Thank you for downloading this Scribner eBook.

Join our mailing list and get updates on new releases, deals, bonus content and other great books from Scribner and Simon & Schuster.

C LICK H ERE T O S IGN U P

or visit us online to sign up at

eBookNews.SimonandSchuster.com

CONTENTS

This book is dedicated to Richard Saunders and his merry band of troublemakers. Never have so many owed so few so much.

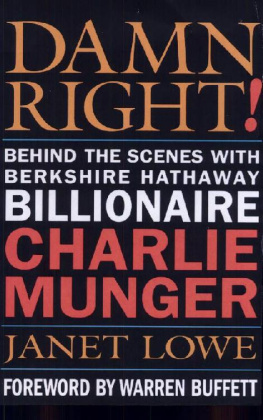

SOURCE NOTE

T he Charlie Munger quotes I chose to include in this book come from a variety of sources that are available on the Internet, among them newspapers, magazines, journals, speeches, books, blogs, quote websites, and other websites. Quotes from company annual meetings come from the online reports posted by attendees and do not necessarily represent a word-for-word recitation of the statements at the meeting. I have identified the sources with their corresponding websites in the back of the book for those of you who wish to continue reading about the very fascinating, and ever interesting, Charlie Munger.

INTRODUCTION

I n the chronicles of American financial history Charlie Munger will be seen as the proverbial enigma wrapped in a paradoxhe is both a mystery and a contradiction at the same time. Warren Buffett said, Charlies most important architectural feat was the design of todays Berkshire. The blueprint he gave me was simple: Forget what you know about buying fair businesses at wonderful prices; instead, buy wonderful businesses at fair prices.... Consequently, Berkshire has been built to Charlies blueprint. My role has been that of general contractor, with the CEOs of Berkshires subsidiaries doing the real work as subcontractors.

How is it that Charliewho trained as a meteorologist and a lawyer and never took a single college course in economics, marketing, finance, or accountingbecame one of the greatest business and investing geniuses of the twentieth and twenty-first centuries? Therein lies the mystery.

Charlie was born in Omaha, Nebraska, on January 1, 1924, in the midst of the Roaring Twenties. The radio and airplane were the cutting-edge technologies of the day. The financier Bernard Baruch was the king of Wall Street. And everyone was getting rich investing in stocks. Charlies father was one of Omahas leading business attorneys, and his roster of clients included many of the states business elite. Charlie spent much of his youth readingthe television and video games of his dayand that is where he discovered a larger world than the idyllic, but very parochial, neighborhood of Dundee, where Warren Buffetts family also lived. The two boys attended the same grade school and high school, though seven years apart in age. In fact, one of Charlies first jobs was working for Warrens grandfather at the Buffett neighborhood grocery storewhich is still standing in the heart of old Dundee.

Charlie was introduced to the world of business at the Buffett grocery store. He learned about taking inventory, stocking shelves, pleasing customers, the importance of showing up on time for work, how to get along with others while accomplishing a joint task, and, of course, running the cash register, where money, the lifeblood of the business, flowed.

Omaha in the 1930s had distinct ethnic immigrant neighborhoods: Italian, Greek, African American, Irish, French, Czech, Russian, and even Chinese. Many immigrants worked for the Union Pacific Railroad and meatpacking plants whose operations were centered in Omaha. Charlie went to public school with the children of those immigrants and as a result developed an appreciation not only of their cultures but also of their commercial aptitude and willingness to work unbelievably hard to give their children a better life.

Charlie often brings up the horrors of the Great Depression at Berkshire Hathaway annual meetings as a reminder of just how bad things can get. But Omaha didnt suffer like other parts of the United States during the Great Depression, in part because it was the crossroads of two major railroads, the Union Pacific and the Burlington, and also because it was home to the Union Stock Yards, the second largest in the world. With this convergence of livestock and transportation, Omaha attracted the big meatpacking companies, which established processing plants in South Omaha. America may have been in a great depression, but it still had to eat, and as many as twenty thousand pigs, sheep, and cattle arrived in Omaha every day. Those animals needed to be slaughtered, butchered, packed, and shipped to other parts of the country. The stockyard generated lots of economic activity even during hard times.

The Kiewit construction company, today one of North Americas largest building companies, was founded in Omaha. The companys first big job was constructing the Livestock Exchange building for the Union Stock Yards. (Peter Kiewit had a huge influence on both Charlie and Warren, and today Berkshires home office is in Kiewit Plaza.) Charlie learned about the business dealings of some of Omahas most prominent businessmen from his father, who represented both the Hitchcock family, who owned the towns leading newspaper, and the Kountze family, who owned the largest bank.

After high school, seventeen-year-old Charlie enrolled in the University of Michigan to study mathematics. He turned nineteen a year after Pearl Harbor, dropped out of college, and joined the US Army Air Corps. The army sent him to Caltech, in Pasadena, California, to study meteorology. There he learned the difference between cumulus and cirrus clouds and fell in love with the sunny Southern California weather.

While the teenage Warren Buffett was busy learning about odds and probability at the Ak-Sar-Ben horse-racing tracka short bike ride from his Omaha homeCharlie Munger was learning this important investment skill while playing poker with his army buddies. Thats where he learned to fold his hand when the odds were against him and bet heavy when the odds were with him, a strategy he later adapted to investing.

After the war Charlie, who did not have an undergrad degree, applied to Harvard Law School, his fathers alma mater. He was rejected. After a phone call from Harvard Laws retired dean, who was a Nebraskan and family friend, he was admitted. Charlie excelled in his law studies and graduated magna cum laude in 1948. He has never forgotten the importance of having friends in high places.

After law school Charlie moved back to Los Angeles, where he joined a prestigious corporate law firm. He learned a lot about business from handling the affairs of Twentieth CenturyFox, a mining operation in the Mojave Desert, and many real estate deals. During that time he was also the director of an International Harvester dealership, where he first learned how hard it is to fix a struggling business. The dealership was a volume business that required a lot of capital to pay for its costly inventory, most of it financed with a bank loan. A couple of bad seasons, and the carrying costs on the inventory start to destroy the business. But if the company cut its inventory to lower the carrying costs, it wouldnt have had anything to sell, which meant that customers would seek out a competing dealership that did have inventory. It was a tough business with lots of problems and no easy solutions.

Charlie thought a lot about business during that time. He made a habit of asking people what was the best business they knew of. He longed to join the rich elite clientele his silk-stocking law firm served. He decided that each day he would devote one hour of his time at the office to work on his own real estate projects, and by doing so he completed five. He has said that the first million dollars he put together was the hardest money he ever earned. It was also during that period that he realized he would never become really rich practicing law; hed have to find something else.

Next page