Contents

Guide

Michael C. Thomsett

Stock Market Math

ISBN 978-1-5015-1581-1

e-ISBN (PDF) 978-1-5015-0742-7

e-ISBN (EPUB) 978-1-5015-0736-6

Library of Congress Cataloging-in-Publication Data

A CIP catalog record for this book has been applied for at the Library of Congress.

Bibliographic information published by the Deutsche Nationalbibliothek

The Deutsche Nationalbibliothek lists this publication in the Deutsche Nationalbibliografie; detailed bibliographic data are available on the Internet at http://dnb.dnb.de.

2017 Michael C. Thomsett

Published by Walter de Gruyter Inc., Boston/Berlin

www.degruyter.com

Advance Praise

I am thankful Michael Thomsett was able to bring clarity and context to investment performance measurement. It's a foreign language to so many but vital to our ability to save and retire. A great read for anyone interested in the markets.

Jakob Rohn, Co-founder,

WorkN and Board Member, Delta Data

Michael Thomsett has done it againsimple, practical and actionable advice for anyone seeking to understand how the stock market works while limiting downside risk. An essential encyclopedia of market knowledge presented with simplicity. A "must read" reference for anyone interested in the stock market.

Gary Lynch, CEO & Founder,

The Risk Project, LLC

Score another winner for Michael Thomsett! In Stock Market Math the education guru is back, big timeproviding us with the blueprints for success. With a writing style that is at once comprehensive, yet easy to understand, Thomsett's trademark ability to "make the complex simple" is on full display. Filled with wisdom, Thomsett's book tackles concepts that will appeal to investors at every level. Beginners will enjoy his breakdown of investment building blocks, while seasoned pros will appreciate his deeper dive into the material. Yet all will take something away from Thomsett's bookand that something is the ability to take higher and more consistent profits out of the stock market.

Michael Stoppa, Author,

The Options Alchemist

Chapter 1

Rates of Return on Investment:

What Goes In, What Comes Out

Even the most seemingly easy calculation can become quite involved.

For example, what is your return? If you invest money in a stock or mutual fund, you need to be able to figure out and compare the outcome; but as the following explanation demonstrates, there are many different versions of return and you need to be sure that when comparing two different outcomes, you are making a like-kind study. Otherwise, you can be deceived into drawing an inaccurate conclusion. And accuracy is one of your goals in going to the trouble of drawing conclusions in the first place.

The return you earn on your investments can be calculated and expressed in many different ways. This is why comparisons are difficult. If you read the promotional literature from mutual funds and other investments, the return provided in the brochure could be one of many different results.

This is why you need to be able to make distinctions between return on investment and return on capital . Your investment return is supposed to be calculated based on the amount of cash you put into a program, fund or stock. Most investors use return on investment in some form to calculate and compare. The return on capital is usually different and is used by corporations to judge operations. To further complicate matters, capital is not the same as capitalization so corporate return calculations can be difficult to compare. Return on capital normally means capital stock. Capitalization is the total funding of an organization, including stock and long-term debt.

A business model of return on capital may present problems, however. Accuracy is in question when the calculation is based on a fixed value, such as capital, versus current value of the same investment:

The book value of capital might not be a good measure of the capital invested in existing investments, since it reflects the historical cost of these assets and accounting decisions on depreciation.

The same question may be applied to capital invested in shares of stock. Since capital is a fixed value at a particular time (purchase of shares), but current valuation may be significantly different, the potential impact makes this calculation one that has to be considered with some qualification, perhaps even discounting its value in favor of return on cash invested.

Judging the Outcome What Did You Expect?

All investment calculations are done in order to monitor and judge standards. You enter an investment with a basic assumption, an expectation about the return you will be able to earn. In order to judge the quality of the investment and the reliability of your own decision-making capabilities, you will need to figure out how well the investment has performed. In so doing, you need to be aware of some popular mistakes investors make, including the following primary points:

- The purchase price is the assumed starting point. It is easy to fall into the trap of believing that the point of entry to any investment is the price-based starting point. Thus, the assumption is that price must move upward from that point. No consideration is given to the realistic point of view that price at any given moment is part of a continuum of ever-evolving upward and downward price point movements. As a starting point, price does not always move upward. In other words, profitability is not the only possible outcome; the rate of return may also be negative.

- A bail-out and/or profit goal is not specifically set . Too often, an investment is made with little or no idea about the individuals expectations. Do you plan to double your money? Triple it? Or would you settle for a 15% return in one year? Equally important is the question of possible loss. How much of your investment capital will you lose before you cut your losses and close it out? If you dont set goals and identify the point at which you will close the investment, then you cannot know what to expect.

