Peterson - Sentiment Analysis

Here you can read online Peterson - Sentiment Analysis full text of the book (entire story) in english for free. Download pdf and epub, get meaning, cover and reviews about this ebook. year: 2016, publisher: John Wiley & Sons, Incorporated, genre: Business. Description of the work, (preface) as well as reviews are available. Best literature library LitArk.com created for fans of good reading and offers a wide selection of genres:

Romance novel

Science fiction

Adventure

Detective

Science

History

Home and family

Prose

Art

Politics

Computer

Non-fiction

Religion

Business

Children

Humor

Choose a favorite category and find really read worthwhile books. Enjoy immersion in the world of imagination, feel the emotions of the characters or learn something new for yourself, make an fascinating discovery.

Sentiment Analysis: summary, description and annotation

We offer to read an annotation, description, summary or preface (depends on what the author of the book "Sentiment Analysis" wrote himself). If you haven't found the necessary information about the book — write in the comments, we will try to find it.

Sentiment Analysis — read online for free the complete book (whole text) full work

Below is the text of the book, divided by pages. System saving the place of the last page read, allows you to conveniently read the book "Sentiment Analysis" online for free, without having to search again every time where you left off. Put a bookmark, and you can go to the page where you finished reading at any time.

Font size:

Interval:

Bookmark:

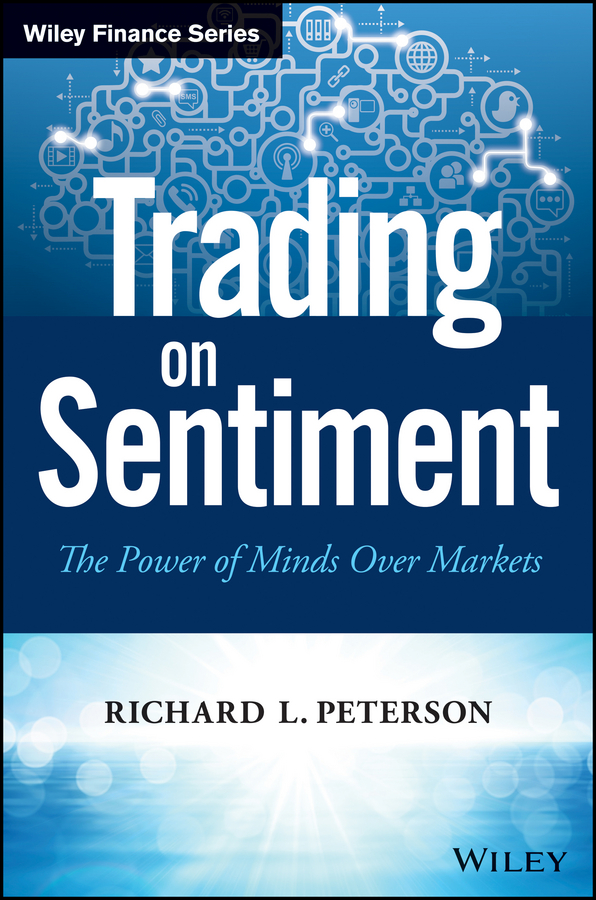

The Wiley Finance series contains books written specifically for finance and investment professionals as well as sophisticated individual investors and their financial advisors. Book topics range from portfolio management to e-commerce, risk management, financial engineering, valuation and financial instrument analysis, as well as much more. For a list of available titles, visit our website at www.WileyFinance.com.

Founded in 1807, JohnWiley & Sons is the oldest independent publishing company in the United States. With offices in North America, Europe, Australia, and Asia, Wiley is globally committed to developing and marketing print and electronic products and services for our customers' professional and personal knowledge and understanding.

Copyright 2016 by Richard L. Peterson. All rights reserved.

Published by John Wiley & Sons, Inc., Hoboken, New Jersey.

Published simultaneously in Canada.

No part of this publication may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronic, mechanical, photocopying, recording, scanning, or otherwise, except as permitted under Section 107 or 108 of the 1976 United States Copyright Act, without either the prior written permission of the Publisher, or authorization through payment of the appropriate per-copy fee to the Copyright Clearance Center, Inc., 222 Rosewood Drive, Danvers, MA 01923, (978) 750-8400, fax (978) 646-8600, or on the Web at www.copyright.com. Requests to the Publisher for permission should be addressed to the Permissions Department, John Wiley & Sons, Inc., 111 River Street, Hoboken, NJ 07030, (201) 748-6011, fax (201) 748-6008, or online at http://www.wiley.com/go/permissions.

Limit of Liability/Disclaimer of Warranty: While the publisher and author have used their best efforts in preparing this book, they make no representations or warranties with respect to the accuracy or completeness of the contents of this book and specifically disclaim any implied warranties of merchantability or fitness for a particular purpose. No warranty may be created or extended by sales representatives or written sales materials. The advice and strategies contained herein may not be suitable for your situation. You should consult with a professional where appropriate. Neither the publisher nor author shall be liable for any loss of profit or any other commercial damages, including but not limited to special, incidental, consequential, or other damages.

