Copyright 2014 by McGraw-Hill Education. All rights reserved. Except as permitted under the United States Copyright Act of 1976, no part of this publication may be reproduced or distributed in any form or by any means, or stored in a data base or retrieval system, without the prior written permission of the publisher.

ISBN: 978-0-07-178167-1

MHID: 0-07-178167-6

The material in this eBook also appears in the print version of this title: ISBN: 978-0-07-178166-4, MHID: 0-07-178166-8.

eBook conversion by codeMantra

Version 1.0

All trademarks are trademarks of their respective owners. Rather than put a trademark symbol after every occurrence of a trademarked name, we use names in an editorial fashion only, and to the benefit of the trademark owner, with no intention of infringement of the trademark. Where such designations appear in this book, they have been printed with initial caps.

McGraw-Hill Education books are available at special quantity discounts to use as premiums and sales promotions or for use in corporate training programs. To contact a representative, please visit the Contact Us pages at www.mhprofessional.com.

This publication is designed to provide accurate and authoritative information in regard to the subject matter covered. It is sold with the understanding that neither the author nor the publisher is engaged in rendering legal, accounting, securities trading, or other professional services. If legal advice or other expert assistance is required, the services of a competent professional person should be sought.

From a Declaration of Principles Jointly Adopted by a Committee of the American Bar Association and a Committee of Publishers and Associations

TERMS OF USE

This is a copyrighted work and McGraw-Hill Education and its licensors reserve all rights in and to the work. Use of this work is subject to these terms. Except as permitted under the Copyright Act of 1976 and the right to store and retrieve one copy of the work, you may not decompile, disassemble, reverse engineer, reproduce, modify, create derivative works based upon, transmit, distribute, disseminate, sell, publish or sublicense the work or any part of it without McGraw-Hill Educations prior consent. You may use the work for your own noncommercial and personal use; any other use of the work is strictly prohibited. Your right to use the work may be terminated if you fail to comply with these terms.

THE WORK IS PROVIDED AS IS. McGRAW-HILL EDUCATION AND ITS LICENSORS MAKE NO GUARANTEES OR WARRANTIES AS TO THE ACCURACY, ADEQUACY OR COMPLETENESS OF OR RESULTS TO BE OBTAINED FROM USING THE WORK, INCLUDING ANY INFORMATION THAT CAN BE ACCESSED THROUGH THE WORK VIA HYPERLINK OR OTHERWISE, AND EXPRESSLY DISCLAIM ANY WARRANTY, EXPRESS OR IMPLIED, INCLUDING BUT NOT LIMITED TO IMPLIED WARRANTIES OF MERCHANTABILITY OR FITNESS FOR A PARTICULAR PURPOSE. McGraw-Hill Education and its licensors do not warrant or guarantee that the functions contained in the work will meet your requirements or that its operation will be uninterrupted or error free. Neither McGraw-Hill Education nor its licensors shall be liable to you or anyone else for any inaccuracy, error or omission, regardless of cause, in the work or for any damages resulting therefrom. McGraw-Hill Education has no responsibility for the content of any information accessed through the work. Under no circumstances shall McGraw-Hill Education and/or its licensors be liable for any indirect, incidental, special, punitive, consequential or similar damages that result from the use of or inability to use the work, even if any of them has been advised of the possibility of such damages. This limitation of liability shall apply to any claim or cause whatsoever whether such claim or cause arises in contract, tort or otherwise.

Stephen M. Horan

To Connie and Cayse and my late mentor, Jeff Peterson

Robert R. Johnson

To Heidi and my late parents, Rowena and Russell

Thomas R. Robinson

To Linda and my late father, Clarence E. Robinson

CONTENTS

SECTION

ONE

INTRODUCTION

CHAPTER

ONE

WHAT IS VALUE INVESTING?

All intelligent investing is value investingacquiring more than you are paying for. You must value the business in order to value the stock.

Charlie Munger

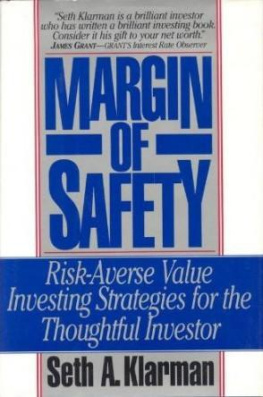

W hat do Benjamin Graham, Warren Buffett, Wally Weitz, and Seth Klarman all have in common? They are all value investors. What is value investing? Like beauty, it is in the eye of the beholder. Some view value investing as purchasing shares of companies that have been beaten down and are out of favorselling at a cheap price relative to other available investments. Others may define value investing in contrast to something elsetypically growth investing. Stock indices are often broken down into value and growth components, and a stock must either be classified under the value category or the growth category, but not both. In practice, however, value investing is not so limiting or narrow.

Value investing may involve any type of security or investment but is most commonly associated with the purchase of shares of stock in a company. Value investment deals with purchasing securities that are reasonably priced given their underlying fundamentals, including growth prospects. Ideally, the shares in the company should be trading at a price that is less than the intrinsic value of the shares and hence be considered a value stock. Being a value investor is no different from seeking value in the purchase of any good or service. We generally prefer to buy things when they are selling at a discount and not when they are selling at a premium.

How does price differ from value? At any point, an assets price is subject to the economic laws of supply and demand. If demand for an asset exceeds the supply of that asset in the short run, then the price of that asset should rise and may exceed the long-term value of that asset. Prices can increase dramatically when seemingly everyone wants to buy an asset (remember the Internet bubble of the late 1990s and the more recent real estate bubble). In both cases, market prices exceeded the long-term intrinsic value of the assets, and when buyers stopped buying, prices fell dramatically (perhaps below intrinsic value in some cases). Similarly, if there is a large supply of an asset but few buyers (low demand) at any point, then the price is likely to fall, perhaps below the long-term intrinsic value. If investors recognize this value and start to buy the asset, demand increases relative to supply, and the price should rise (sometimes above intrinsic value). Value investing can be characterized by the practice of buying companies when their intrinsic value exceeds the current market price and selling companies when the current market price exceeds their intrinsic value. Some view value investing as more extreme (deep value), that is, buying good companies when nearly everyone else is selling and selling them when nearly everyone else is buying. At its core, value investing is indeed contrarian by nature; it does something different from other types of investing. However, value investing can also involve the practice of buying a growth stock that other investors are buying when it can be purchased at a reasonable price relative to its growth prospects. We will discuss this in more detail later in this chapter.

Next page