First edition published in 2014 by Lund Humphries in association with Sothebys Institute of Art.

This revised edition published in 2020 by Lund Humphries

Lund Humphries

Office 3, Book House

261 A City Road

London EC1V 1JX

UK

www.lundhumphries.com

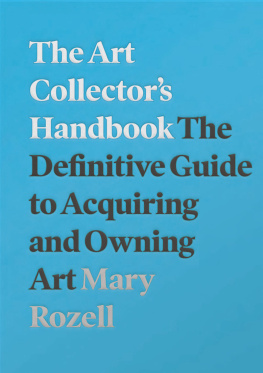

The Art Collectors Handbook: The Definitive Guide to Acquiring and Owning Art

Mary Rozell, 2020

All rights reserved

ISBN (paperback): 9781848224018

ISBN (eBook PDF ): 9781848224025

ISBN (eBook ePub): 9781848224032

ISBN (eBook Mobi): 9781848224049

A Cataloguing-in-Publication record for this book is available from the British Library

All rights reserved. No part of this publication may be reproduced, stored in a retrieval system or transmitted in any form or by any means, electrical, mechanical or otherwise, without first seeking the permission of the copyright owners and publishers. Every effort has been made to seek permission to reproduce the images in this book. Any omissions are entirely unintentional, and details should be addressed to the publishers.

Mary Rozell has asserted her right under the Copyright, Designs and Patent Act, 1988, to be identified as the Author of this Work.

Copy edited by Michela Parkin

Designed by Oliver Keen

Cover designed by Alex Kirby

Set in Poynter and Plantin

Printed in the United Kingdom

Contents

Preface

There are more collectors worldwide than ever before. Not only have emerging economic markets around the globe spawned new art markets, but the digital age offers unprecedented ease of discovering and collecting art, bringing in more participants at every level. Sales in the global art market reached an estimated $64.1 billion in 2019. Once an intimidating closed world of galleries and a few auction houses, the art business has been democratized in many ways by globalization, technology, and the international surge of art fairs.

Few people wake up and decide they want to be an art collector. Rather, they tend to buy an artwork, and then another, and over time they find they own a constellation of items that comprise a meaningful collection. Or they may suddenly inherit works of art. Such individuals may not consider themselves to be collectors, and yet they may one day discover that they are owners of a valuable art collection, perhaps even one that constitutes the majority of their net worth. Other individuals describe themselves as being bitten by the collecting bug or they explain their desire to collect as an illness, an obsession, or an unruly passionbuilding up a collection relatively quickly, rabid in their desire to own art. And, more and more, individuals are putting together collections with arts investment potential in mind.

No matter how one acquires art or for what purpose, there is more to art collecting than discovering a work at an art fair or gallery and finding the perfect place to hang it. First, it is not always simple to buy art. There may be intense competition, there are unspoken rules, and there can be plenty of pitfalls along the way. Second, owning art (and, for that matter, relinquishing art) requires thought, time, and, frequently, a significant sum of money. Depending on the circumstances, a collector can expect to spend 1 to 5 per cent of the collections value on maintenance annually.and financial loss. In the case of larger collections, management can be a sizable burden or even a full-time job. Some collectors employ entire art departments consisting of curators, collection managers, registrars, and other assistants to address collection matters year-round.

One well-known contemporary art collector stated that if she had known how much work it was to own art, she would never have started collecting. Collection management is the unglamorous aspect of having an art collection. It requires conscientious stewardship and a kaleidoscopic approach. Myriad specialistsincluding conservators, installers, insurers, scholars, lighting and climate control specialists, and tax and estate plannersmust be called upon to provide the necessary expertise and care. These professionals are indispensable to sound management, and cultivating trusted relationships with them can be both rewarding and educational. For optimal results, however, collectors themselves need to possess an awareness of fundamental art collection management principles and practice, starting at the acquisition stage. A collectors wishes, needs, or priorities may not always be entirely in sync with those of a specialist, and being able to ask the right questions and raise critical issues can be immensely beneficial.

When I was first hired to direct a significant art collection almost twenty years ago, I had an MA in Art History, a law degree with a practice specialization in art law, and years of experience working in the art profession, both in the United States and abroad. What I did not have was a road map for approaching such a multi-faceted responsibility, or anything more than superficial knowledge of those vital back businesses that keep the art world afloat: insurance, conservation, logistics, storage, etc. Over time, I have learned much on the job from the experts, professionals, and collectors who shared their knowledge, and felt that a compendium of this information might be of use for the private individual collector.

This book thus aims to serve as a generalist reference for such individuals, providing an overview of the salient art collecting topics to consider as well as direction on best practice. The intent is to offer guidance for those just starting out along with more technical details and complex considerations that may be of use to the seasoned collector. The content should also serve as a resource for professionals in the field as well as for students.

Originally published in 2014 as part of the Art Business handbook series produced jointly by Lund Humphries and Sothebys Institute of Art (SIA), where I was Director of the Art Business M.A. program in New York at the time, this new volume includes many updates as well as an expanded focus. It also includes perspectives gained from my experience as Global Head of the UBS Art Collection, a position I have held since September 2015.

With respect to the art industry, these last five years have been marked by astonishing changes across the board. Art businesses as well as existing models of practice have come and gone or been reinvented. Lines have blurred between auction houses and galleries, and power has been further consolidated among a handful of top galleries. Laws and tax codes have changed. The effects of global warming and political instability due to trade wars and the specter of Brexit are also having an impact on the art trade. At the same time, the European Unions Anti-Money Laundering Fifth Directive, which now includes the art business, is beginning to push the art market towards greater transparency. Furthermore, technological advances are shaking things up as never before, with new media art making a comeback as virtual reality and interactive works enter the mainstream, and a new generation of art buyers looking to blockchain and fractional ownership in the quest for transactional certainty and new forms of ownership.

While the first decade of the 21st century was remarkable for the explosion of art fairs globally, the expansion of Asias role, and the rise of art as an investment, these past few years have seen an even greater financialization of the art market, excitement around all the possibilities of art-tech, and the proliferation of private museums in unprecedented numbers. These shifts, too, have shaped the contents of this new edition.

Next page