For general information on our other products and services or for technical support, please contact our Customer Care Department within the United States at (800) 762-2974, outside the United States at (317) 572-3993 or fax (317) 572-4002.

Wiley publishes in a variety of print and electronic formats and by print-on-demand. Some material included with standard print versions of this book may not be included in e-books or in print-on-demand. If this book refers to media such as a CD or DVD that is not included in the version you purchased, you may download this material at http://booksupport.wiley.com.

For more information about Wiley products, visit www.wiley.com.

Library of Congress Cataloging-in-Publication Data is available:

ISBN 9781119122760 (Hardcover)

ISBN 9781119163749 (ePDF)

ISBN 9781119163756 (ePub)

Cover Design: Wiley

Cover Images: brain social media VLADGRIN/istockphoto.com; summer background

Magnilion/istockphoto.com

To the MarketPsych team. Your inspiration and persistence created something entirely new in the world.

From investor neuroimaging to developing sentiment-based market models, Dr. Peterson spends his time exploring the intersection of mind and markets. Dr. Peterson is CEO of MarketPsych, where he is a creative force behind the Thomson Reuters MarketPsych Indices (TRMI). The TRMI is a data feed of emotions and macroeconomic topics in social and news media covering 8,000 equities, 130 countries, 30 currencies, and 35 commodities. Dr. Peterson has published in academic journals, including Games and Economic Behavior and the Journal of Neuroscience, written textbook chapters, and is an associate editor of the Journal of Behavioral Finance. His book Inside the Investor's Brain (Hoboken, NJ: John Wiley & Sons, 2007) is in six languages, and it and MarketPsych (Hoboken, NJ: Wiley 2010) were named top financial books of the year by Kiplinger. Dr. Peterson received cum laude Electrical Engineering (B.S.), Arts (B.A.), and Doctor of Medicine degrees (M.D.) from the University of Texas. Called Wall Street's Top Psychiatrist by the Associated Press, he performed postdoctoral neuroeconomics research at Stanford University and is board-certified in psychiatry. He lives in California with his family.

As a 12-year-old boy I was befuddled when my fathera finance professorgave me trading authority over a small brokerage account. At the time I didn't understand what the stock market was, and I had no idea how to proceed. He educated me on how to read stock tables in the daily newspaper (this was 1985), call a broker, and place an order. I was set free with my limited knowledge and zero experience with the goal of growing the balance.

To select investments, I first turned to the local newspaper. I reviewed the micro-text of the stock tables. The numbers didn't make sense to memy first dead-end. For Plan B I visited the library, and the librarian referred me to dusty books from the 1960s that extolled the virtues of 'tronics stocks and Dow Theory. Nothing for me here, I thought. I wanted to know what to buy right now, not to learn ancient theory.

Next I went to a bookstore. A young attendant directed me to the magazine section, and the first magazine I picked up listed the Top 10 Growth Stocks of 1985. Perfect! I thought. I went home, called up the broker, and dictated the top 10 names to him, buying shares in each.

Over the next few months, I didn't pay attention to the stocks' performance. About a year later I figured it would be a good time to check in. I expected to hear that I had made big gains. In fact, I fantasized that the broker would soon be calling me for investment advice. When I opened an account statement I sawto my disbeliefthat the account was down 20 percent.

Confused, I went back to the bookstore. I related my tale to another attendant, and he condescendingly informed me, Clearly you bought the wrong magazine. He's right! I realized. This new, wiser guide helped me find a magazine extolling the Top 10 Most Innovative stocks of 1986. I went home, invested in a few of the top 10, and waited. I paid more attention this time, and I noticed that the first three monthly account statements were positive. I felt good, back on track, and I imagined I would be redeemed as a genius stock investor.

A year later, after a nine-month hiatus, I opened the latest account statement. The damage was worsemy account was now down nearly 50 percent from where it had started. This can't be right, I thought. I sheepishly called the broker. He confirmed the loss.

I wanted to understand what the experts knew that I did not, so I started reading books by investing by gurus such as Benjamin Graham and Peter Lynch. I noticed that these books were teaching me not only about fundamentals, but also about psychology. It seemed that many of history's most successful investors used an understanding of investor behavior. Baron Nathan von Rothschild, an early scion of the Rothschild banking dynasty, in 1812 guided investors to, Buy to the sound of cannons, sell to the sound of trumpets. Benjamin Graham wrote, We buy from pessimists, and we sell to optimists. Warren Buffett modernized the saying as, Be fearful when others are greedy and greedy when others are fearful. This advice seemed like useful guidance, but it wasn't specific or easily actionable.

Next pageFont size:

Interval:

Bookmark:

Similar books «Sentiment Analysis»

Look at similar books to Sentiment Analysis. We have selected literature similar in name and meaning in the hope of providing readers with more options to find new, interesting, not yet read works.

Discussion, reviews of the book Sentiment Analysis and just readers' own opinions. Leave your comments, write what you think about the work, its meaning or the main characters. Specify what exactly you liked and what you didn't like, and why you think so.