Investing in Collectables

An Investors Guide to Turning Your Passion into a Portfolio

CHARLES BEELAERTS

WITH KEVIN FORDE

First published 2011 by Wrightbooksan imprint of John Wiley & Sons Australia, Ltd

42 McDougall Street, Milton Qld 4064

Office also in Melbourne

Typeset in 11.5/14 pt Garamond

Charles Beelaerts and Kevin Forde 2011

The moral rights of the authors have been asserted

National Library of Australia Cataloguing-in-Publication data:

Author: Beelaerts, Charles.

Title: Investing in Collectables / Charles Beelaerts; contributor, Kevin Forde.

ISBN: 9781742468198 (pbk.)

Notes: Includes index.

Subjects: Collectors and collecting. Investments. Collectibles.

Other Authors/Contributors: Forde, Kevin.

Dewey Number: 790.132

All rights reserved. Except as permitted under the Australian Copyright Act 1968 (for example, a fair dealing for the purposes of study, research, criticism or review), no part of this book may be reproduced, stored in a retrieval system, communicated or transmitted in any form or by any means without prior written permission. All enquiries should be made to the publisher at the address above.

Cover images: library and books Yellowj, 2010. Used under license from Shutterstock.com; framed painting Sandra Cunningham, 2010. Used under license from Shutterstock.com; wine bottle GorillaAttack, 2010. Used under license from Shutterstock.com; Victorian coin Scott Latham, 2010. Used under license from Shutterstock.com; fob watch iStockphoto.com/Angelo Marcantonio.

Printed in China by Printplus Limited

10 9 8 7 6 5 4 3 2 1

Disclaimer

The material in this publication is of the nature of general comment only, and does not represent professional advice. It is not intended to provide specific guidance for particular circumstances and it should not be relied on as the basis for any decision to take action or not take action on any matter which it covers. Readers should obtain professional advice where appropriate, before making any such decision. To the maximum extent permitted by law, the authors and publisher disclaim all responsibility and liability to any person, arising directly or indirectly from any person taking or not taking action based upon the information in this publication.

About the authors

Charles Beelaerts is an economics graduate of the University of Sydney and a graduate of Harvard Business School. He is a financial consultant and author who has previously worked as an analyst for banks and investment firms.

Kevin Forde holds a Master of Economics degree from the University of NSW, where he has lectured for 10 years. He has worked as an industrial analyst and as a funds manager.

Acknowledgements

The input of Anne Cummins of Sydney Artefacts Conservation in chapter 4 and in other parts of the book is gratefully acknowledged. Thanks are also due to Ian Westbrook of Westbrook Financial Communications for his help with the fascinating collectables. Finally, a special thank you to the team at John Wiley & Sons for their work on the book.

Introduction

This book is about investing in collectables. There are no hard and fast rules about what is collectable and the range can vary from such things as lucky charms worth virtually nothing to Old Masters worth millions. However, the focus of this book is how to make a profit out of collecting and this excludes many items that you can legitimately claim as collectables as they have no real value to other people. One area that is specifically excluded is mass-produced items because one of the features of a profitable collectable market is limited supply. As you might expect, the fewer there is of a collectable in existence, the more valuable it is.

Potential returns

There is worldwide evidence suggesting that investors are turning to collectables to provide better returns than share and fixed interest markets. For example, the current Capgemini and Merrill Lynch World Wealth Report found that investors were seeking items that are perceived to have tangible long-term value. The two categories that the report found most in demand were art and other collectables, such as coins, antiques and wine. Auction houses have also recently reported increased demand for these items. For example, according to Artprice, global fine art auctions raised US$3.8 billion in six months, which was nearly as much as for the whole of the previous year. While the amount raised is not high in absolute terms the turnover of Woodside Petroleum on the Australian Securities Exchange on one day alone can exceed A$4 billion it represents a significant upwards trend. Note that Artprices figure is for

fine art auctions only and it does not include private and dealer sales.

Did you know ...

Collectables do not correlate strongly with other investments such as shares, bonds or property. In bad economic times collectables often hold their value.

