In addition to our author, we would like to thank Larry B. Kling, Vice President, Editorial, for his overall guidance, which brought this publication to completion; Pam Weston, Vice President, Publishing, for setting the quality standards for production integrity and managing the publication to completion; Diane Goldschmidt, Senior Editor, for project management; Alice Leonard, Senior Editor and Molly Solanki, Associate Editor, for preflight editorial review; Rachel DeMatteo, Graphic Artist, for designing the pages; Christine Saul, Senior Graphic Designer, for our cover design; and Jeff LoBalbo, Senior Graphic Designer, for post-production file mapping.

We also gratefully acknowledge Sandra Rush for copyediting the manuscript and Kathy Caratozzolo of Caragraphics for typesetting this edition.

About Our Author

Donald P. Balla has taught at John Brown University in Arkansas since 1985, although not all of his classes have been within the Business Division. He has taught regular day students and degree completion (advanced) students. He is a self-described educational experimenter and divergent thinker who was recognized as an outstanding teacher of the year in 2005.

Mr. Balla is also a licensed attorney, certified public accountant, and an accomplished musician. I started out as a musician, he says. Trying to make a living as a musician turned me into an accountant. Today, most of his legal work is pro bono for the areas expanding Hispanic population.

In a diverse career that spans more than 30 years, he has taught a variety of courses under the subjects of accounting, law, taxes, business, economics, computer programs, music, and art. His unusual Basic Economics class has received national attention among Christian business faculty. One semester, he says, a class ran a deficit, extravagantly increased their own grades, and then left the deficit for an honors class to pay off.

Mr. Balla received a masters degree in Music and Composition from Florida State University, an M.S in Financial Services from American College in Pennsylvania, and a Juris Doctor from the University of Arkansas.

Classical guitarist, novelist, electrician, public speaker, and Vietnam veteran, Mr. Balla lives with his wife of 37 years, Judy, within strolling distance of the campus.

