Copyright

HBR Press Quantity Sales Discounts

Harvard Business Review Press titles are available at significant quantity discounts when purchased in bulk for client gifts, sales promotions, and premiums. Special editions, including books with corporate logos, customized covers, and letters from the company or CEO printed in the front matter, as well as excerpts of existing books, can also be created in large quantities for special needs.

For details and discount information for both print and ebook formats, contact .

Copyright 2018 Mark W. Johnson

All rights reserved

No part of this publication may be reproduced, stored in or introduced into a retrieval system, or transmitted, in any form, or by any means (electronic, mechanical, photocopying, recording, or otherwise), without the prior permission of the publisher. Requests for permission should be directed to , or mailed to Permissions, Harvard Business School Publishing, 60 Harvard Way, Boston, Massachusetts 02163.

First eBook Edition: July 2018

ISBN 978-1-6336-9646-4

eISBN 978-1-6336-9647-1

For my mother, Adriana, who taught me

by example all the important things.

And for my beloved wife, Jane, and my children,

Kristina, Mark, Kathryn, Ella, and William.

They remind me every day what matters most.

The shift from oral to written speech is essentially a shift from sound to visual space Because print controlled not only what words were put down to form a text but also the exact situation of the words on the page and their spatial relationship to one another, the space itself on a printed sheetwhite space as it is calledtook on high significance that leads directly into the modern and post-modern world.

Walter Ong

FOREWORD

Business Models and Innovation

More than a decade ago, Mark Johnson, SAPs Henning Kagermann, and I hashed out the principles of business model reinvention in the pages of the Harvard Business Review. A few years after that, Mark refined, clarified, and vastly expanded on our work in Seizing the White Space , a book that has proven itself to be even more relevant today, as new technologies continue to upend the marketplace. One of the most important and least understood insights that youll derive from this book is that a new technology alone is not enough to propel a business into transformational growth. The business model that goes with it is absolutely key to its success or failure. I am delighted that the Harvard Business Review Pres s is reissuing it in this newly revised and updated edition, and proud to be able to introduce it. Mark was my student at Harvard Business School, and we went on to cofound the consultancy Innosight together. In the years since, he has become my teacher as well as my partner, which is about the most gratifying thing that any professor can say of a former student.

If our work on business model innovation has more than held up over the years, the term itself has become something of an empty clich or buzz phrase, so much so that I have been tempted at times to retire it. Thats a shame, because a deep understanding of the underlying principles of business models is an incredibly powerful tool, not just for management theorists but practitioners. Knowing how to build (or rebuild) a seamless business model is what allows the strongest leaders to stave off disruption from their competitors while driving innovation in their own enterprises.

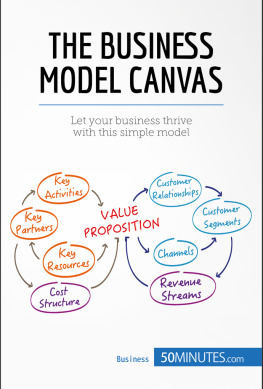

Essentially, a business model can be broken down into four distinct elements:

- A value proposition , which is to say, a product or service that does a job that customers need and that can be supplied to them at a price that they can afford.

- Resources , which are the people, technology, facilities, equipment, funding, branding, and raw materials required to create the product or service and deliver it.

- Processes , which are the means that people in organizations develop to produce and deliver products in repeatable, scalable, and sustainable ways.

- A profit formula , which is how the company creates value for itself and its shareholders. It includes a revenue model (how much money can be made by selling how many products at a certain price), a cost structure (direct costs, overhead costs, and economies of scale), a target unit margin (how much must be netted from each transaction to achieve profitability), and resource velocity (how quickly resources need to be used to achieve profitability; for example, lead times, throughput, inventory turns).

I like to imagine that each of these four elements has a dial on it. When they are all set correctly, both the customer and the company receive what they need. However, between the time that the company designs, builds, and ships its first order and the time that it ships its 10 millionth, the settings on the dials will have been changed many times.

Those dials rarely change in isolation; if the setting on one conflicts with another, that other dials setting must be changed as well. This is why change, especially disruptive change, is so hard to dobecause the more innovative a customer value proposition is, the less likely it is that it will be compatible with the resources, processes, and profit formulas that the business was originally built on. What this means in practice is that the new-and-different must be separated and even protected from the tried-and-true. As Mark says, To play a new game on a new field requires a new game plan.

Mark takes the mystery out of business model innovation by laying out a structured, repeatable set of processes that lead in logical steps from brainstorming and initial planning to implementation, acceleration, and scalingand he makes it all accessible by sharing case histories from real businesses. An admirably lucid thinker and a great explainer, with Reinvent Your Business Model , Mark Johnson has equipped a new generation of innovators with the insights and the tools that they need to seize the white spaces where the greatest opportunities lie.

Clayton M. Christensen

Introduction

I t has been eight years since this book was first published (under the slightly different title of Seizing the White Space: Business Model Innovation for Growth and Renewal ). Much has happened in the business world since then. Blockbuster filed for bankruptcy in 2010 and closed all its remaining stores in 2013, a victim of Netflixs disruptive business model. A&P supermarkets (which the Wall Street Journal once dubbed Walmart before Walmart) gave up the ghost in 2015, shortly after its 156th birthday. In June 2017, Whole Foods Market, which had done so much to upend the traditional business model for supermarkets, was acquired by Amazon, which has been turning the entire retail sector upside down over the past two decades.

Buffeted by competition from the iPhone and the tech giant Googles Android system, RIMs BlackBerry fell into a death spiral from which it never recovered. And in 2014, the Finnish tech giant Nokia sold its once world-beating mobile phone unit to Microsoft. Unable to stanch the units bleeding, Microsoft handed it off to Foxconn just two years later, writing off at least $9 billion. In 2015, Google reorganized itself under the umbrella of a new holding company it calls Alphabet (for alpha bet ), redoubling its commitment to making big, winning wagers on what its cofounder Larry Page calls the business of starting new things. Some of Googles new things (the aforementioned Android operating system, for example) have been alpha-plus; some (like Google Glass) have been duds. The gales of creative destruction never cease to blow.

Whats been fascinating and gratifying to me over this near-decade, is seeing, again and again, how intensely important the art and science of business model innovation remains, and how relevantindeed crucialare the lessons that this book imparts. One point that I made in the first edition has been borne out repeatedly: digital transformation and business model innovation are not necessarily the same things.