- The specific method of calculation is not understood . It is difficult to determine whether an investment is a success of a failure unless you also know how the return calculation is made. This includes making clear distinctions between different types of returns, the effect of taxes, and how the formula works. All of these variables have to be considered with consistent comparisons between them or they will not be valid.

- The time factor is not considered . You need to take into account the reality that not all investments produce a return in the same amount of time. The longer the time required (thus, the longer your capital is tied up), the less effective the return. So, the time element is crucial to the comparison of one investment to another.

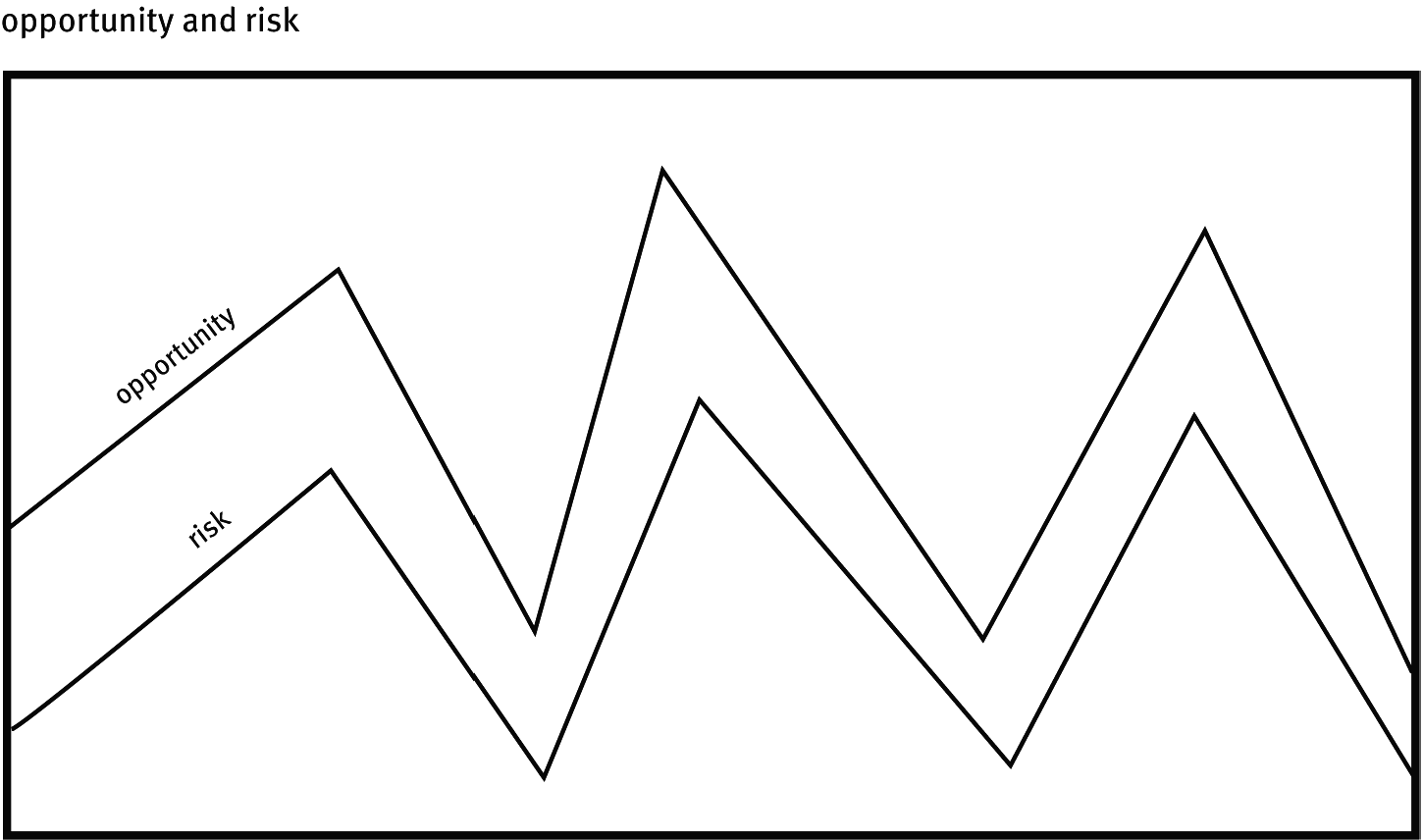

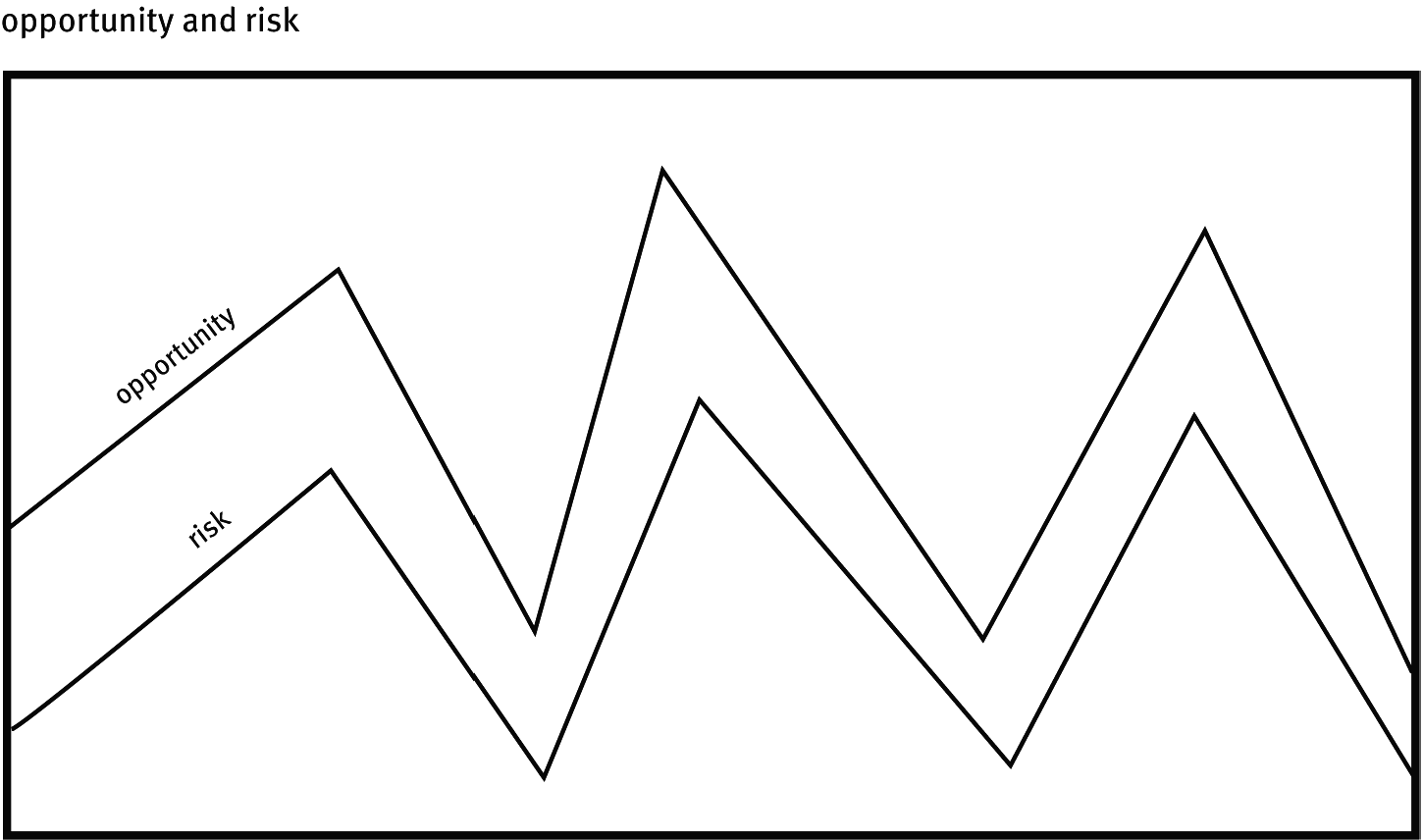

- The varying degrees of risk are not taken into account . Risk is not only as aspect of opportunity; it is really the reverse effect of it as well. Opportunity for profit and risk of loss are two sides of the same coin. This relationship between the two attributes is shown in .

Figure 1.1: Relationship between opportunity for profit and risk of loss.

Even so, some investors focus only on the heads side and invest with the profitability potential in mind, but have made no plans for the contingency of loss. How much could you lose? How much can you afford? What criteria do you use to judge risk? For example, investors who base their decisions on fundamental analysis look for revenue and earnings trends and compute working capital and capitalization ratios. Investors who prefer to trust in technical signals check price volatility and look at charts. Whatever method you use, a decision should be assessed based on potential for both profit and loss.