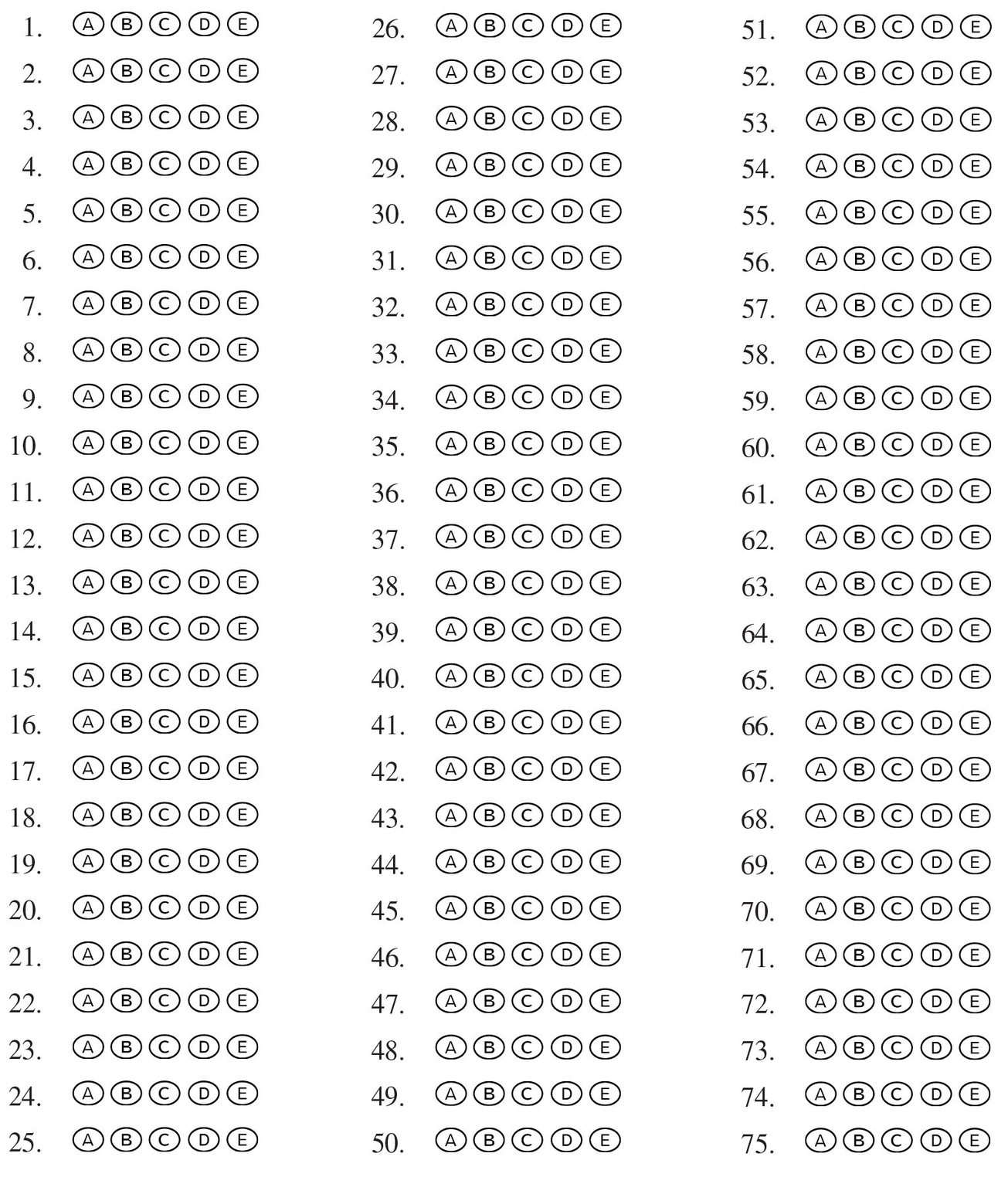

PRACTICE TEST 1

CLEP FINANCIAL ACCOUNTING

PRACTICE TEST 1

(Answer sheets appear in the back of this book.)

| TIME: | 90 Minutes |

| 75 Questions |

DIRECTIONS : Each of the questions or incomplete statements below is followed by five possible answers or completions. Select the best choice in each case and fill in the corresponding oval on the answer sheet.

1. What does double entry accounting mean?

- Record all transactions in the asset section and in the equity section.

- Record transactions upon paying and receiving cash.

- Record where the money came from and where it went.

- Record transactions in the general ledger and the general journal.

- Record debts we owe and debts others owe us.

2. Which of the following is NOT an asset?

- A car

- Loans we owe

- Cash

- Inventory

- Real estate

3. Which of the following are parts of a heading for a balance sheet?

- I. A date

- II. The name of the business

- III. The name of the owner

- IV. A period of time

- I, II, and III only

- I, II, and IV only

- II and III only

- I and II only

- I, II, III, and IV

4. If Company A has $10,000 of assets and $6,000 of liabilities, what is the equity ratio?

| (A) 2:1 | (D) $4,000 |

| (B) 60% | (E) 40% |

| (C) 166% |

5. Which statement below about expenses is FALSE?

- Expenses always make owners equity go down.

- Expenses always involve cash leaving the business.

- Expenses always lower net income.

- Borrowing money is not an expense.

- Expenses usually happen as a result of normal business operations.

6. Depreciation expense

- represents the cash spent this period for asset upkeep

- measures the amount of asset appreciation during a year

- for an asset happens the year that asset is purchased

- for an asset happens the year that asset is sold

- estimates the amount of the asset used up during the year

7. If the cost of goods sold = $6,000, total expenses = $4,000, and gross profit = $3,000, what amount is sales?

| (A) $13,000 | (D) $2,000 |

| (B) $10,000 | (E) $1,000 loss |

| (C) $9,000 |

8. At the end of the year, Bobs Bargains financial statements show these amounts: net income = $10,000, owners equity at the beginning of the year = $2,000, depreciation expense = $4,000, and withdrawals = $1,000. What is the balance of the owners equity account at the end of the year?

| (A) $3,000 | (D) $11,000 |

| (B) $7,000 | (E) $12,000 |

| (C) $9,000 |

9. Which is the best reason for creating a cash flow statement?

- It is the easiest financial statement to create.

- Net income reflects cash received from operations.

- Bankers want to see how quickly business assets depreciate.

- Owners need to know how much money they can safely take out of the business.

- The balance sheet does not contain information useful in determining what has happened to cash.

10. Where does one find the information to create a cash flow statement?

- On a special worksheet showing the changes in balance sheet accounts

- On a special worksheet showing the increase in the income statement accounts for the year

- The amounts in the balance sheet accounts

- The balances in the income and expense accounts

- The amounts in the cash flow statement accounts

11. Which of the following is NOT part of the cash flow statement?

- Cash from operations

- Cash from investing activities

- Cash from financing activities

- Cash from marketing activities

- Calculation of cashend of period

12. During 20x1, a business borrowed $10,000, paid back $2,000 of the loan with an additional $100 of interest, bought an $8,000 machine, and paid the owner a $500 withdrawal. Assuming this is all the relevant information, what is the cash flow from financing activities?

| (A) (600) | (D) $7,500 |

| (B) (100) | (E) $8,000 |

| (C) $7,400 |

13. Who is/are LEAST likely to see your sole proprietorship financial statements?

- Your business banker

- Your business partners

- The Internal Revenue Service

- Your employees

- Potential investors

14. If there is uncertainty about the amount of a liability, which accounting principle would require you to present your financial statements showing the larger estimate of the liability?