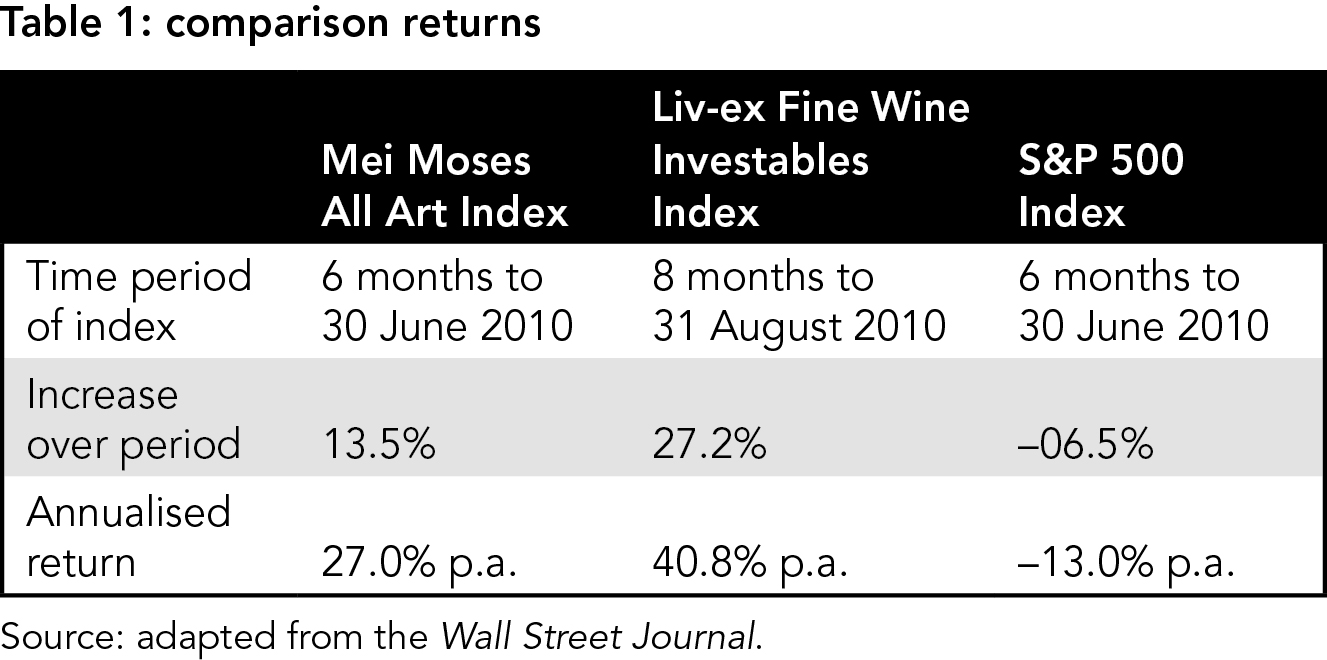

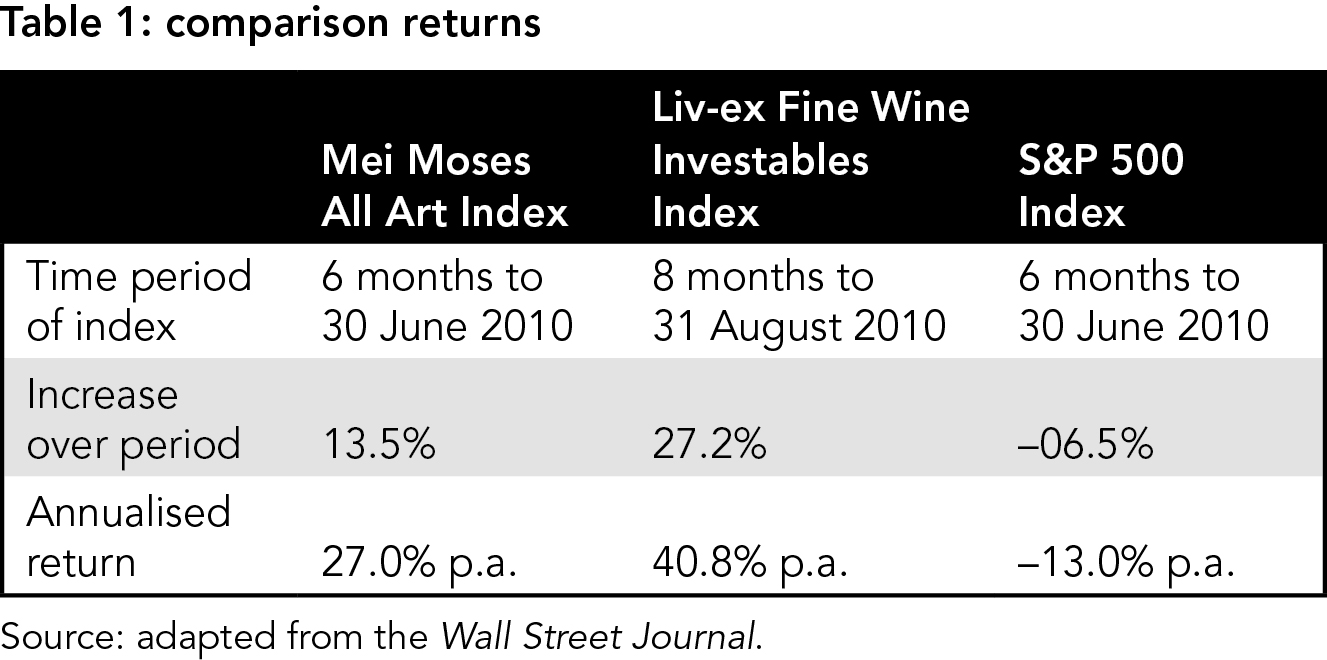

Similarly investment returns are good. The Mei Moses All Art Index, which tracks auction prices, increased by 13.5 per cent in six months compared with a fall of 6.5 per cent in the S&P 500 Index. The Liv-ex Fine Wine Investables Index, which tracks the price of fine wines from 24 chateaux in Bordeaux, increased by 27.2 per cent in eight months. Table 1 shows the adjusted annual return to investors who invested in these indices.

Note that in table 1 commissions are ignored but they are much higher with art and wine than they are with shares.

Given the vast range of items that people collect it is not possible to generalise about the investment potential of collectables just as some investment properties can increase in value while others are falling. But if you put the time and effort into identifying desirable collectables just as you would in identifying growth shares on the sharemarket it is certainly possible to make handsome profits.

Why invest in collectables?

Apart from above average returns potential, there are other reasons for investing in collectables. These include the following:

Since collectables are tangible assets where supply may be restricted, they provide an excellent hedge against inflation. If inflation is running at 3 per cent per annum, you need at least this rate of return to keep pace and collectables generally provide this. When financial markets are uncertain there are benefits in owning tangible assets.

Collectables do not correlate strongly with other investments, such as shares, bonds or property. In bad economic times collectables often hold their value.

Collectables do not exhibit the same level of volatility found, for example, in the sharemarket. Collectables do not usually increase markedly in price one day and fall back the next, although they are not traded in the same way.

An investor in collectables does not need to monitor their performance as often as investors in other assets. You can buy and forget to a greater extent than you can with many other types of investments.

But like any other investment, collectables can rise and fall in price and they can certainly lose considerable value if they go out of fashion. So as an investor in collectables, you need to make decisions with your head, not your heart.