramsey, a Cambridge colleague of Keynes (and philosophy supervisor of Wittgenstein) produced a now-famous algebraic analysis of savings that said broadly (without the algebra) that we save too little. He died two years later aged only twenty-six.

It often puzzles non-economists that saving is identical with investment crucially, this is necessarily true, but only after the event (ex post), no matter what we might have wished for ex ante. (Auberon Waugh, eldest son of Evelyn Waugh, gave up on the economics part of his Oxford University PPE course Politics, Philosophy and Economics precisely because he could not understand this identity.) Arguably, people have an intuitive sense of Ramseys analysis and are vaguely (or precisely) conscious of the need to save more. But what if many of the best tech capital spending (capex) opportunities lie not so much in new products requiring capex but in making better use of existing capital assets, e.g. Uber and Lyft for drivers already owning cars, or Airbnb for people with spare rooms or just wanting to finance a holiday abroad by letting out their home? The return on existing capital could remain high in this scenario, while the desire to save simply turns out to mean a shortage of demand. That investment is identical to saving in aggregate would show up as an unwanted build-up of unsold inventory: stockbuilding that would be an unwelcome and unproductive form of capex. Nominal and real interest rates could become negligible, as demand weakens and the return on new capex weakens with it. If this sounds familiar, that is because it is.

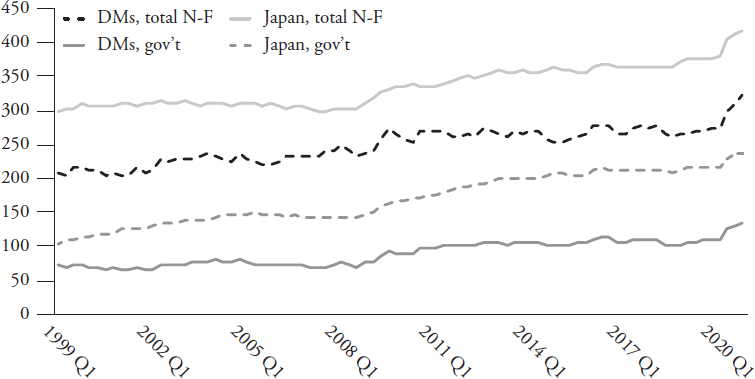

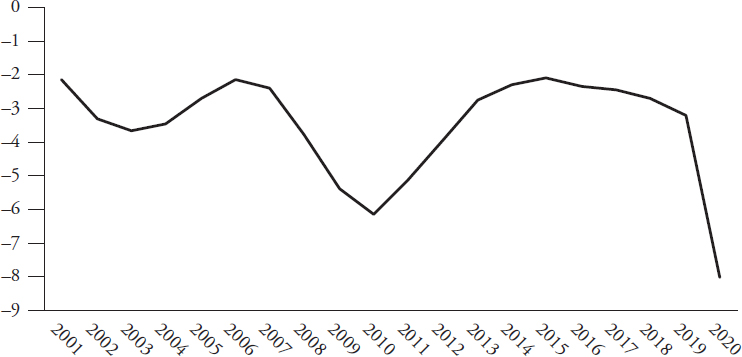

Figure 3 OECD countries general government net lending

(minus sign = budget deficit), percentage of GDP

Sources: OECD, TS Lombard

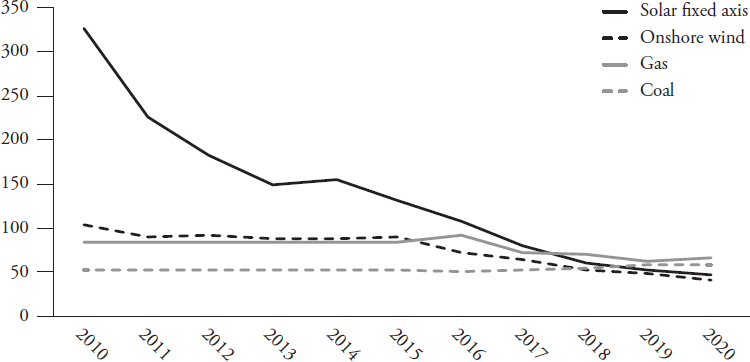

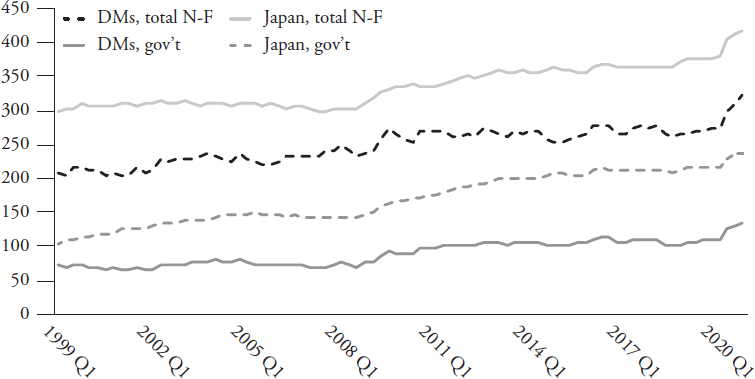

One result of these tendencies is that advanced economies are now chronically dependent on budget deficits to sustain demand and full employment, despite rejection since the 200709 global financial crisis (GFC) of Keynesian remedies to disinflation and/or deflation. show how this has led to progressively higher debt levels, both in the non-financial private sector and especially governments. In Essay 1 we will see how for advanced economies the sluggish ten-to-twelve-year recovery from the GFC has to a great extent been caused by too-strict fiscal policies. Yet dependence on budget deficits persists and has been aggravated by Covid-19. Without a new source of investment demand, this could become an acute policy quandary. Even with the significant boost to capex that we expect from replacement of fossil-fuelled electricity generation, large debts could put countries in difficulties should more lively capex cause interest rates to rebound to more normal levels, as is likely.

Figure 4 Advanced economies in aggregate and Japan

non-financial debt as percentage of GDP

Sources: BIS, TS Lombard

Cue a fresh wave of creative destruction in Schumpeters resonant phrase. With the descent of renewables-generated electricity costs below that of fossil fuels a disparity expected to grow rapidly in the 2020s the entire existing energy infrastructure of the world becomes potentially obsolescent stranded assets in the current jargon. The clear political commitment to net-zero carbon emissions by mid-century in most advanced countries (and by 2060 in Chinas case) requires that these stranded assets are replaced. It is entirely possible that extreme weather events beyond the scale of those anticipated by the meteorological scientists that forecast global warming will create earlier pressure for action.

The scale of commitment will be analysed in Essay 2, but 2020 was a watershed, after which climate-change denialists will be permanently on the defensive in an anti-science cul-de-sac: the Covid-19 crisis has discredited people that wilfully ignore scientific evidence. Nonetheless, the plausibility of the various routes proposed to achieve net zero will be an important part of the analysis, as will be the arguments over the timing of this goal. But the emergence of renewable-sourced electricity as cheaper than fossil fuels ensures that the replacement of obsolescent capacities will happen anyhow simply to minimise costs. What political resistance to such changes may achieve could prove to be a mere timing issue.